Why Capital-Intensive Business Valuation Matters

For long-term investors, understanding the valuation of capital-intensive businesses is crucial. These businesses require significant upfront investment in physical assets, which can lead to high entry barriers, strong competitive positioning, and potentially attractive returns. However, they also come with unique risks and challenges that can impact their long-term value.

Key Business and Financial Drivers

Capital-intensive businesses are driven by a mix of operational efficiency, asset utilization, cost control, and market demand. The ability to generate high returns on invested capital is a key determinant of their value.

- Operational Efficiency: The efficient use of capital assets can significantly impact profitability and return on investment.

- Asset Utilization: High asset utilization can lead to economies of scale and improved profitability.

- Cost Control: Effective cost control can help capital-intensive businesses maintain margins and profitability in the face of cyclical demand or price fluctuations.

- Market Demand: The value of capital-intensive businesses is closely tied to market demand for their products or services, which can be influenced by economic cycles, technological changes, and competitive dynamics.

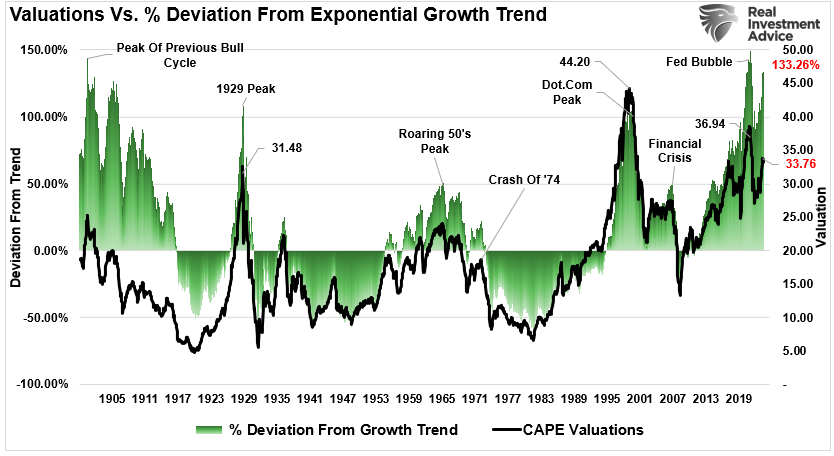

Expectations vs Reality

Investors often expect capital-intensive businesses to deliver consistent, high returns due to their significant investment in assets and high entry barriers. However, these businesses can be subject to cyclical demand, price volatility, and competitive pressures, which can lead to variability in returns and potential value impairment.

What Could Go Wrong

Several potential risks can negatively impact the value of capital-intensive businesses. These include operational inefficiencies, overcapacity, high leverage, regulatory changes, technological disruption, and economic downturns. Any of these factors can lead to underperformance, asset write-downs, and potential financial distress.

Long-Term Perspective

Despite the short-term risks and challenges, capital-intensive businesses can deliver attractive long-term returns if they can effectively manage their assets, control costs, and navigate market cycles. Their high entry barriers can also provide a competitive advantage and protect against new entrants.

Investor Tips

- Focus on businesses with strong operational efficiency and high asset utilization.

- Be aware of the risks and challenges associated with capital-intensive businesses.

- Consider the long-term potential and competitive positioning of the business.

This article is for informational purposes only and does not constitute investment advice. Investors should do their own research and consult with a professional advisor before making any investment decisions.

Leave a Reply