Why Understanding Risk and Return Matters

As a long-term investor, understanding the concept of risk and return in the stock market is crucial. This knowledge forms the basis of your investment decisions, helping you to balance your portfolio, and ultimately, achieve your financial goals. By evaluating the potential risks against the expected returns, you can make informed decisions and mitigate possible financial losses.

Key Business or Financial Drivers

Several key drivers can impact the risk and return of your investments. These include business performance, market trends, economic indicators, and geopolitical events. A company’s financial health, for instance, can directly influence its stock value. Similarly, market trends can dictate the general direction of stock prices, while economic indicators can provide a broad view of the country’s economic landscape, influencing stock market performance.

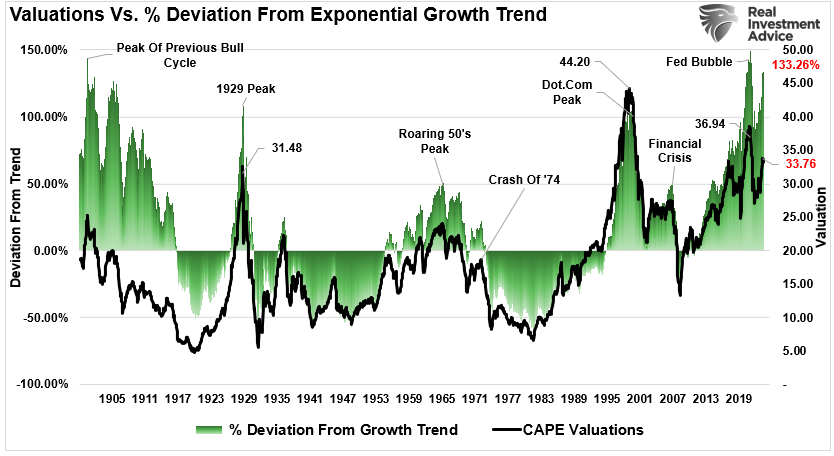

Expectations vs Reality

Investors often have expectations about the returns they will receive based on various factors such as the company’s performance, industry trends, and economic conditions. However, the actual returns can significantly differ due to unpredictable market fluctuations, changes in business strategies, or unexpected financial crises. Therefore, it’s important for investors to constantly monitor their investments and adjust their strategies based on the changing market conditions.

What Could Go Wrong

Investing in the stock market involves a certain degree of risk. Market volatility could lead to financial losses, while a company’s poor performance could result in a drop in its stock price. Furthermore, unforeseen events such as economic recessions or geopolitical crises could negatively impact the entire stock market.

Long-term Perspective

While short-term market fluctuations can impact your investments, it’s essential to maintain a long-term perspective. Over the years, the stock market has shown a general trend of growth despite periods of volatility. Therefore, a long-term investment strategy can help you weather short-term market downturns and capitalize on the market’s overall upward trend.

Investor Tips

- Always diversify your portfolio to mitigate risks.

- Stay informed about market trends and economic indicators.

- Regularly review and adjust your investment strategy based on market conditions.

This article is intended to provide a general overview of the concepts of risk and return in the stock market. It should not be considered as financial advice. Always consult with a financial advisor before making investment decisions.

Leave a Reply