Why This Topic Matters to Investors

Investment strategies have continually evolved in response to market dynamics and changing investor preferences. As a long-term investor, understanding these shifts in the US stock market is key to positioning your portfolio for sustained growth. This evolution impacts your investment decisions, risk management, and potential returns.

Key Drivers of Investment Strategy Evolution

Several factors have shaped the evolution of investment strategies in US stocks. These include technological advancements, regulatory changes, and shifts in economic indicators. Understanding these drivers provides insights into potential market trends and investment opportunities.

Technological Advancements

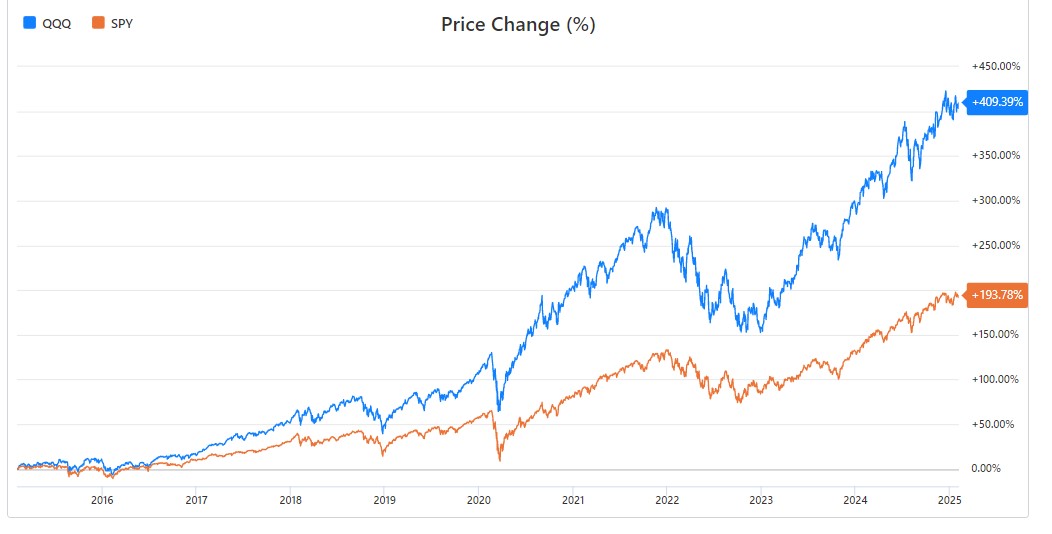

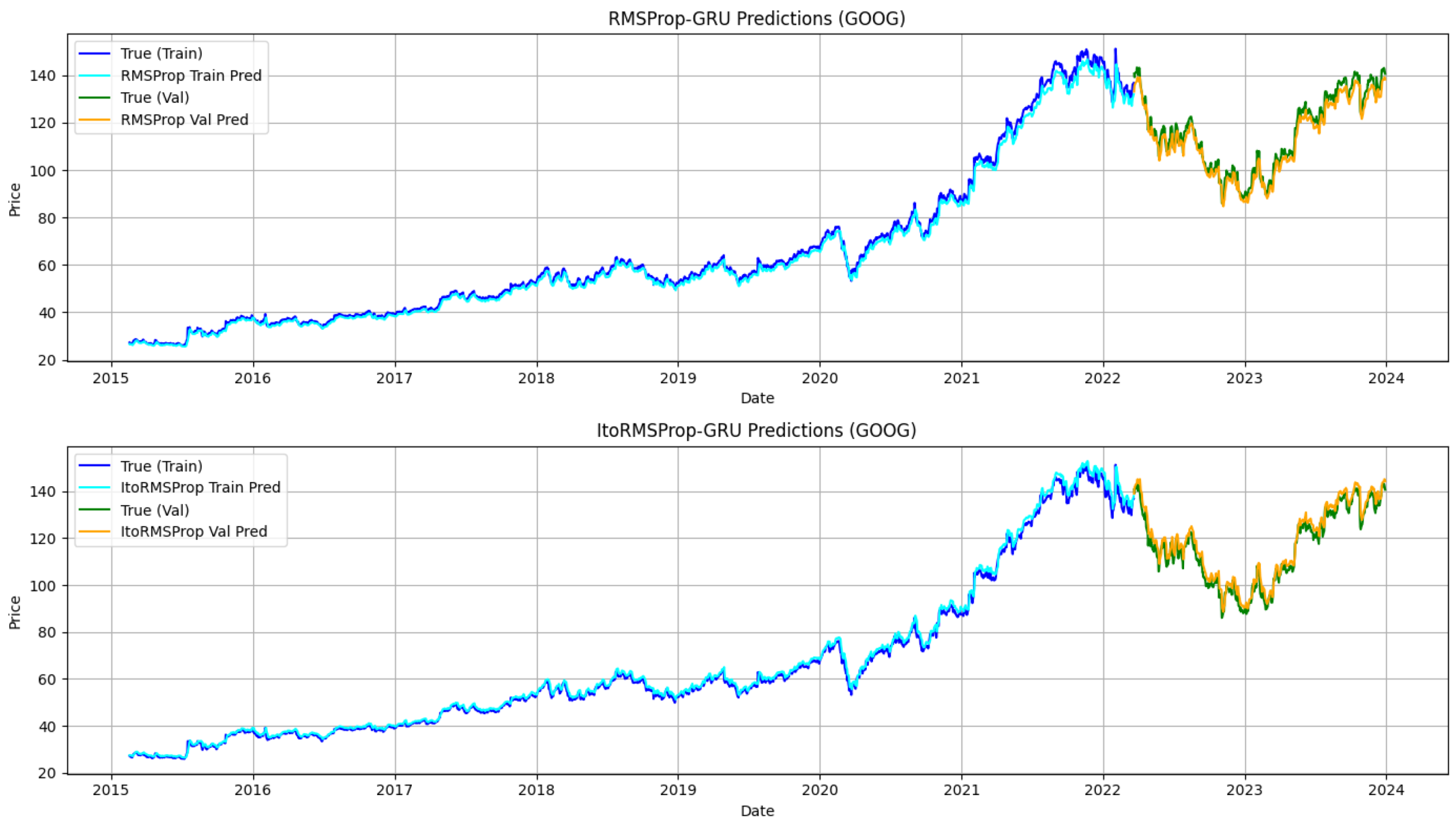

The advent of high-speed trading platforms and AI-driven investment tools have democratized access to US stocks, leading to a shift towards algorithmic and high-frequency trading strategies. This shift has increased market liquidity but also heightened volatility.

Regulatory Changes

The regulatory landscape has also influenced investment strategy evolution. For instance, changes in corporate governance rules have impacted dividend policies, influencing income-focused investment strategies.

Economic Shifts

Economic indicators such as interest rates, inflation, and GDP growth rates play a significant role in shaping investment strategies. For instance, low-interest rates have encouraged growth investing in recent years.

Expectations Vs Reality

While the evolution of investment strategies has opened up new investment avenues, it’s important to manage expectations. Notably, advancements in technology and algorithmic trading have not necessarily translated into higher returns for every investor. The reality is that investing in stocks still requires a solid understanding of fundamental analysis and risk management.

What Could Go Wrong

Several things could go wrong when investing in US stocks. Market volatility, economic downturns, and adverse regulatory changes can negatively impact stock performance. Moreover, while technological advancements have increased access to stock investing, they have also heightened the risk of cyber threats and market manipulation.

Connecting Short-term Factors to Multi-year Outcomes

Short-term factors such as economic indicators, market sentiment, and corporate news can influence stock prices in the short run. However, for long-term investors, it’s the multi-year trends and company’s long-term prospects that matter. Understanding the evolution of investment strategies can help investors navigate short-term noise and focus on long-term growth.

Investor Tips

- Stay informed about market trends and regulatory changes that could impact your investment strategy.

- Adapt your investment strategy to changing market conditions, but keep your long-term investment goals in focus.

- Ensure you have a robust risk management strategy in place to protect your investment.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute investment advice. Always do your own research before making any investment decisions.

Leave a Reply