Why Earnings Sensitivity Analysis Matters

Earnings Sensitivity Analysis is a critical tool for long-term stock investors. It helps to forecast the potential impact of external factors on a company’s earnings, thereby informing investment decisions in US equities.

Key Business and Financial Drivers

Two primary factors drive earnings sensitivity: operational efficiency and interest rate fluctuations. Operational efficiency, including cost management and revenue generation, directly impacts earnings. On the other hand, interest rate fluctuations can influence a company’s borrowing costs and investment income, subsequently affecting its earnings.

Operational Efficiency

Improvements in operational efficiency can lead to margin expansion and higher earnings. Investors should monitor factors like cost of goods sold, labor costs, and overhead expenses. Efficient operations can weather economic downturns, leading to sustainable long-term growth.

Interest Rate Fluctuations

Changes in interest rates can significantly affect a company’s net interest income, especially for financial institutions. Rising interest rates can increase borrowing costs but can also boost returns on interest-earning assets. Investors should keep a close eye on monetary policy and macroeconomic indicators.

Expectations vs Reality

Investors often base their expectations on analysts’ earnings forecasts. However, these forecasts may not always align with the actual earnings due to unforeseen changes in the business environment or internal operations. Therefore, it’s crucial to compare expectations with the reality, and adjust investment strategies accordingly.

What Could Go Wrong

If a company fails to manage its operational costs or doesn’t adapt to interest rate changes, its earnings could take a hit. Additionally, unforeseen events like economic downturns or regulatory changes can also impact earnings negatively. Therefore, while Earnings Sensitivity Analysis provides valuable insights, it’s not fail-proof and should be used alongside other assessment tools.

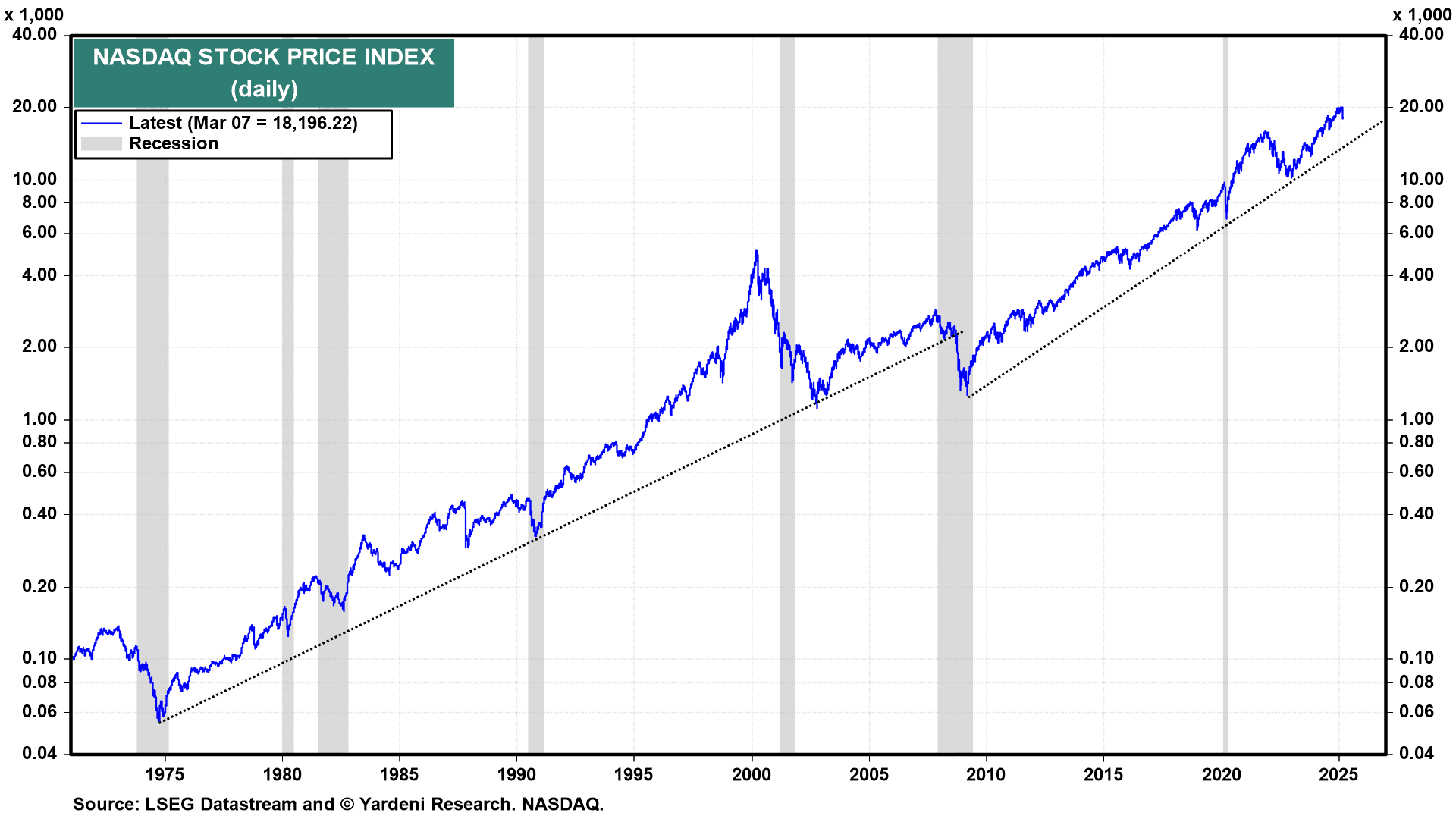

Long-term Perspective

While short-term earnings fluctuations can affect a company’s stock price, it is the long-term earnings growth potential that matters most to investors. Earnings Sensitivity Analysis helps in assessing this potential, enabling investors to make informed long-term investment decisions.

Investor Tips

- Regularly monitor operational efficiency indicators and interest rate changes.

- Always compare earnings forecasts with actual results to identify any deviations.

- Use Earnings Sensitivity Analysis in conjunction with other financial analysis tools for a holistic view.

Disclaimer: This information is for educational purposes only and should not be considered as investment advice. Always conduct your own research before making any investment decisions.

Leave a Reply