Why Earnings and Long-Term Business Health Matter

The earnings of a company and its long-term health are two critical factors that every investor must consider. These factors not only influence the company’s current valuation but also provide insights into its future potential and sustainability. Investors who understand these aspects can make more informed decisions about their investments.

Key Business and Financial Drivers

Several key business and financial drivers directly impact a company’s earnings and long-term health. These include revenue growth, operating margins, and return on invested capital. These drivers are not standalone factors but are interdependent and should be analyzed collectively for a comprehensive understanding of the company’s performance.

Revenue Growth

Consistent revenue growth is a strong indicator of a business’s sustainability. It signals strong demand for the company’s products or services and management’s ability to capitalize on market opportunities.

Operating Margins

Operating margins reflect the efficiency of a company’s operations. Higher margins indicate that the company can convert a larger portion of its sales into profits, which can contribute to stronger earnings.

Return on Invested Capital

Return on invested capital (ROIC) measures how effectively a company uses its capital to generate profits. A high ROIC may indicate that the company has durable competitive advantages, leading to better long-term business health.

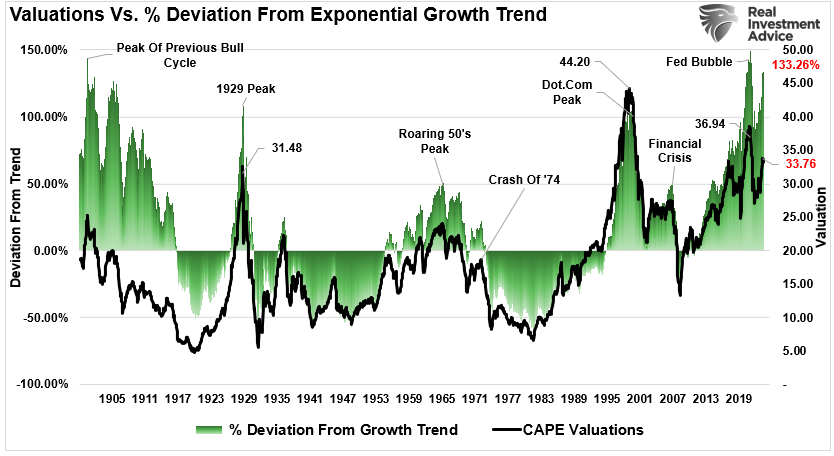

Expectations vs Reality

Often, the market’s expectations about a company’s future performance are reflected in its stock price. However, there can be a disconnect between these expectations and the company’s actual performance. For instance, if a company consistently surpasses earnings expectations, its stock price may rise. However, if the earnings are achieved through cost-cutting rather than revenue growth, it may not be sustainable in the long term.

What Could Go Wrong

While analyzing a company’s earnings and long-term business health, investors must consider potential risks. These could include changes in market conditions, competitive pressures, regulatory changes, or operational inefficiencies. Any of these factors can adversely impact a company’s earnings and long-term health.

Long-Term Perspective

Investors should not focus solely on short-term earnings but also consider the company’s long-term prospects. Factors such as the company’s competitive position, industry trends, and management’s strategic plans can significantly influence its long-term business health.

Investor Tips

- Look beyond the headlines: Don’t rely solely on earnings reports. Dig deeper into the company’s financials and understand the factors driving its earnings.

- Consider the long-term perspective: Evaluate the company’s long-term prospects and sustainability, not just its current performance.

- Monitor the market: Keep an eye on market trends, industry developments, and potential risks that could impact your investment.

This article is for informational purposes only and should not be considered as investment advice. Always do your own research or consult with a professional advisor before making investment decisions.

Leave a Reply