Why News Matters for Investors

Investing in the stock market is far from a simple task. One of the most dynamic factors influencing stock prices is the news. Understanding the relationship between news and stock prices can give investors a strategic edge, enabling them to make informed decisions and potentially mitigate risks.

Key Business or Financial Drivers

The Influence of Corporate News

News directly related to a company, such as earnings reports, mergers, acquisitions, or product launches, can significantly impact the company’s stock price. For instance, positive quarterly earnings reports can boost investor confidence, leading to an increase in stock demand and subsequently, stock prices.

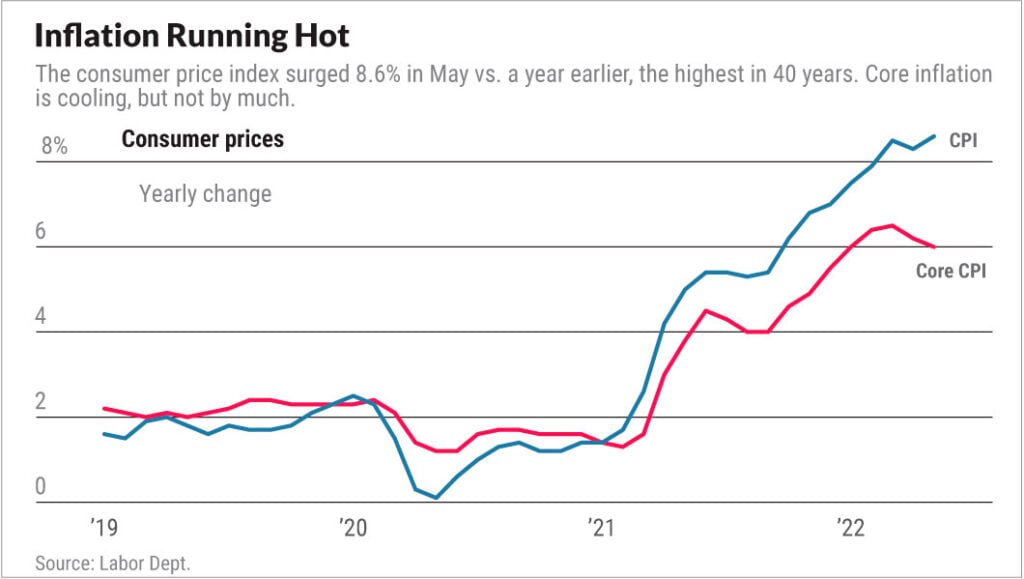

Macro News Impact

News on a broader scale, such as changes in economic indicators, shifts in government policies, or global events, can also sway the stock market. For instance, an economic recession might trigger a broad market sell-off, while positive government policies related to a specific sector could spur growth in that sector.

Expectations vs Reality

Often, investor expectations are built into stock prices. If the news aligns with these expectations, there may be little impact on stock prices. However, when the actual news deviates significantly from expectations, it could cause substantial price movements. For example, if a company reports earnings far above or below market expectations, its stock price is likely to experience significant volatility.

What Could Go Wrong

News can be a double-edged sword. While positive news can fuel stock price increases, negative news can trigger sharp declines. Moreover, the impact of news can be unpredictable and short-lived. Therefore, relying solely on news to make investment decisions could lead to potential pitfalls.

Long-Term Perspective

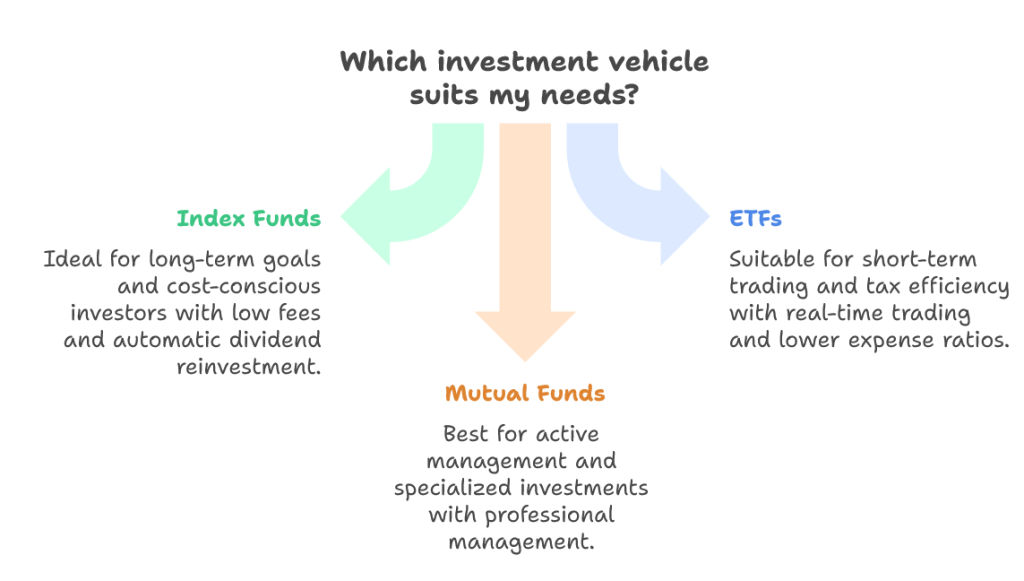

While news can cause short-term stock price fluctuations, the impact tends to diminish over time. Long-term investors should focus more on the company’s fundamental performance and industry outlook. News should be used to supplement, not replace, thorough financial analysis and due diligence.

Investor Tips

- Stay informed: Regularly monitor news related to your investments.

- Understand the context: Consider the broader economic and industry trends when interpreting news.

- Stay patient: Resist the urge to make impulsive decisions based on a single piece of news. Always consider the long-term perspective.

This article is intended for informational purposes only. It is not intended to be investment advice. Always conduct your own research and consult with a professional financial advisor before making investment decisions.

Leave a Reply