Why Company Risk Assessment Matters to Investors

Company risk assessment is a critical part of the investment decision-making process. It helps to determine the potential risks associated with a company, from financial stability to industry competition, and therefore, directly impacts the potential return on investment. In the volatile and complex US market, a comprehensive understanding of a company’s risk profile can make the difference between a profitable investment and a costly mistake.

Key Business and Financial Drivers

In order to assess a company’s risk, investors need to analyze key business and financial drivers. These include the company’s financial health, industry position, competitive landscape, and the potential for growth or decline in its sector. A company with strong financials, a solid position in its industry, and a favorable competitive environment has a lower risk profile.

- Financial Health: A company’s financial health can be assessed by analyzing its balance sheet, income statement, and cash flow statement. High levels of debt, declining revenues, or negative cash flow are all potential indicators of risk.

- Industry Position: A company’s position within its industry can also impact its risk profile. Companies that are leaders in their industries generally have a lower risk profile than those that are not.

- Competitive Landscape: The level of competition within a company’s industry can impact its ability to generate profits and therefore, its risk profile.

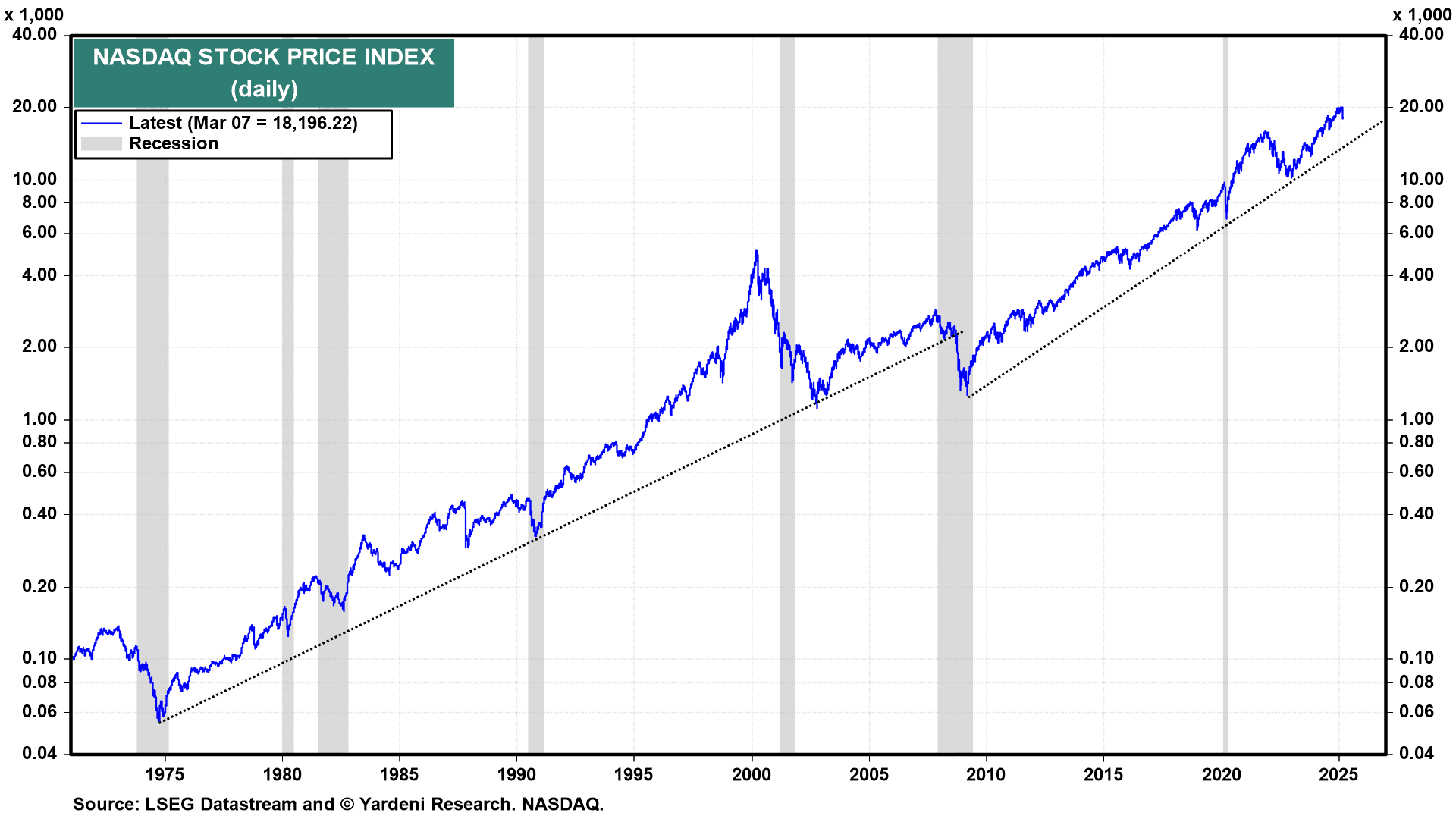

- Potential for Growth: The potential for growth or decline in a company’s sector can impact its future profitability and risk profile. This can be assessed by analyzing industry trends and economic indicators.

Expectations Vs Reality

Often, the stock price reflects the market’s expectations of a company’s future performance. However, these expectations may not always align with reality. Differences between expectations and reality can create investment opportunities. For example, if the market is overly pessimistic about a company’s future prospects, this could result in an undervalued stock. Conversely, overly optimistic expectations could lead to an overvalued stock. Therefore, it’s important for investors to assess the gap between expectations and reality when evaluating a company’s risk profile.

What Could Go Wrong

Despite thorough risk assessment, unforeseen events or changes in the market can impact a company’s risk profile. This could include changes in government policy, economic downturns, or disruptive technological advancements. Therefore, it’s important for investors to consider potential adverse scenarios and their potential impact on their investments.

Long-term Perspective

While short-term factors can impact a company’s risk profile, it’s important for investors to maintain a long-term perspective. This involves considering how short-term factors could impact the company’s long-term performance and sustainability. For example, while a company may currently be facing financial difficulties, it may have a solid recovery plan in place that could improve its long-term prospects.

Investor Tips

- Regularly monitor the company’s financial health and industry position.

- Consider the potential impact of changes in the market or government policy on your investments.

- Maintain a long-term perspective when assessing a company’s risk profile.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always do your own research and consult with a professional before making any investment decisions.

Leave a Reply