Why Valuation Matters

Understanding historical valuation trends in US stocks is critical for investors as it offers insights into the pricing of securities relative to various measures such as earnings, assets, and sales. This knowledge enables investors to make informed decisions, anticipate future market trends, and identify potential investment opportunities.

Key Business and Financial Drivers

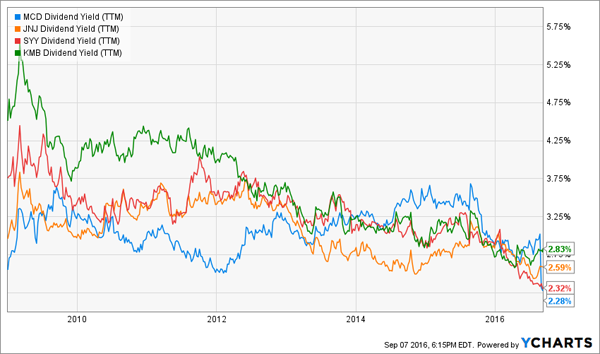

Several factors have historically influenced the valuation of US stocks, including corporate earnings, interest rates, inflation, and investor sentiment. Corporate earnings are a fundamental driver of stock prices, and a trend of growing earnings often leads to higher stock valuations. Conversely, higher interest rates and inflation can negatively impact stock valuations as they increase the cost of capital and reduce future cash flows. Investor sentiment, influenced by economic and geopolitical events, can also significantly impact stock valuations.

Expectations vs Reality

The market’s expectations of a company’s future earnings growth are often baked into its current stock price. However, these expectations can be off the mark if the company fails to meet its projected earnings. Additionally, over-optimistic forecasts can inflate stock valuations, potentially leading to a market correction when the reality falls short of expectations.

What Could Go Wrong

Investors should be aware of the risks associated with relying solely on historical valuation trends. Past performance is not always indicative of future results, and unforeseen events can cause significant shifts in stock valuations. For instance, regulatory changes, technological disruptions, or global economic crises can drastically affect a company’s earnings and consequently its stock valuation.

Long-Term Perspective

While short-term factors can cause fluctuations in stock valuations, long-term investors should focus more on the multi-year outcomes. Trends in corporate earnings growth, economic conditions, and changes in industry dynamics over the long term are often more indicative of a stock’s future performance.

Investor Tips

- Always consider a company’s earnings potential and economic conditions when evaluating its stock.

- Be aware of the impact of interest rates and inflation on stock valuations.

- Stay informed about regulatory changes and industry trends that could affect your investments.

This article is provided as an information resource and is not intended to be a substitute for professional advice. Investors should seek appropriate professional advice before making any investment decisions.

Leave a Reply