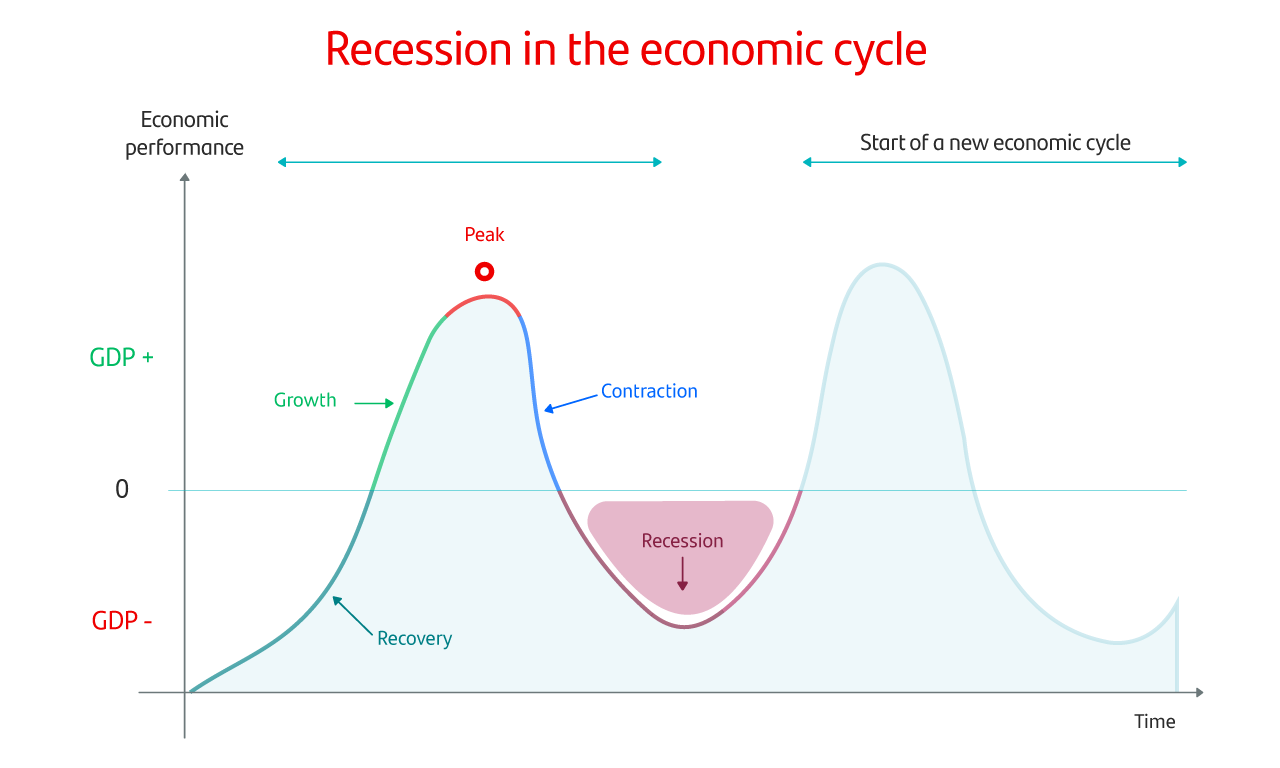

Introduction: Why Industry Maturity Matters

For long-term stock investors, understanding the stage of industry maturity is paramount. It provides an insight into the future growth potential, competitive landscape, and sustainability of business models within the industry. This knowledge can shape investment strategies and risk management.

Key Business and Financial Drivers

As industries evolve, distinct business and financial drivers emerge.

- Product Lifecycle: In mature industries, most products are in the saturation or decline phase, leading to slower growth rates.

- Market Saturation: Mature industries tend to have high market saturation, reducing the potential for significant market expansion.

- Profit Margins: With increased competition, profit margins can often come under pressure in mature industries.

Expectations Vs Reality

Investors often associate mature industries with stable and predictable returns. However, this is not always the case. Regulatory changes, technological disruptions, and competitive dynamics can cause significant variances in expected versus actual returns.

What Could Go Wrong

Mature industries, while seemingly stable, carry their own set of risks. Regulatory changes may introduce unexpected costs. Technological advancements can disrupt traditional business models. Increased competition can erode profit margins.

A Long-Term Perspective

While short-term factors such as market fluctuations can impact stock performance, understanding the implications of industry maturity can help investors make informed decisions for sustainable, long-term returns.

Investor Tips

- Research: Regularly assess the maturity stage of the industry of your holdings.

- Monitor: Keep an eye on regulatory changes and technological advancements that could impact your investments.

- Evaluate: Regularly evaluate whether your investment aligns with your long-term financial goals.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research or consult with a financial advisor before making investment decisions.

Leave a Reply