Introduction: Why Post-Earnings Analysis Matters

For long-term investors, understanding a stock’s performance extends beyond just quarterly earnings. It requires a comprehensive review of various business and financial drivers, along with a realistic outlook on what could go right or wrong. This article provides a checklist to guide investors through this process and understand what post-earnings data means for a stock’s long-term potential.

Key Business and Financial Drivers

Revenue growth, profit margins, and cash flows are the critical financial metrics that can provide insights into a company’s operational efficiency. However, understanding the underlying business drivers, such as customer acquisition costs, churn rates, or product innovation, can offer a more holistic view of a company’s potential for long-term growth.

Revenue Growth and Profit Margins

While strong revenue growth signals increasing demand for a company’s products or services, expanding profit margins indicate operational efficiency. However, investors should delve deeper into these numbers to understand the sources of growth and efficiency.

Customer Metrics

Long-term investors should also consider customer-centric metrics. High customer acquisition costs or increasing churn rates could signal potential challenges in sustaining growth or profitability over the long term.

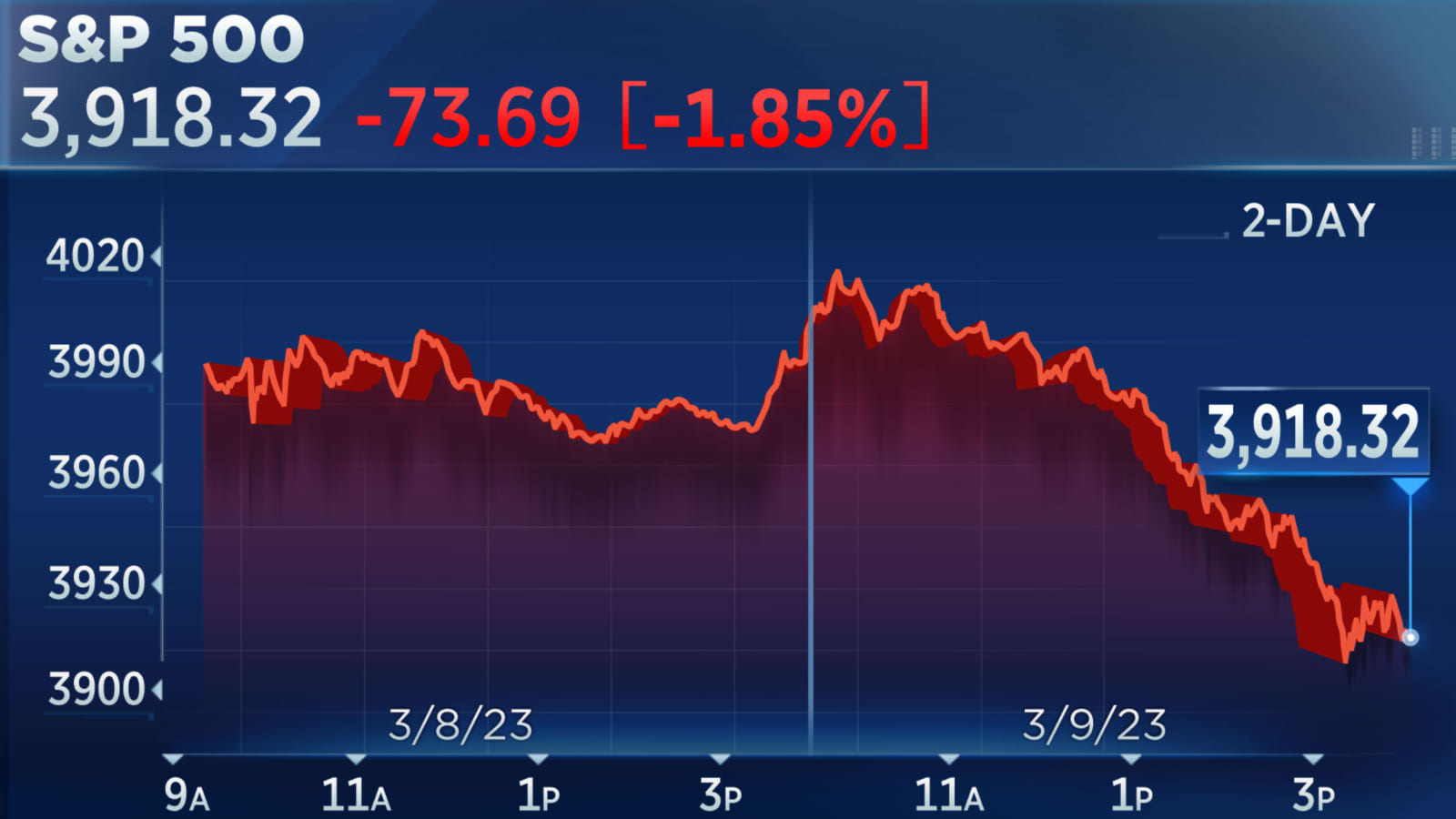

Expectations Vs. Reality

Often, a stock’s price movement post-earnings is more about how the results compared to market expectations than the results themselves. If earnings fall short of expectations, even an otherwise profitable quarter could lead to a stock price dip. Conversely, exceeding expectations can provide a short-term boost to the stock price.

What Could Go Wrong

While the focus is on long-term growth, it’s essential to consider potential risks. Market volatility, regulatory changes, or increased competition could impact a company’s long-term growth trajectory. Additionally, internal factors such as key personnel changes or problems with product development could also pose challenges.

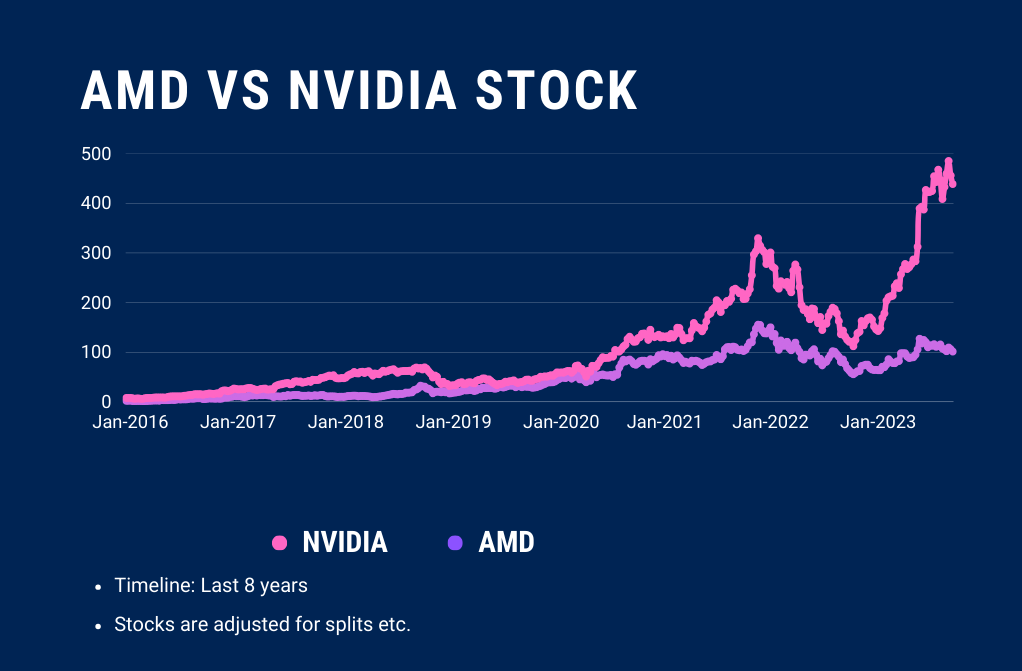

Long-Term Perspective

While quarterly earnings provide a snapshot of a company’s financial health, long-term investors should focus more on trends over several quarters or years. This approach helps identify sustainable growth patterns and mitigate the impact of short-term market fluctuations.

Investor Tips

- Consider both financial and business drivers when analyzing a stock.

- Understand the market expectations priced into the stock.

- Identify potential risks and challenges that could impact long-term growth.

- Focus on multi-year trends, not just a single quarter’s results.

This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research and consult with a professional advisor before making investment decisions.

Leave a Reply