Introduction: The Importance of Long-Term Perspectives

For investors, the allure of a company beating its earnings estimates can be enticing. However, a single earnings beat often doesn’t translate into long-term stock performance. This article delves into why this is the case, providing a comprehensive analysis of the underlying business and financial drivers that truly determine a company’s long-term success.

Key Business and Financial Drivers

While earnings beats can create short-term market excitement, it’s crucial to understand that they are often influenced by one-time events or temporary market conditions. Instead, investors should focus on key business and financial drivers, such as revenue growth, profit margin, competitive positioning, and cash flow generation, as these factors provide a more comprehensive view of a company’s long-term prospects.

Expectations vs Reality

When a company beats earnings estimates, it raises expectations for future performance. However, these heightened expectations can often be misaligned with reality. It’s not uncommon for companies to miss earnings estimates in the subsequent quarters, leading to stock price volatility. This is why it’s important to look beyond a single earnings beat when assessing a company’s long-term prospects.

What Could Go Wrong

A single earnings beat doesn’t immunize a company against future setbacks. Business risks such as competitive pressures, regulatory changes, or macroeconomic shifts can derail growth and profitability. Moreover, financial risks like excessive leverage or poor cash flow management can also pose significant challenges. Investors should, therefore, assess these potential risks when making long-term investment decisions.

Long-Term Perspective

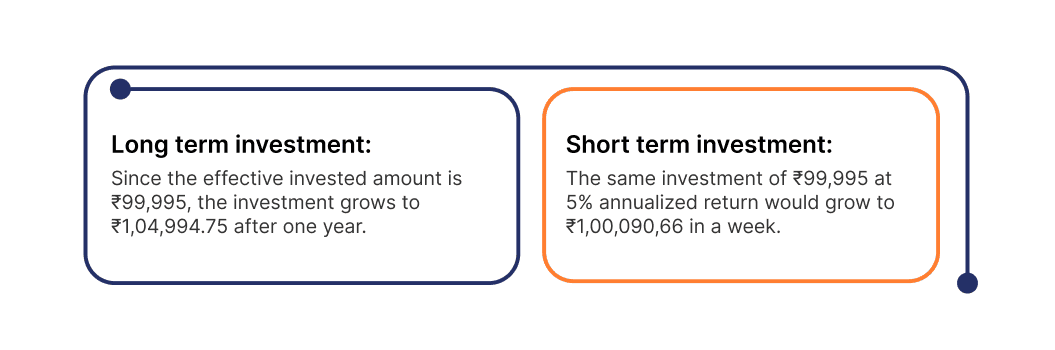

Investing is a long-term game. While a single earnings beat can boost a company’s stock price in the short term, it doesn’t necessarily translate into sustained long-term performance. Investors should, therefore, focus on a company’s long-term business and financial fundamentals, and not get swayed by short-term market noise.

Investor Tips

- Look beyond a single earnings beat and assess a company’s long-term business and financial fundamentals.

- Consider potential business and financial risks that could impact a company’s long-term performance.

- Keep your investment expectations aligned with reality.

Disclaimer

This article is for informational purposes only and should not be considered as investment advice. Please do your own research before making any investment decisions.

Leave a Reply