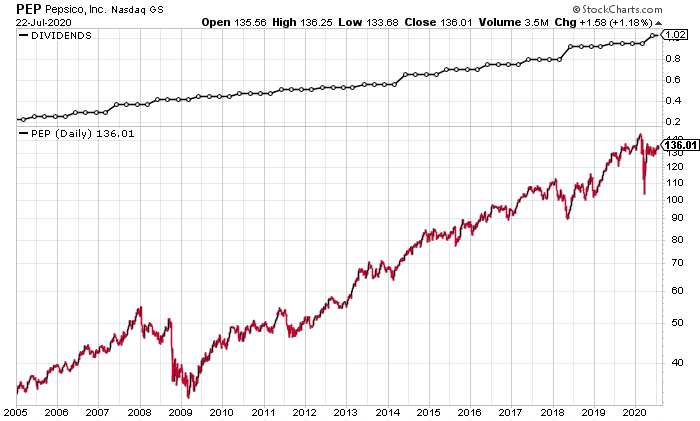

Why Earnings Consistency Matters

Investors often prioritize earnings consistency when evaluating potential investment opportunities. This is due to the fact that a company with consistent earnings generally indicates a stable business model, reliable management, and a robust financial health. Furthermore, such companies are typically better equipped to withstand economic downturns and offer investors a steady stream of dividends.

Key Business and Financial Drivers

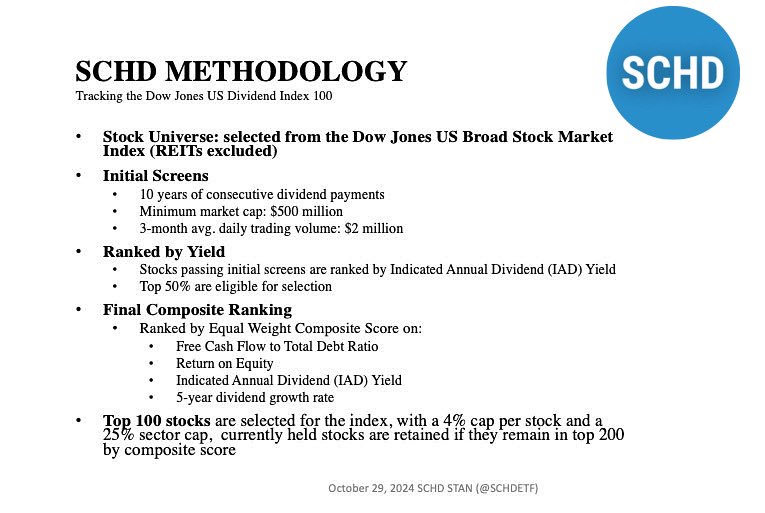

Several key factors drive earnings consistency. These include a company’s competitive positioning, the stability of its industry, the effectiveness of its management team, and its ability to control costs. Moreover, a company’s financial policies – such as its approach to debt and its dividend payout ratios – can also significantly impact earnings consistency.

Expectations vs Reality

Investor expectations for earnings consistency can often be over-optimistic. While a strong track record of consistent earnings is certainly a positive sign, it does not guarantee future performance. Business environments change, and even the most established companies can experience periods of earnings volatility. Therefore, it is crucial for investors to regularly reassess their expectations and adjust their investment strategies accordingly.

What Could Go Wrong

Several factors could potentially disrupt a company’s earnings consistency. These include unexpected changes in the business environment, shifts in consumer behavior, regulatory changes, or operational mishaps. Moreover, over-reliance on a single source of revenue or a small group of customers can also pose significant risks.

Long-Term Perspective

Earnings consistency should be viewed as a long-term indicator rather than a short-term performance measure. While short-term disruptions can impact earnings, a company with a strong track record of earnings consistency is often better equipped to weather these storms and deliver long-term value to investors.

Investor Tips

- Always consider earnings consistency in the context of other financial indicators, such as revenue growth and profit margins.

- Look for companies that have a diverse revenue base and a proven ability to manage costs effectively.

- Regularly reassess your investment strategy to ensure it remains aligned with your long-term financial goals.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Always do your own research and consult with a professional before making any investment decisions.

Leave a Reply