Introduction: Why Sector Rotation Matters

For long-term investors, understanding sector rotation trends in US equities is crucial. It provides insight into the economic cycle, highlights the sectors that are likely to outperform, and assists in portfolio balancing. Simply put, it influences your investment strategy and potential returns.

Key Business and Financial Drivers

Sector rotation is driven by various factors. The economic cycle is a major driver. Sectors respond differently to different stages of the cycle. For instance, during an economic expansion, cyclical sectors such as industrials and technology often outperform. On the other hand, during a downturn, defensive sectors such as healthcare and utilities may offer better returns. Additionally, monetary policy, interest rates, and geopolitical events can also influence sector rotation trends.

Expectations Vs. Reality

Investors often expect certain sectors to perform well during specific stages of the economic cycle. However, these expectations may not always align with reality. For example, while the technology sector is expected to thrive in an expansion, disruptions like the dot-com bubble can lead to underperformance. Hence, it’s essential to keep a close eye on the actual performance of sectors and adjust your investment strategy accordingly.

What Could Go Wrong

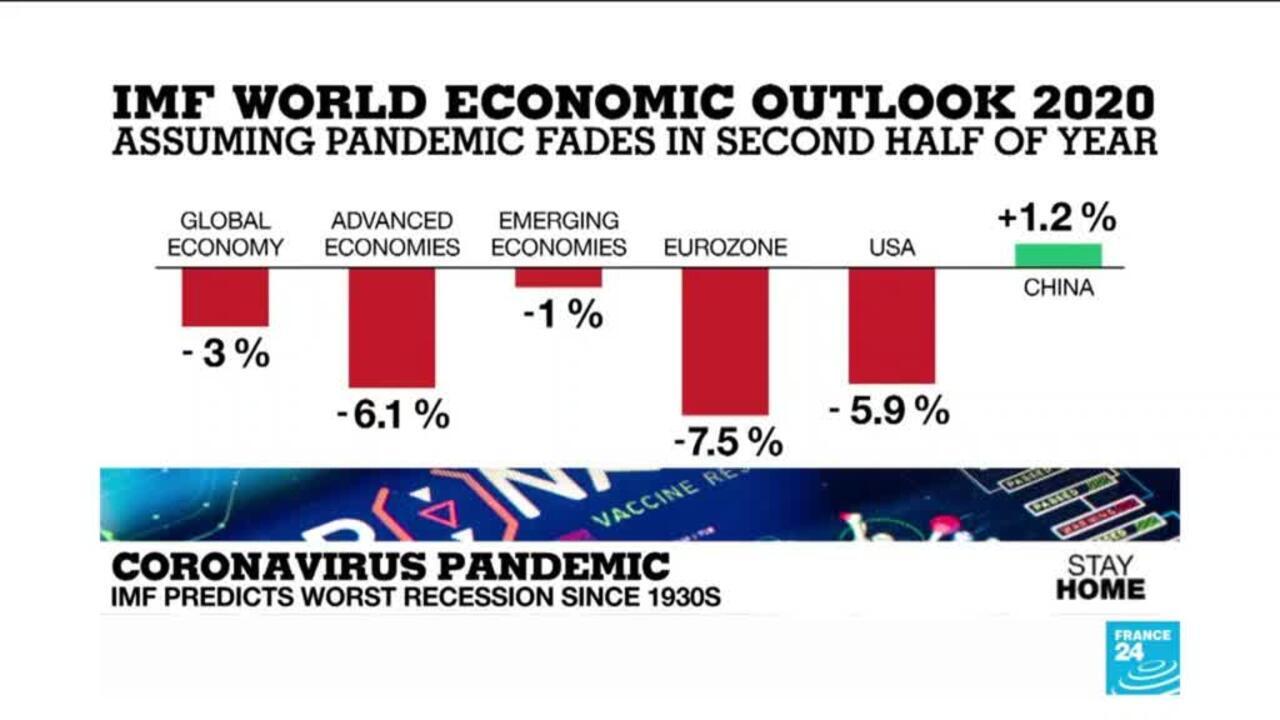

There are several risks associated with sector rotation investing. Misinterpreting economic data can lead to incorrect predictions about the economic cycle, resulting in investment in underperforming sectors. Additionally, unforeseen events such as pandemics or geopolitical crises can disrupt expected sector performance.

Long-term Perspective

While sector rotation trends can provide short-term investment opportunities, it’s vital to maintain a long-term perspective. Understanding how these trends connect to multi-year outcomes can help investors manage risk and make strategic investment decisions. For instance, a sector that underperforms in the short-term due to an economic downturn might offer attractive long-term investment opportunities once the economy recovers.

Investor Tips

- Stay updated with economic data and financial news to understand the current stage of the economic cycle.

- Monitor sector performance regularly and adjust your investment strategy accordingly.

- Don’t rely solely on sector rotation for your investment strategy. Diversify your portfolio to manage risk.

Disclaimer

This article is for informational purposes only and should not be considered as investment advice. Investing involves risk, including the potential loss of principal.

Leave a Reply