Why This Topic Matters

As an investor, understanding the impact of cost pressure on US earnings is crucial. It provides insights into a company’s operational efficiency, pricing power, and profitability, all of which significantly influence investment decisions and returns.

Key Business and Financial Drivers

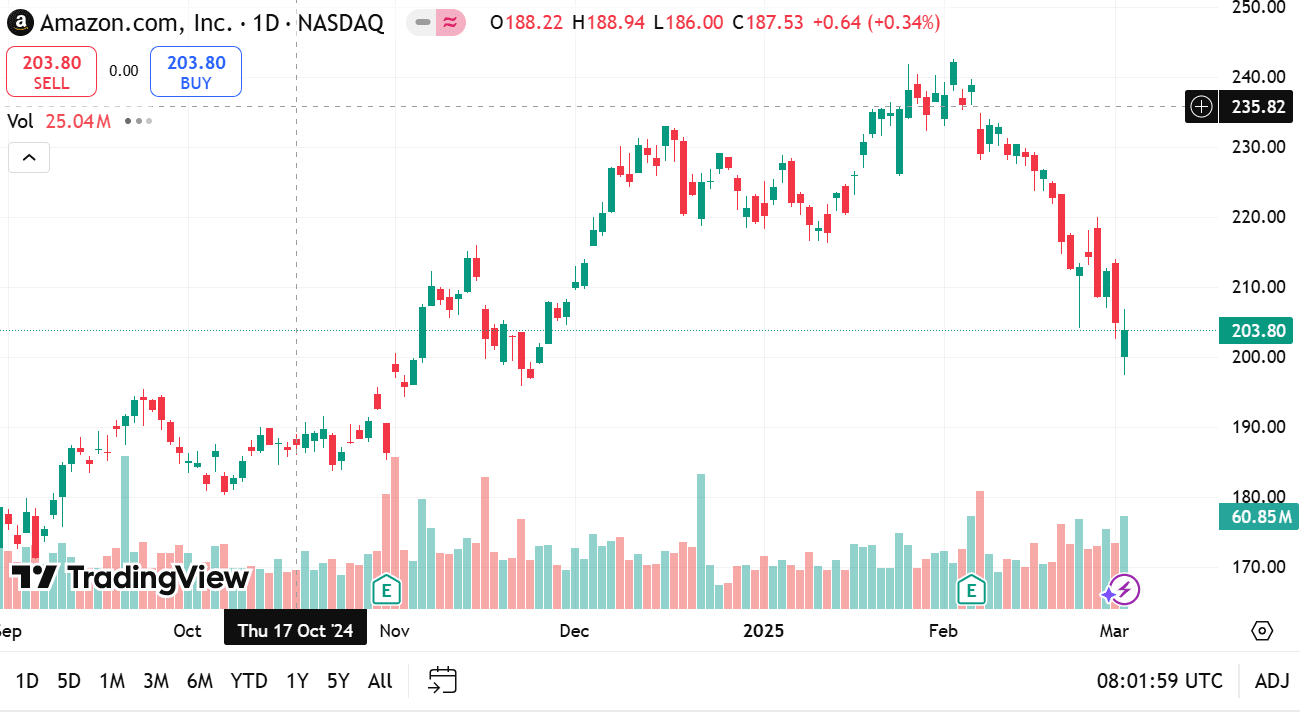

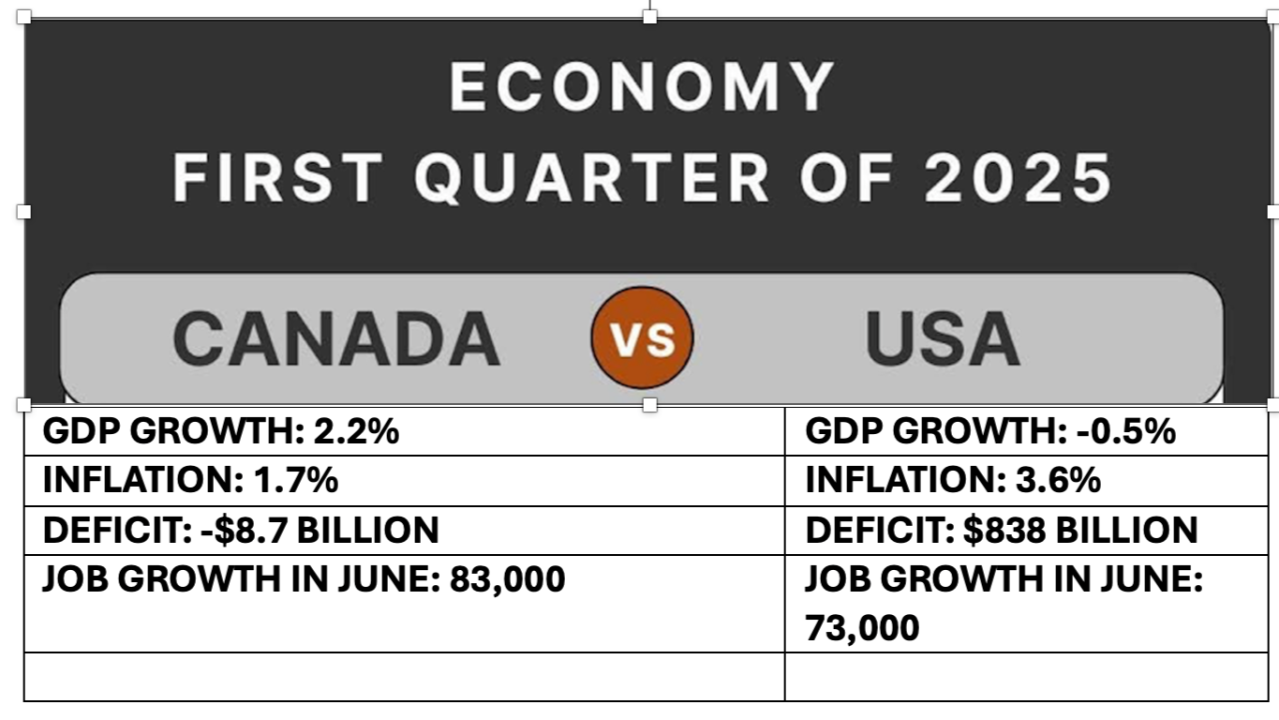

Factors such as inflation, rising raw material prices, labor costs, and supply chain disruptions often contribute to increased cost pressures. These can significantly impact a company’s gross margins and ultimately, its net earnings. Hence, monitoring these indicators can provide investors with valuable clues about future earnings performance.

Expectations vs Reality

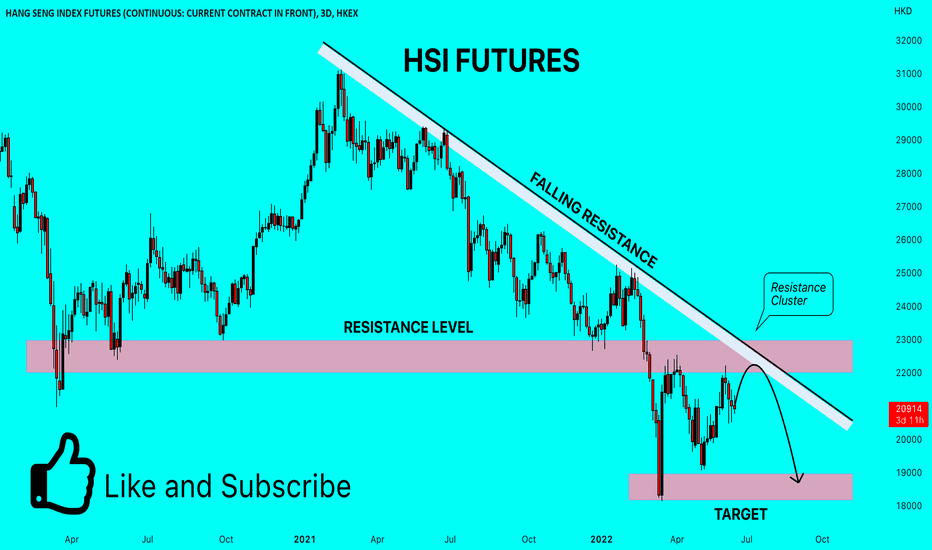

Markets often price in expectations of future earnings based on current economic conditions. However, unforeseen increases in cost pressures can lead to lower-than-expected earnings, negatively impacting stock prices. Conversely, effective cost management can result in higher-than-expected earnings, providing a potential upside to stock prices.

What Could Go Wrong

Failure to manage cost pressures effectively can erode a company’s profitability, especially if it lacks pricing power to pass on increased costs to consumers. Additionally, prolonged periods of high inflation can exacerbate cost pressures, further impacting earnings and the overall investment outlook.

Long-Term Perspective

While cost pressures can impact short-term earnings, it’s important to remember that successful companies often implement strategies to mitigate these challenges over time. Therefore, a temporary dip in earnings due to increased costs might not necessarily translate into poor long-term performance.

Investor Tips

- Monitor indicators such as inflation and raw material prices to anticipate potential cost pressures.

- Analyze a company’s operational efficiency and pricing power as these can influence its ability to manage cost pressures.

- Consider the company’s long-term strategies to mitigate cost pressures when making investment decisions.

This article is intended for informational purposes only. It is not a recommendation to buy or sell any stock or investment product, nor is it financial advice. Always do your own research and consider your financial circumstances before making investment decisions.

Leave a Reply