Introduction: Why Valuation Opportunity Matters

Understanding the concept of valuation opportunity is crucial for long-term investors. It provides insights into underpriced stocks that have the potential to provide significant returns, making the US equities market an excellent place for identifying such investment prospects.

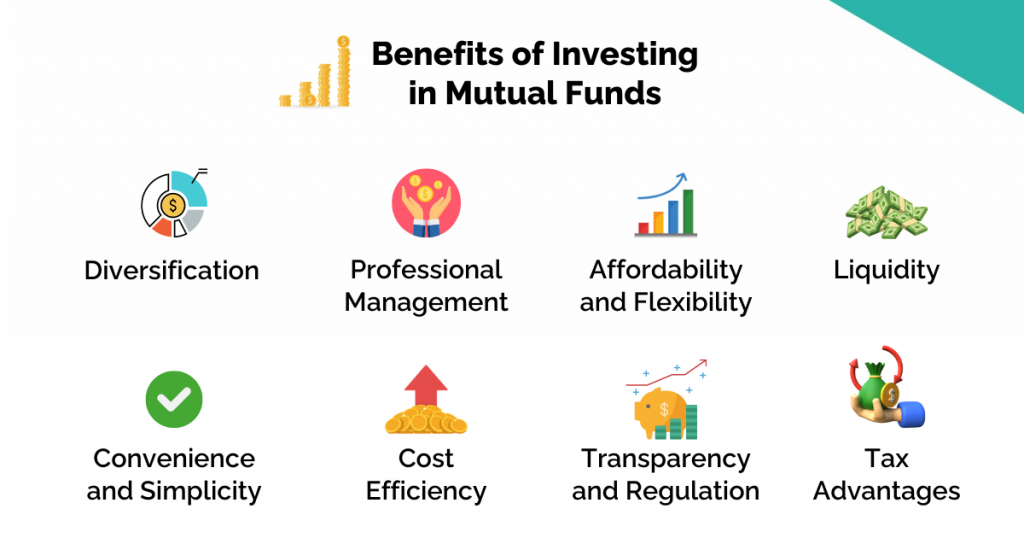

Key Business or Financial Drivers

Several factors drive the valuation of US equities, and understanding these can help identify potential opportunities. These include the company’s earnings, economic indicators, industry trends, and investor sentiment.

Expectations vs Reality

Often, market expectations for a company might be overly optimistic or pessimistic, leading to over or underpricing of the stock. By comparing these expectations with the company’s actual performance, investors can identify potential valuation opportunities.

What Could Go Wrong

Investing based on valuation opportunities does not come without risks. Market volatility, unexpected economic downturns, and company-specific issues can negatively impact the valuation of a stock, leading to potential losses.

Long-Term Perspective

While short-term market fluctuations can create valuation opportunities, it’s vital to consider the company’s long-term prospects. A company with a sustainable competitive advantage, solid financials, and a robust business model is more likely to provide significant returns in the long run.

Investor Tips

- Stay informed about the latest market trends and economic indicators.

- Regularly review your investment portfolio to identify potential valuation opportunities.

- Consider the long-term prospects of a company before investing.

Disclaimer

This article is for informational purposes only and is not intended as investment advice. Always conduct your own research or consult with a financial advisor before making investment decisions.

Leave a Reply