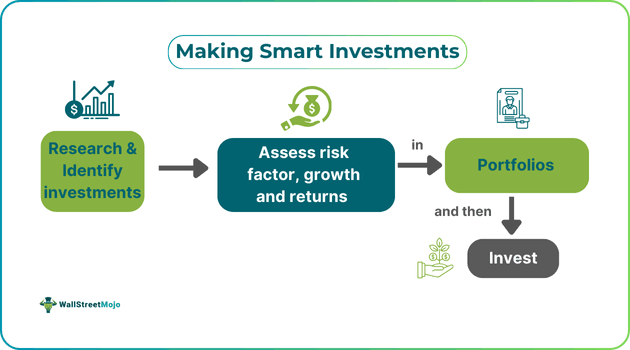

Introduction

Understanding the competitive dynamics in US industries is a crucial factor for investors aiming to make informed decisions about long-term stock investments. This knowledge can provide insights into the potential growth or decline of specific industries, thereby influencing the profitability of investments.

Key Business and Financial Drivers

Several business and financial drivers impact the competitive dynamics within US industries. These include technological advancement, regulatory policies, economic conditions, and market demand. For instance, industries that rapidly adopt and innovate with technology can gain a competitive edge, enhancing their attractiveness to investors.

Expectations vs. Reality

Market expectations often revolve around the assumption that industries with high barriers to entry and less competition are more likely to yield higher returns. However, this isn’t always the case. For instance, industries with fewer competitors can also be less innovative and more susceptible to regulatory changes, which could negatively impact investment returns.

What Could Go Wrong?

Several factors could negatively impact the competitive dynamics within US industries. These include economic downturns, changes in consumer behavior, regulatory shifts, and technological disruptions. Such changes could lead to decreased profitability for companies within the affected industries, which could in turn negatively impact investment returns.

Long-term Perspective

While short-term factors like sudden market changes or economic downturns can impact industries, it’s essential to maintain a long-term perspective. Industries evolve over time, and those that adapt and innovate are more likely to succeed in the long run. Therefore, investors should consider the potential for industry evolution and growth when making long-term investment decisions.

Investor Tips

- Stay informed about industry trends and changes in competitive dynamics.

- Consider both short-term factors and long-term potential when making investment decisions.

- Be prepared for potential risks and have a plan in place to mitigate them.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a professional financial advisor before making investment decisions.

Leave a Reply