The importance of rigorous US stock research can never be overstated for a long-term stock investor. It not only helps in making informed investment decisions but also shapes the long-term investment portfolio, thereby determining the return on investment.

Key Business and Financial Drivers

The core investment question that arises from this topic is: How can rigorous US stock research impact the long-term investment outcomes? The answer lies in the analysis of key business or financial drivers.

Revenue and Profitability

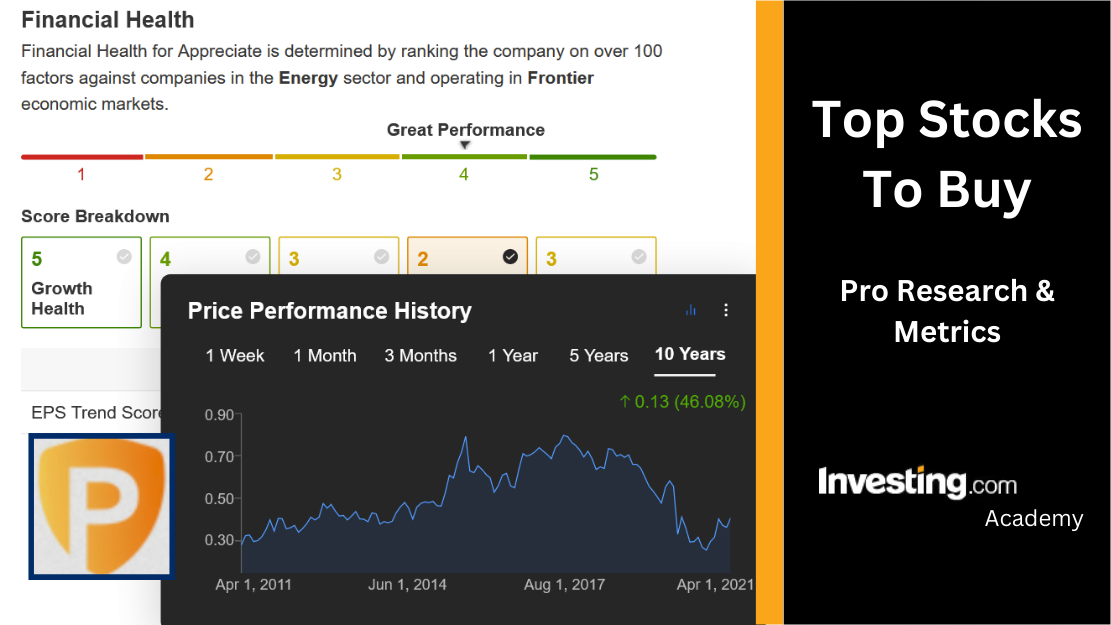

Revenue and profitability trends are crucial in understanding a company’s financial health. A consistent increase in these metrics over time indicates a company’s ability to expand its business and improve its market share.

Debt and Cash Flow

Excessive debt can restrict a company’s growth and flexibility. In contrast, healthy cash flows indicate a company’s ability to meet its short-term obligations and invest in growth opportunities.

Expectations Vs Reality

Stock prices often reflect the market’s expectations about a company’s future performance. However, these expectations may not always align with reality. For instance, a company might be overvalued due to excessive market hype, even though its fundamentals do not justify such high valuations. Similarly, a company with strong fundamentals might be undervalued due to negative market sentiment.

What Could Go Wrong

Despite the rigor of stock research, things can still go wrong. Unforeseen market events, changes in government policies, or even a sudden shift in consumer behavior can dramatically impact a company’s performance. Therefore, it’s essential to keep an eye on such external factors and adjust your investment strategy accordingly.

Long-Term Perspective

While short-term factors can cause market volatility, the long-term performance of stocks is typically driven by the company’s fundamentals. Therefore, a long-term perspective can help investors navigate short-term market fluctuations and make sound investment decisions.

Investor Tips

- Conduct thorough research before investing in a stock.

- Keep an eye on a company’s financial health and market trends.

- Stay updated with market news and government policies.

- Invest with a long-term perspective.

This article is for informational purposes only and should not be considered as investment advice. Always consult with a certified financial advisor before making any investment decisions.

Leave a Reply