Introduction

The understanding of equity market cycles is a crucial aspect of long-term investment strategies. It provides investors with insights into timing their investments and thus, maximize returns. This article delves into the topic of equity market cycle consultation in the US and how it affects your investment decisions.

Key Business or Financial Drivers

Several factors drive the equity market cycles. These include economic conditions, corporate earnings, interest rates, and investor sentiment. A deep understanding of these factors can help investors predict market trends and make informed investment decisions.

Economic Conditions

The state of the economy often mirrors the equity market cycle. In a booming economy, companies tend to perform well, leading to higher stock prices, while a recession may lead to a market downturn.

Corporate Earnings

Corporate earnings are a direct reflection of a company’s health. Consistent earnings growth can drive stock prices up, while a decline can trigger a market downturn.

Expectations Vs Reality

Investors often have expectations about the equity market cycle based on historical data and economic forecasts. However, the reality can be different due to unforeseen factors such as political instability, policy changes, or global events like a pandemic. Therefore, investors must remain flexible and adjust their strategies as per the current market conditions.

What Could Go Wrong

Predicting the equity market cycle is not an exact science. Despite thorough analysis, things can go wrong. Economic indicators may not accurately predict a market downturn, or a sudden economic event could disrupt the market cycle. Hence, investors must be prepared for market volatility and potential losses.

Long-term Perspective

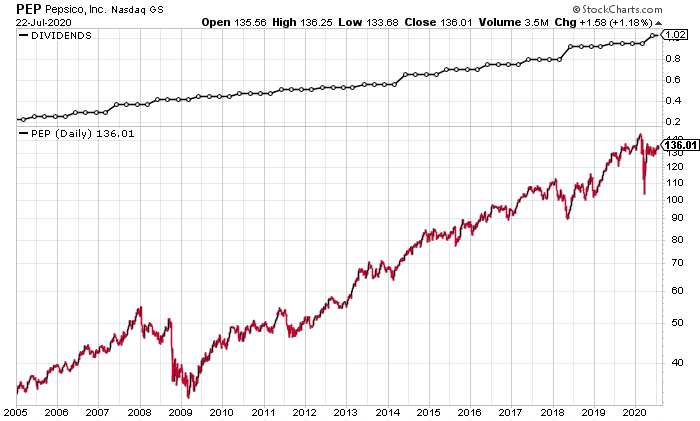

While short-term market fluctuations can impact immediate returns, a long-term perspective can help mitigate risks. Investors should focus on trends over several market cycles to understand the potential long-term outcomes of their investments.

Investor Tips

- Stay updated with economic indicators and market trends

- Invest in diverse sectors to spread risk

- Adopt a long-term investment strategy

- Be prepared to adjust your investment strategy as per market conditions

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Always conduct your own research or consult with a professional before making investment decisions.

Leave a Reply