Why Strategic Clarity Matters in US Equities Investment?

Investment strategic clarity is paramount for long-term stock investors. It enables investors to understand the underlying business models, financial health, and future prospects of US equities. Knowing these factors can help investors make informed decisions and potentially earn significant returns over time.

Analysis of Key Business and Financial Drivers

There are several key business and financial drivers that affect the performance of US equities. These include the company’s profitability, its competitive position, economic conditions, and regulatory environment. Understanding these drivers can provide strategic clarity and guide investment decisions.

Expectations vs Reality

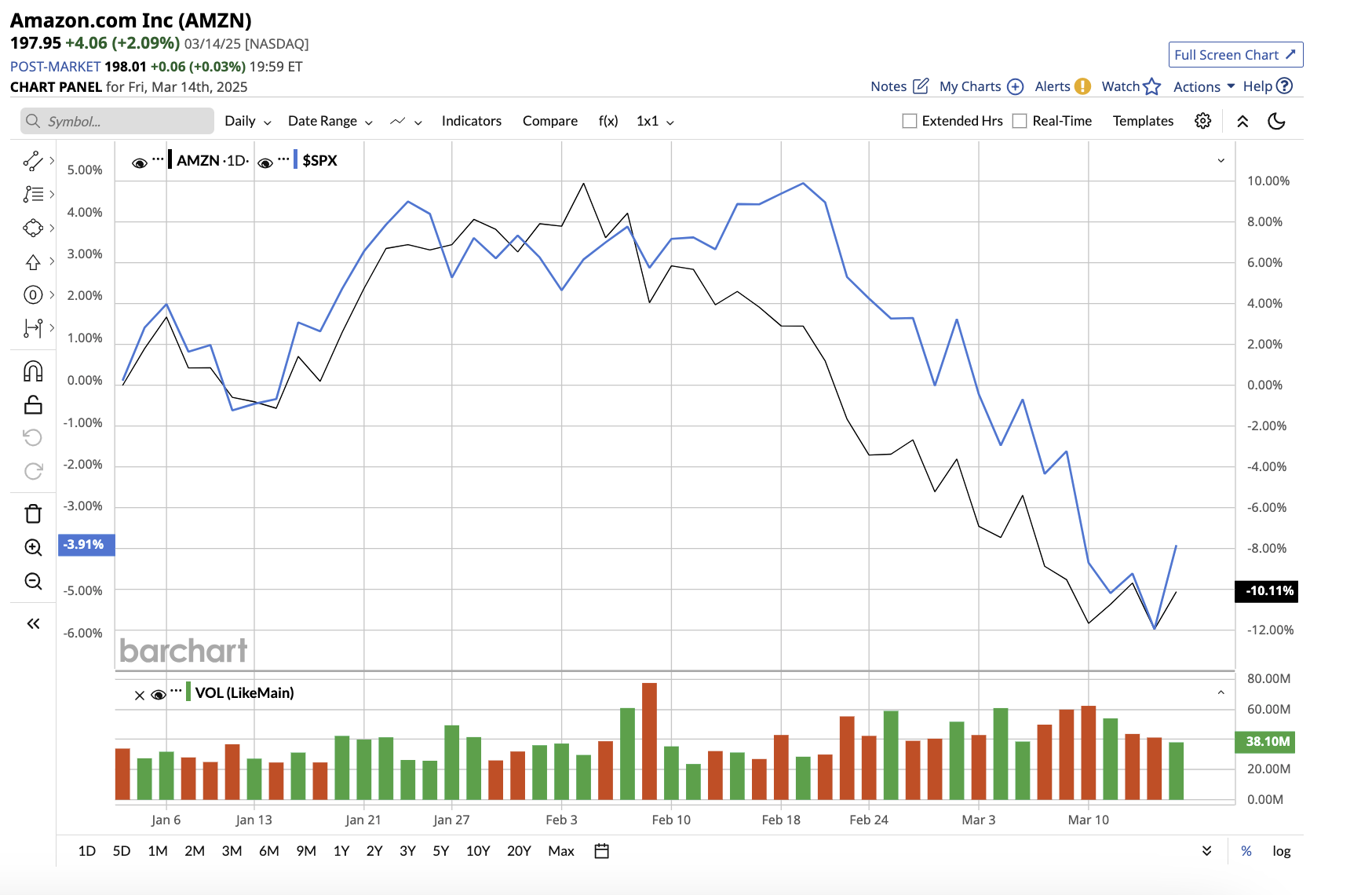

Investors often have certain expectations about a stock’s performance based on its past performance, the company’s announcements, or analysts’ forecasts. However, the actual performance may differ due to unforeseen business or economic factors. Hence, it’s crucial for investors to continuously review and adjust their expectations to align with reality.

What Could Go Wrong

Several things could go wrong when investing in US equities. These include a sudden economic downturn, changes in regulatory policies, or unforeseen business challenges. Additionally, investors’ expectations may not always align with the stock’s actual performance, leading to potential losses.

Long-Term Perspective

While short-term factors can affect a stock’s performance, investors should not lose sight of the long-term perspective. This involves considering the company’s ability to sustain its competitive position, grow its profits, and navigate through economic and regulatory changes over several years.

Investor Tips

- Regularly review your investment strategy and adjust it based on changes in business and economic conditions.

- Research thoroughly about the company and its industry before investing.

- Don’t rely solely on past performance or analysts’ forecasts. Consider a variety of factors, including the company’s financial health and future prospects.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always consult with a financial advisor before making any investment decisions.

Leave a Reply