Introduction

As a crucial factor for long-term profitability and competitive advantage, the pricing power of a company serves as a key indicator for investors. A firm with strong pricing power can raise prices without losing customers, which can significantly enhance its profitability and resilience against inflation and increased costs. This article delves into the case study of pricing power in US companies to provide insightful perspectives for long-term investors.

Analyzing Key Business and Financial Drivers

Several factors contribute to a company’s pricing power. These include the strength of its brand, its competitive position, the quality of its products or services, and customer loyalty. Companies with high pricing power often have strong brands, differentiated products, and a loyal customer base, which allows them to increase prices without impacting demand.

Brand Strength and Competitive Position

Companies with strong brands can command higher prices due to the perceived value and trust associated with their products. Similarly, a dominant competitive position allows companies to set prices higher than their competitors.

Product Quality and Customer Loyalty

High-quality products can justify higher prices, especially if the products are unique or innovative. Customer loyalty, often a result of superior customer service or product satisfaction, also contributes to pricing power as loyal customers are less price sensitive.

Expectations vs Reality

Investors often expect companies with strong pricing power to maintain or grow their profit margins over time. However, this may not always be the case. The ability to sustain pricing power depends on the firm’s continuous investment in its brand, product quality, and customer relationships. Any missteps in these areas can erode pricing power and hurt profit margins.

What Could Go Wrong

While pricing power is a significant advantage, several factors can undermine it. Increased competition, changing consumer preferences, technological disruptions, and regulatory changes can all challenge a company’s ability to maintain its pricing power. Additionally, overly aggressive pricing strategies can backfire, leading to customer backlash and damage to the brand’s reputation.

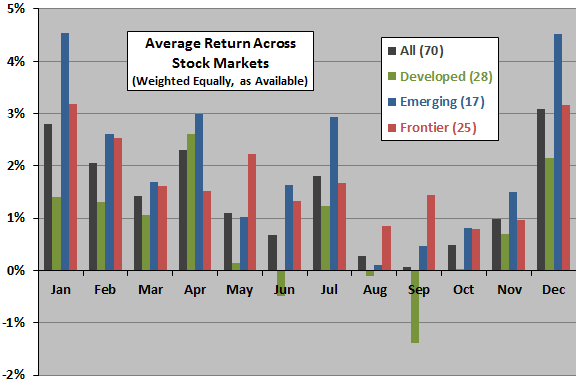

Connecting Short-Term Factors to Multi-Year Outcomes

While short-term factors such as economic conditions and market trends can impact a company’s pricing power, it’s the long-term factors like brand strength, product quality, and customer loyalty that ultimately determine its ability to sustain pricing power over multiple years. Therefore, investors need to consider both short-term and long-term factors when assessing a company’s pricing power.

Investor Tips

- Monitor a company’s pricing strategy and its impact on sales volume and profit margins over time.

- Assess the company’s brand strength, product quality, and customer loyalty as indicators of its pricing power.

- Stay updated on industry trends, competitive dynamics, and regulatory changes that could impact the company’s pricing power.

This article is intended for informational purposes only and should not be construed as investment advice. Always conduct your own research or consult with a qualified professional before making investment decisions.

Leave a Reply