Why Business Expansion Strategies Matter to Investors

Business expansion strategies are critical for investors as they reflect a company’s long-term growth potential. They signal management’s confidence in the business and its ability to generate sustainable profits, fostering investor confidence. An effective expansion strategy can lead to increased market share, diversified risks, and improved financial performance, thereby enhancing shareholder value.

Key Drivers of Business Expansion

The success of a business expansion strategy largely depends on the company’s ability to identify and exploit growth opportunities, manage risks, and maintain financial stability while scaling up operations. These factors collectively influence the company’s valuation and investors’ return expectations.

Growth Opportunities

Companies with a clear understanding of their competitive advantages and market trends are better positioned to identify lucrative growth opportunities. Investors should watch for management’s ability to leverage these opportunities to drive business expansion.

Risk Management

Business expansion is often associated with increased risks, including operational, financial, and market risks. A company’s ability to effectively manage these risks is a crucial factor that investors need to consider.

Financial Stability

Financial stability is essential for successful business expansion. Companies with strong balance sheets and robust cash flows are more likely to sustain their expansion plans over the long term without compromising financial health.

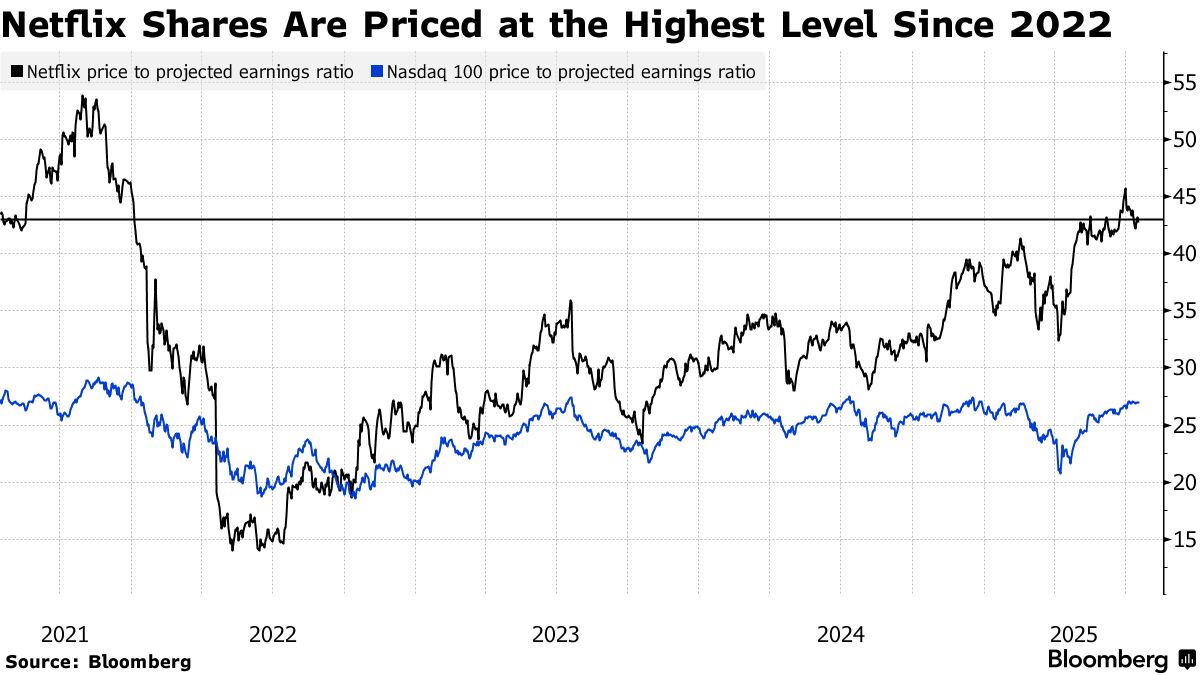

Expectations vs Reality

Investors often price in the expected benefits of business expansion into a company’s stock. However, the actual outcome may vary depending on the effectiveness of the expansion strategy and the company’s execution capabilities. Investors need to monitor the company’s progress against its expansion plans and adjust their investment decisions accordingly.

What Could Go Wrong

Despite a well-articulated business expansion strategy, several factors could derail a company’s growth plans. These include a failure to accurately identify growth opportunities, poor execution, inability to manage risks, and financial instability. Investors should be mindful of these risks and be prepared to reassess their investment thesis if these issues arise.

Long-term Perspective

While short-term factors such as quarterly earnings often influence investor sentiment, it’s important to maintain a long-term perspective. Successful business expansion can result in sustained revenue growth, profitability improvement, and increased shareholder returns over the multi-year horizon.

Investor Tips

- Monitor the company’s progress in implementing its business expansion strategy.

- Assess the company’s ability to manage risks associated with business expansion.

- Stay focused on the long-term growth prospects of the company, rather than short-term market fluctuations.

Disclaimer

This article is for informational purposes only and should not be construed as investment advice. Always conduct your own research before making investment decisions.

Leave a Reply