Why This Topic Matters

Buybacks are a common way for companies to return capital to shareholders. However, the timing of these buybacks can significantly affect shareholder returns. Understanding this dynamic can help investors make informed decisions and potentially improve their long-term investment outcomes.

Key Business and Financial Drivers

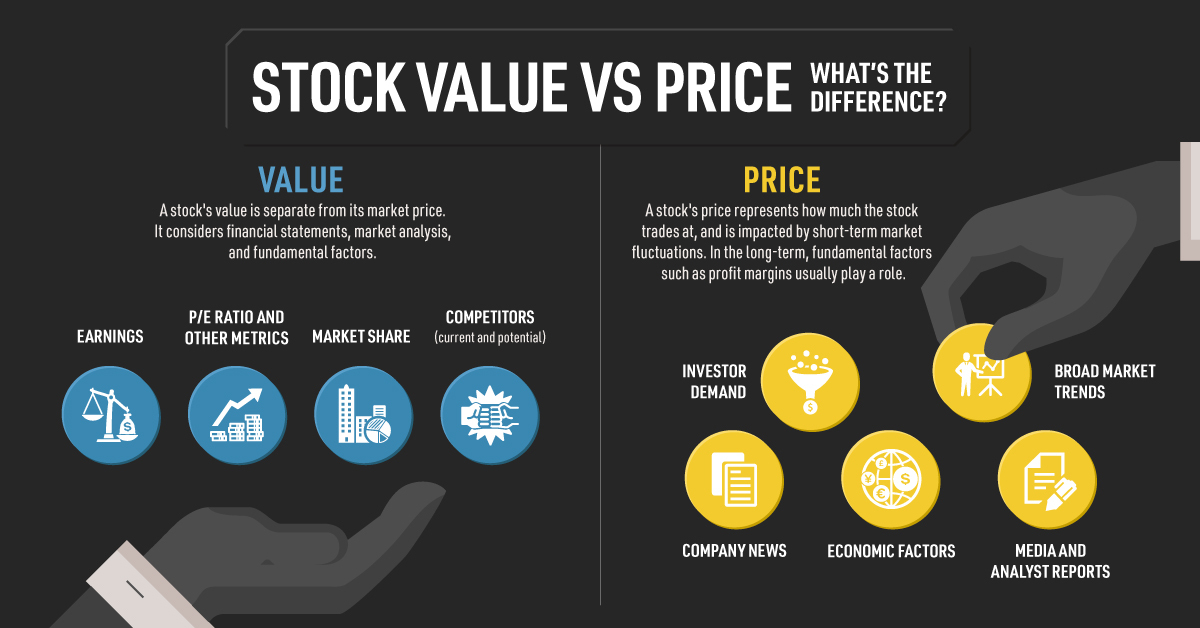

The main business driver behind buybacks is the company’s perception of its own value. If a company believes its shares are undervalued, it may choose to buy back shares, effectively investing in itself. This can lead to increased earnings per share and potentially higher stock prices, benefiting shareholders.

From a financial perspective, buybacks can be influenced by a company’s cash flow situation. Companies with strong cash flow may be more likely to execute buybacks. In contrast, during periods of financial stress, companies may suspend or reduce buybacks.

Expectations vs Reality

Investors often anticipate that buybacks will lead to immediate share price appreciation. However, the reality can be quite different. The impact of buybacks on share prices can depend on numerous factors, including the overall market environment, investor sentiment, and the company’s future earnings prospects.

What Could Go Wrong

Buybacks can go wrong in several ways. If a company conducts a buyback when its share price is high, it effectively overpays for its own shares, which can negatively impact long-term shareholder returns. Additionally, if a company uses debt to finance a buyback and subsequently faces financial difficulties, it could lead to increased financial risk and potential losses for shareholders.

Long-Term Perspective

While buybacks can impact short-term share price movements, their long-term effects are more significant. A well-timed buyback can enhance shareholder value over the long term by reducing share count and increasing earnings per share. However, poorly timed buybacks can destroy shareholder value and potentially lead to financial instability.

Investor Tips

- Monitor the timing and scale of a company’s buybacks as part of your investment analysis.

- Consider the company’s valuation and financial health when assessing the potential impact of buybacks on shareholder returns.

- Do not rely solely on buybacks as a source of investment returns. Diversification and fundamental analysis remain key.

This article is for informational purposes only and should not be considered financial advice. Investing involves risk, including the potential loss of principal. Always conduct your own research or consult with a licensed financial professional before making any investment decisions.

Leave a Reply