Why This Topic Matters

Deciphering the delicate balance between earnings growth and valuation is a critical aspect of long-term investment in US equities. Understanding this relationship can provide valuable insights into a company’s intrinsic value and its future growth potential, thereby guiding investors towards more informed and strategic investment decisions.

Key Business and Financial Drivers

Several key drivers influence the relationship between earnings growth and valuation. These include the company’s earnings growth rate, the price-to-earnings (P/E) ratio, and the overall market conditions. Investors should also consider the company’s competitive advantage, management team, and industry trends.

Earnings Growth vs Reality

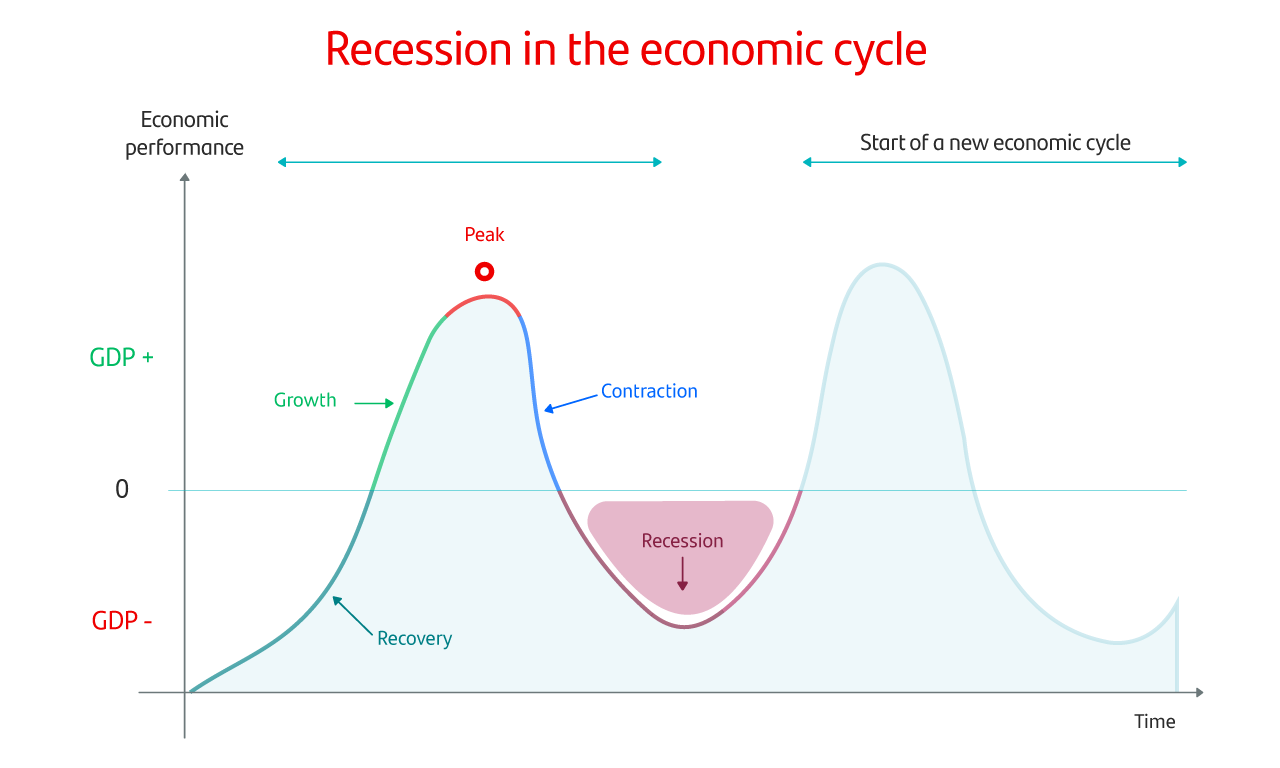

Investor expectations about a company’s future earnings growth significantly influence its current valuation. However, these expectations may not always align with reality. For instance, a company may be overvalued if its projected earnings growth is overly optimistic, leading to inflated stock prices. On the other hand, a company might be undervalued if its projected earnings growth is overly pessimistic, resulting in bargain stock prices. Investors need to critically assess these expectations to avoid overpaying for growth or missing out on potential bargains.

What Could Go Wrong

Investments in equities come with certain risks. Overestimating a company’s earnings growth can lead to overvaluation and potential losses if the growth fails to materialize. Similarly, underestimating earnings growth can result in missed opportunities. Changes in market conditions, such as interest rate hikes or regulatory changes, can also adversely affect a company’s valuation and earnings growth.

Long-Term Perspective

While short-term factors can influence earnings growth and valuation, it’s essential for long-term investors to focus on a company’s fundamental strength and growth potential over multiple years. This approach can help investors weather short-term market volatility and achieve sustainable returns over the long run.

Investor Tips

- Understand the key drivers influencing earnings growth and valuation.

- Avoid overreliance on single metrics and consider a holistic view of the company.

- Stay updated with market trends and changes in regulatory environment.

Disclaimer

This article is for informational purposes only and should not be considered investment advice. Always conduct your own research or consult with a professional before making investment decisions.

Leave a Reply