Why Sentiment-Driven Rallies Matter to Investors

Understanding the dynamics of sentiment-driven rallies in US stocks is vital for long-term investors. These rallies, often fueled by investor optimism rather than fundamental market factors, can significantly impact stock prices and market trends. Learning to navigate these sentiment shifts can equip investors with valuable insights for their long-term investment strategy.

Analysis of Key Business or Financial Drivers

There are several key drivers behind sentiment-driven rallies. These include economic indicators, market trends, and investor psychology. The last of these – investor psychology – is particularly influential, as it can often override the other two in driving market movements.

- Economic indicators: Investors may react positively to signs of economic growth, causing a sentiment-driven rally.

- Market trends: Existing market trends can influence investor sentiment, particularly if those trends align with investor expectations.

- Investor psychology: The beliefs and attitudes of investors can significantly impact market movements. This is particularly the case during periods of market volatility, where sentiment can rapidly shift.

Expectations vs Reality

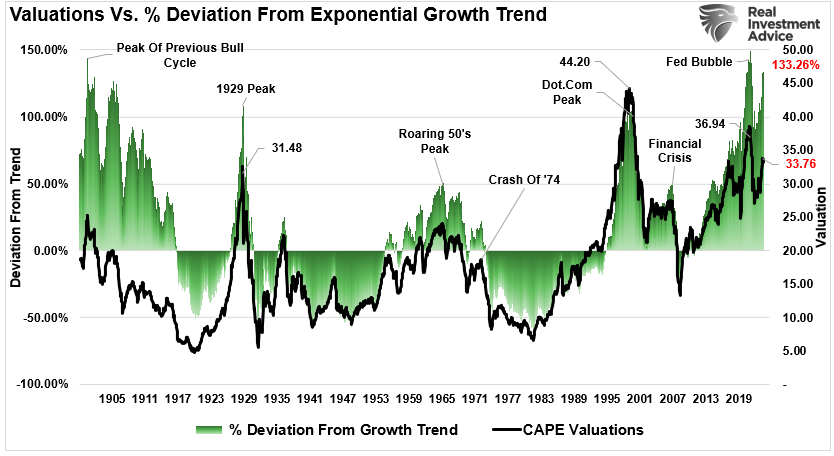

One common feature of sentiment-driven rallies is the disconnect between market expectations and reality. Investors, influenced by a variety of factors, may develop overly optimistic expectations about the future performance of a stock or the market as a whole. This optimism can fuel a sentiment-driven rally, causing stock prices to rise. However, if the expected performance does not materialize, the rally may quickly reverse, leading to a market correction.

What Could Go Wrong

There are several risks associated with sentiment-driven rallies. If investor sentiment shifts, a rally can quickly turn into a sell-off, leading to a significant drop in stock prices. Additionally, if a rally is driven by unrealistic expectations, it may be followed by a market correction once reality sets in. This can result in financial losses for investors who bought in during the rally.

The Long-Term Perspective

While sentiment-driven rallies are often seen as short-term phenomena, they can have long-lasting effects on the market. For instance, a prolonged rally can lead to inflated stock prices, which may take years to correct. Therefore, understanding sentiment-driven rallies is essential for long-term investors.

Investor Tips

- Stay informed: Keep up with economic indicators and market trends to understand the potential drivers of sentiment-driven rallies.

- Remain realistic: Avoid getting caught up in market euphoria. Always base investment decisions on solid fundamentals rather than sentiment.

- Be patient: Sentiment-driven rallies can be unpredictable. It’s important to stay patient and stick to your long-term investment strategy.

Please note that this article is intended for informational purposes only and should not be considered as investment advice. Always consult with a qualified financial professional before making any investment decisions.

Leave a Reply