Why Factor Based Investing Strategies Matter

Factor based investing strategies in US equities have become popular among long-term investors as they systematically exploit certain characteristics or “factors” such as size, value, and momentum, which historically have provided higher returns. Understanding these strategies can potentially enhance portfolio performance and risk management.

Key Business and Financial Drivers

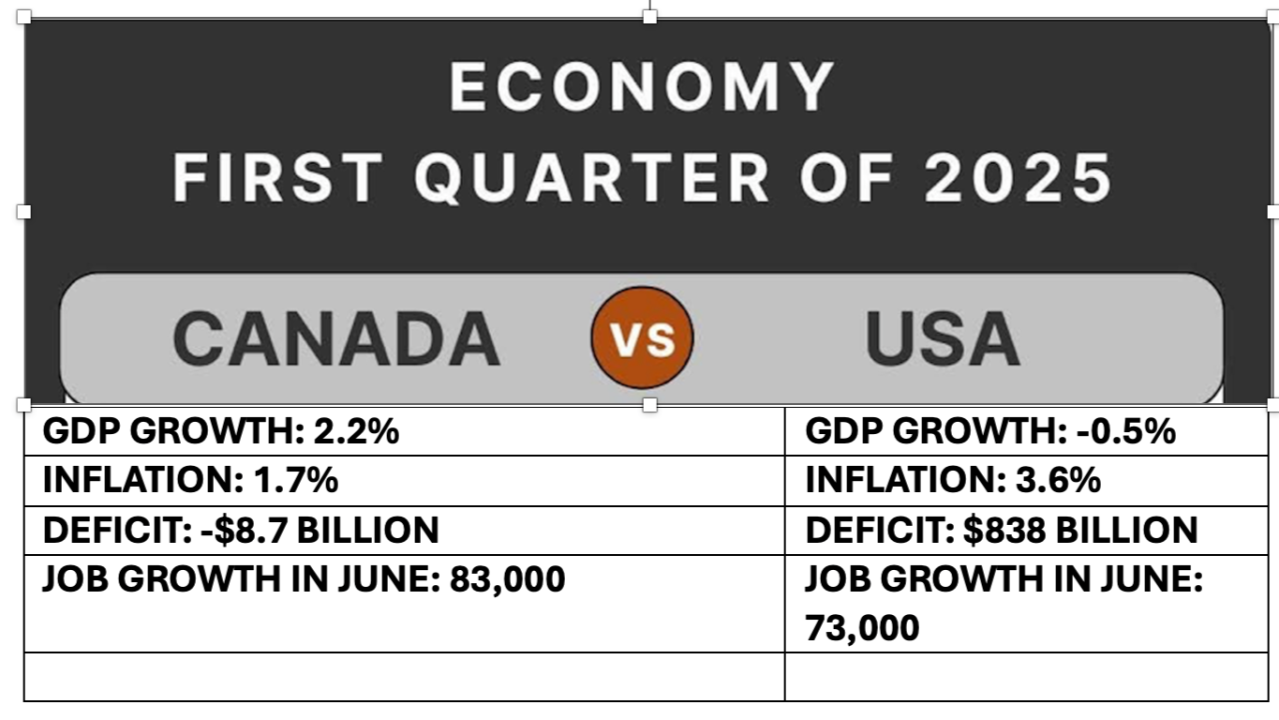

Factor based investing strategies rely on identifying and utilizing certain stock characteristics or “factors” that have historically demonstrated superior returns. These factors can be broadly categorized into macroeconomic factors (such as inflation and GDP growth) and style factors (such as size, value, and momentum).

Expectations Vs Reality

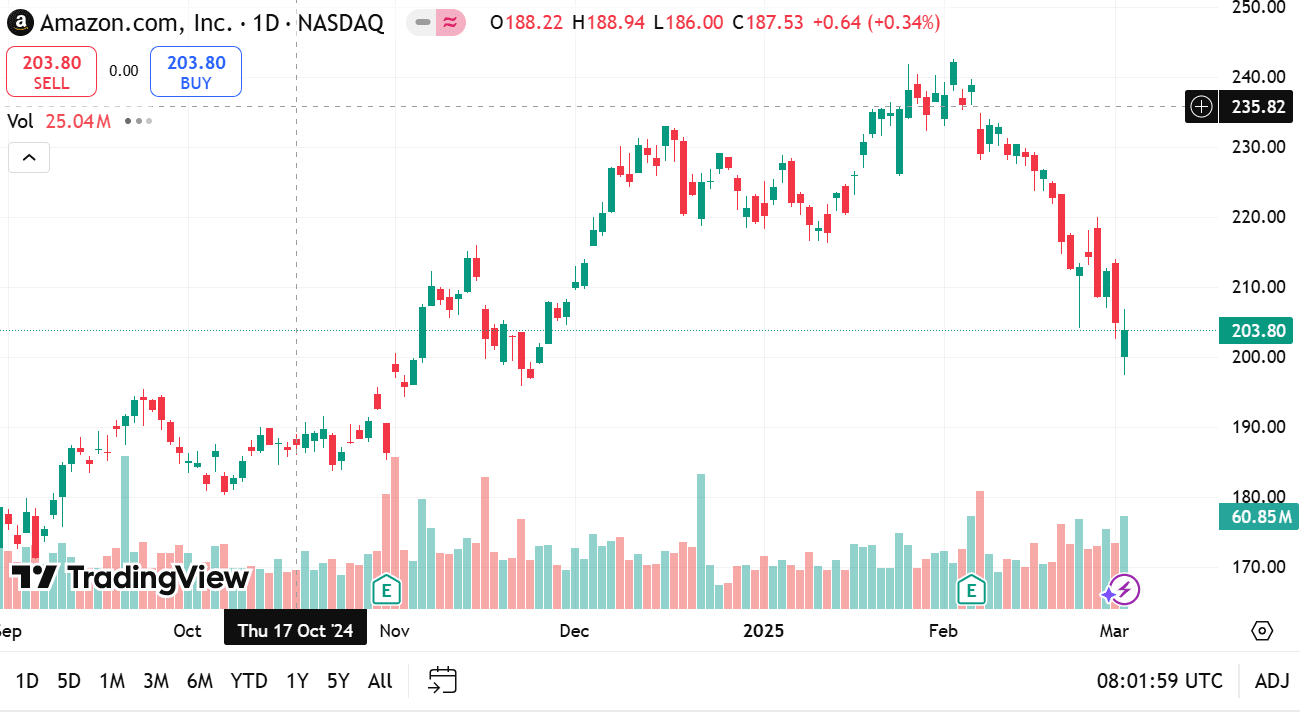

While the historical performance of these factors has been positive, it’s important to note that past performance is not always indicative of future results. Market conditions can change, and factors that have performed well in the past may not necessarily do so in the future. Therefore, it’s crucial for investors to regularly review and adjust their factor investing strategies based on current market conditions.

What Could Go Wrong

While factor based investing provides a systematic and disciplined approach to investing, it is not without risks. The most significant risk is that the factors chosen may not outperform the market. For instance, the value factor, which involves investing in stocks that appear underpriced, may underperform in a market dominated by growth stocks. Additionally, factor investing requires a long-term commitment and may underperform in the short term.

Long-Term Perspective

While factor based investing may experience short-term underperformance, it is designed for long-term investing. Factors such as value and size have shown to yield higher returns over longer investment horizons. Therefore, it’s important for investors to maintain a long-term perspective and not be swayed by short-term market fluctuations.

Investor Tips

- Understand the factors: Knowing the factors you are investing in and their historical performance can help make informed investment decisions.

- Stay committed: Factor investing requires patience and a long-term perspective. Do not be swayed by short-term market fluctuations.

- Regularly review your strategy: Market conditions can change, and so can the performance of different factors. Regularly reviewing and adjusting your strategy can help align it with current market conditions.

Disclaimer: This article is for informational purposes only and is not intended as investment advice. Always conduct your own research and consider your financial situation before making investment decisions.

Leave a Reply