Introduction: Why US Equity Scenario Matters?

As a long-term stock investor, understanding the US equity scenario is crucial. It enables you to make informed investment decisions, assess the potential risks and returns, and align your investment strategy with the evolving market trends.

Key Business or Financial Drivers

Some of the key drivers that influence the US equity market include corporate earnings, interest rates, inflation, and economic indicators such as GDP growth rate and unemployment rate. Understanding these drivers can help investors navigate the market more effectively.

Expectations Vs Reality

The US equity market is often influenced by investor expectations. However, the reality can sometimes diverge from these expectations. For instance, while investors might expect a positive correlation between corporate earnings and stock prices, external factors such as geopolitical tensions or macroeconomic uncertainties can cause stock prices to fall despite strong earnings.

What Could Go Wrong

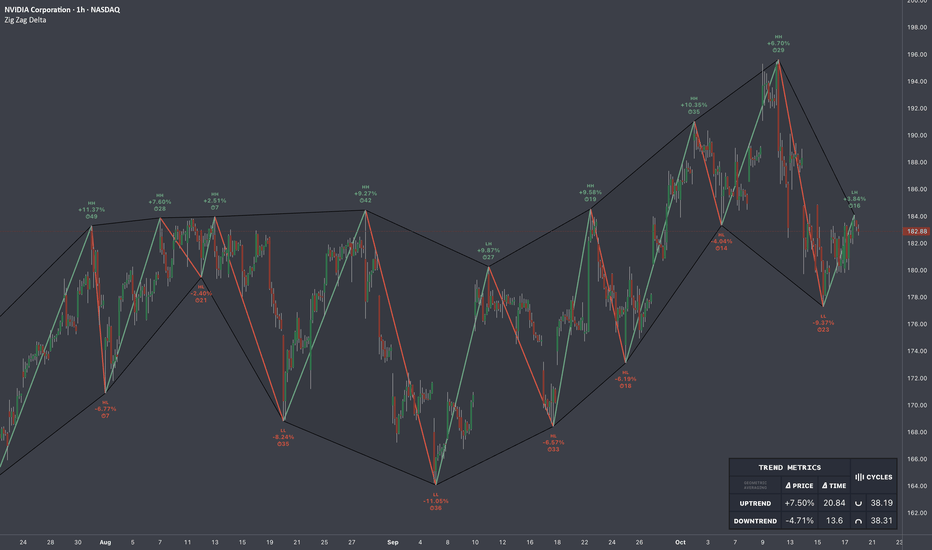

Investing in the US equity market is not without risks. Some of the potential pitfalls include market volatility, economic downturns, changes in monetary policy, and geopolitical risks. A sudden increase in interest rates, for instance, could lead to a sharp sell-off in the equity market.

Long-Term Perspective

While short-term factors can cause market fluctuations, it’s important for long-term investors to focus on the underlying fundamentals of the economy and the market. Over the long term, factors such as corporate earnings, economic growth, and innovation tend to drive the performance of the US equity market.

Investor Tips

- Stay updated with the latest economic indicators and corporate earnings reports.

- Consider the impact of interest rates and inflation on your investment portfolio.

- Be prepared for market volatility and have a diversified investment portfolio.

Please note that the information provided in this article is for educational purposes only and should not be considered as investment advice. Always do your own research or consult with a professional advisor before making investment decisions.

Leave a Reply