Introduction

Portfolio downside planning is an essential consideration for long-term investors. It provides a safety net against market volatility and helps maximize risk-adjusted returns. This strategy, when properly executed, allows investors to build resilient portfolios that can withstand market downturns and generate consistent returns over the long term.

Key Business and Financial Drivers

The primary drivers for portfolio downside planning are market volatility and the investor’s risk tolerance. Market volatility can impact the value of investments, whereas risk tolerance determines the level of risk an investor is willing to accept.

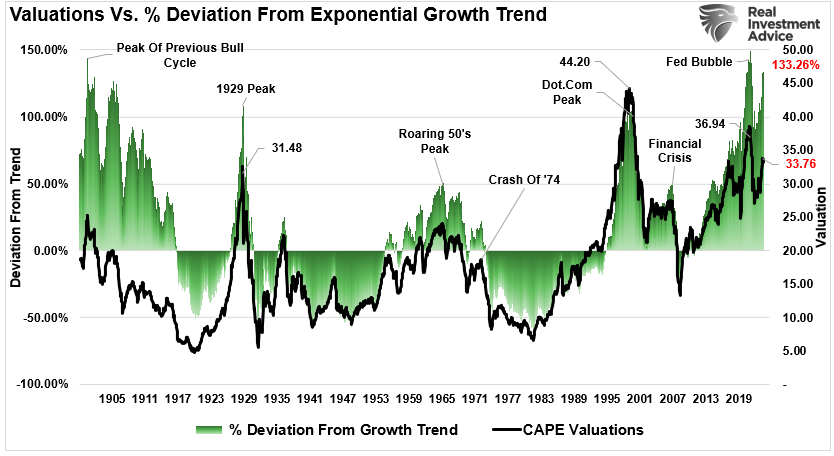

Market Volatility

Market volatility is a key consideration for downside planning. High volatility often leads to larger price swings, increasing the potential for losses. However, it also presents opportunities for high returns. Thus, investors need to balance their portfolios to mitigate these risks and capitalize on potential gains.

Risk Tolerance

Risk tolerance is another crucial factor. Investors with a low risk tolerance should focus more on downside planning to protect their portfolios. Conversely, investors with a high risk tolerance may accept greater risks for higher potential returns.

Expectations Vs. Reality

Many investors expect their portfolios to continually appreciate without any downside. However, this is often not the reality. Markets fluctuate, and investments can depreciate. Therefore, having a downside planning strategy in place is crucial to safeguard investments against unforeseen market downturns.

What Could Go Wrong

Without proper downside planning, investors might face significant losses during market downturns. They may also miss out on opportunities to buy stocks at lower prices during these periods.

Long-Term Perspective

While downside planning can help mitigate short-term risks, its real value is in long-term investing. A well-executed downside planning strategy can help investors weather market storms and generate consistent returns over the long term.

Investor Tips

- Assess your risk tolerance: Understanding your risk tolerance is the first step in effective downside planning.

- Monitor market volatility: Keep a close eye on market volatility and adjust your portfolio accordingly.

- Seek professional advice: Consult with a financial advisor or investment professional for personalized downside planning strategies.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research and consult with a professional before making investment decisions.

Leave a Reply