Why Diversification Matters

For long-term investors, understanding diversification is key to managing risk and potential returns. In the unpredictable world of the stock market, diversification serves as a safety net, guarding against major losses. Looking at a US stock diversification case study can provide significant insights on how to effectively diversify your portfolio for long-term growth.

Key Drivers of Diversification

Diversification is driven by the correlation between assets. A portfolio composed of assets that are not correlated can potentially provide higher returns with lower risk. The US stock market offers a broad range of sectors and industries, providing ample opportunities for diversification.

Expectations versus Reality

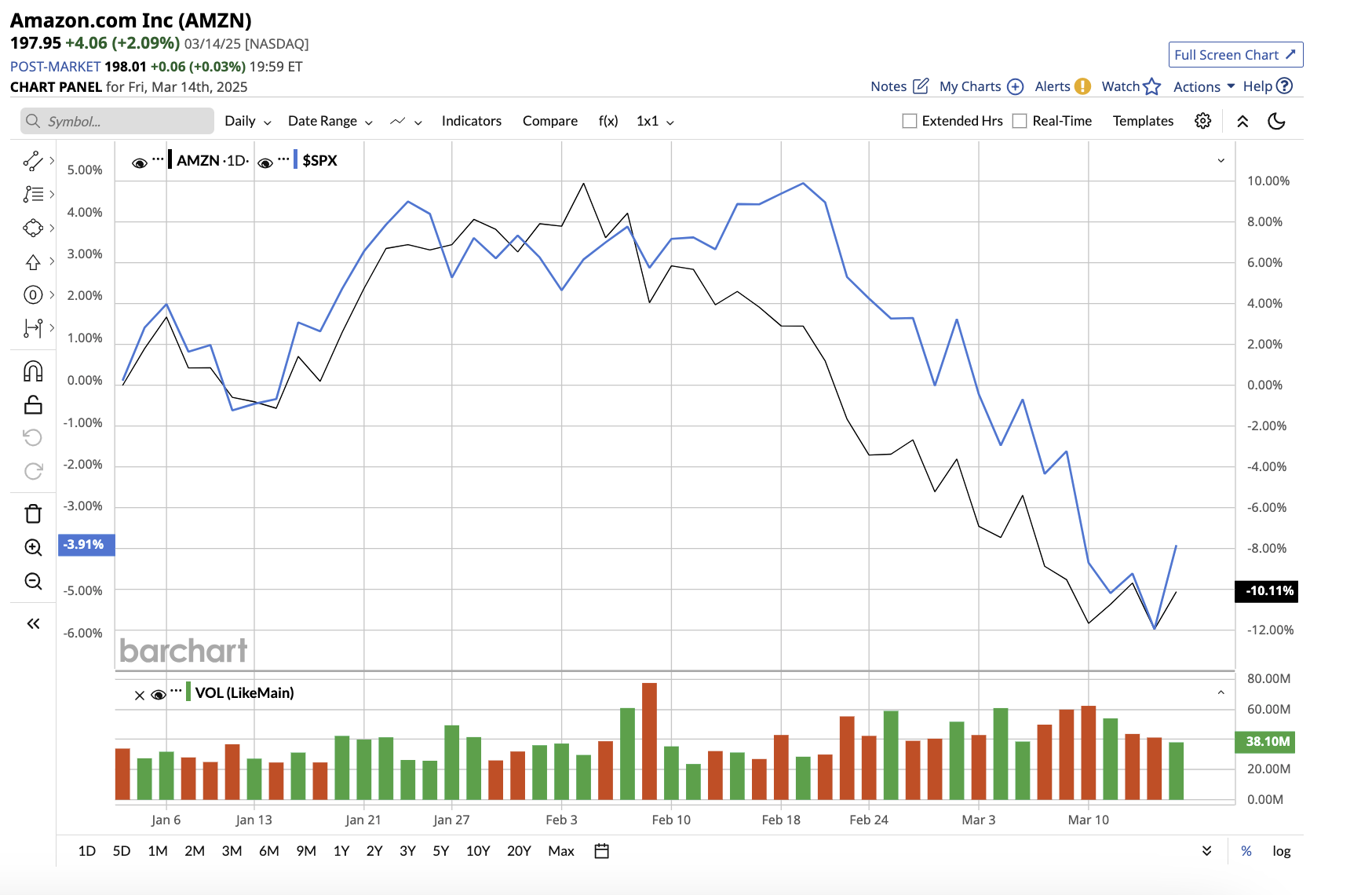

Many investors believe that diversification automatically guarantees protection against losses. However, during significant market downturns, correlation among different stocks can increase, reducing the effectiveness of diversification. It is crucial to understand that diversification does not eliminate risk but rather helps manage it.

What Could Go Wrong

Over-diversification is a common pitfall. While intending to mitigate risk, excessively spreading investments too thin can dilute potential returns. Also, keeping track of a large number of investments can be challenging, leading to mismanagement.

Long-term Perspective

While diversification may not always protect against short-term market volatility, it can smooth out returns over the long run. By investing in a variety of sectors, industries, and asset classes, investors can benefit from the growth of different parts of the economy over time.

Investor Tips

- Ensure your portfolio is diversified across various sectors and industries.

- Avoid over-diversification. It’s important to find a balance between risk and potential returns.

- Regularly review and rebalance your portfolio to maintain your desired level of diversification.

This article is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a professional advisor before making investment decisions.

Leave a Reply