Why This Topic Matters to Investors

The process of investment research for US equities is integral for long-term investors as it provides insights into understanding the market dynamics and identifying potential investment opportunities. A comprehensive research process can lead to more informed decisions and potentially higher investment returns over time.

Analysis of Key Financial Drivers

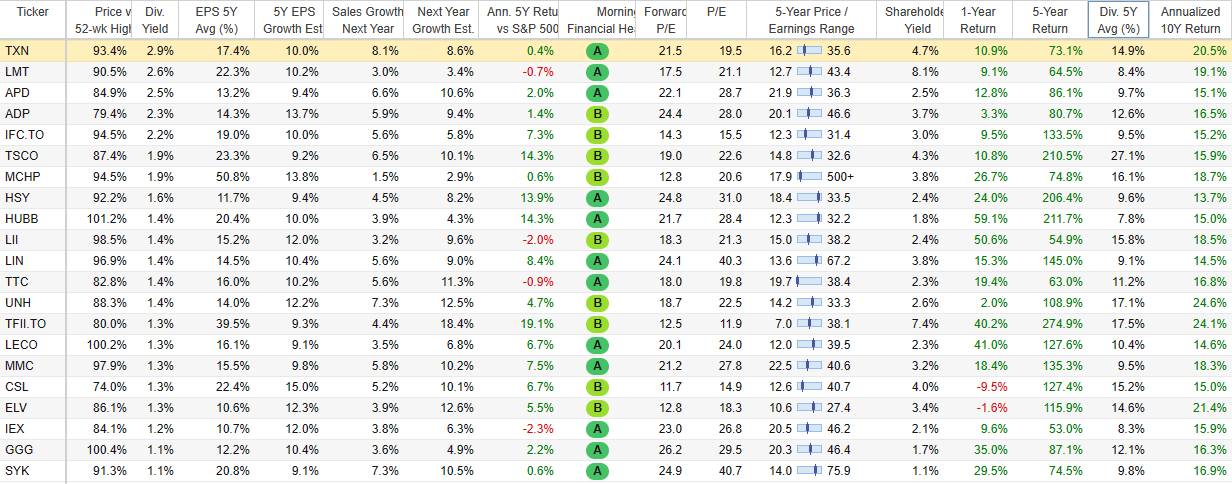

Understanding the key financial drivers is a critical step in the investment research process. These drivers chiefly include revenue growth, profit margins, and return on equity, among others. These parameters shape the financial health of a company and can influence its stock performance.

Expectations Vs. Reality

Investors often have certain expectations priced into a stock based on prevalent market sentiment, future growth projections, and historical performance. However, these expectations do not always align with reality. For instance, a company’s projected earnings growth might be overly optimistic, not accounting for potential market fluctuations or regulatory changes.

What Could Go Wrong

Several factors can derail the investment research process and subsequently, investment outcomes. These include over-reliance on past performance, lack of diversification, and neglecting macroeconomic indicators. Further, an unexpected event like a global pandemic or geopolitical tensions can significantly impact market dynamics and stock performance.

Long-Term Perspective

While short-term factors like quarterly earnings reports and market news can have immediate effects on stock prices, long-term investors should focus on broader trends and fundamental business performance. Over a multi-year horizon, a company’s ability to generate sustainable earnings growth and maintain a robust balance sheet is more likely to drive stock performance.

Investor Tips

- Stay updated with regular earnings reports and company news, but don’t overlook broader industry trends and macroeconomic indicators.

- Avoid herd mentality. Make informed decisions based on thorough investment research.

- Diversification is key. It helps to spread risk and can potentially lead to more stable returns over the long term.

Disclaimer: This article does not constitute professional investment advice. It is recommended to consult with a certified financial advisor before making any investment decisions.

Leave a Reply