Why Valuation Review Consultation Matters to Investors

Valuation review consultation is an essential tool for long-term stock investors. It helps investors assess the intrinsic value of a US stock, evaluate its risk-reward ratio, and make informed investment decisions. By going beyond quantitative metrics, it provides a deeper understanding of a company’s financial health, competitive position, and growth potential.

Key Business and Financial Drivers

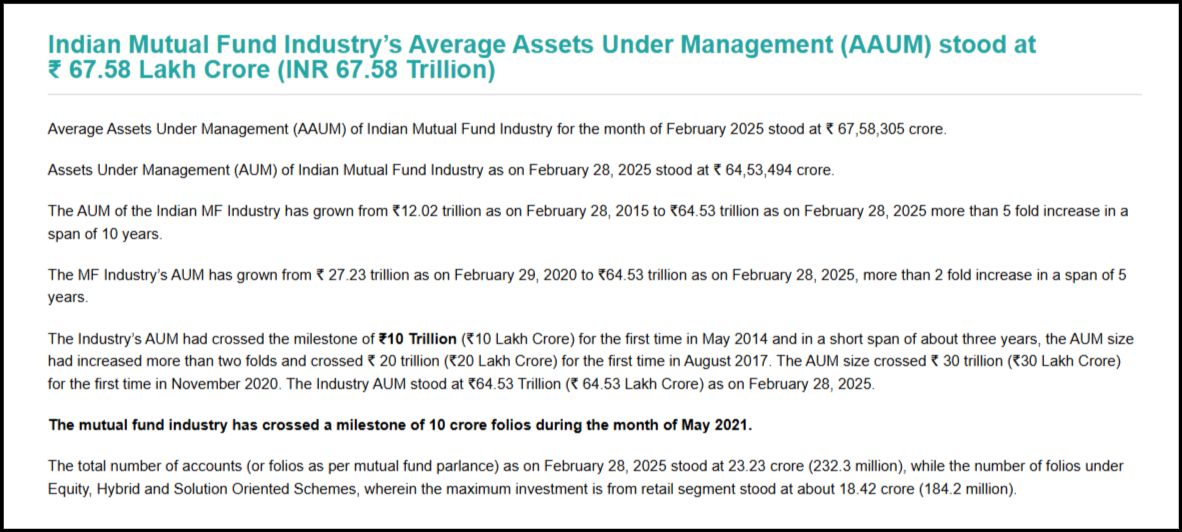

Several key business and financial drivers influence the valuation of US stocks. These include revenue growth, profit margins, cash flow, debt level, and return on equity. The dynamics of these drivers can signal a company’s operational efficiency, financial stability, and ability to generate shareholder value.

Revenue Growth

Strong and consistent revenue growth is an indication of a company’s competitive strength and market acceptance. A slowdown or decline in revenue growth may signal market saturation, increased competition, or declining demand for the company’s products or services.

Profit Margins

High profit margins reflect a company’s pricing power and operational efficiency. Shrinking margins could suggest rising costs, pricing pressure, or inefficiencies that could impact profitability.

Expectations vs Reality

Market expectations for a stock are typically reflected in its price. Investors often expect high growth, strong profitability, and low risk. However, these expectations can be unrealistic, leading to overvaluation and potential investment risks.

What Could Go Wrong

Several factors can derail the expected outcomes of a stock investment. These include a slowdown in revenue growth, a contraction in profit margins, an increase in debt levels, negative cash flow, or a lower-than-expected return on equity. Additionally, external factors such as economic downturns, regulatory changes, or disruptive technology can negatively impact a company’s performance and stock valuation.

Long-Term Perspective

While short-term factors can cause volatility in stock prices, long-term investors should focus on a company’s multi-year performance and growth prospects. A long-term perspective can help investors weather short-term fluctuations and capitalize on the compound effect of growth over time.

Investor Tips

- Regularly review the valuation of your stocks to ensure they are fairly priced.

- Monitor key business and financial drivers to assess a company’s performance and growth potential.

- Manage your expectations and be prepared for potential risks.

- Adopt a long-term investment perspective to reap the benefits of compounding.

This article is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a professional investment advisor before making investment decisions.

Leave a Reply