Why Market Volatility Matters

Market volatility is not just a measure of price swings or uncertainties in financial markets, it’s a key parameter that shapes the investment strategies of long-term investors. Understanding and factoring in market volatility can help investors make informed decisions, maximize returns, and mitigate potential risks.

Key Business or Financial Drivers

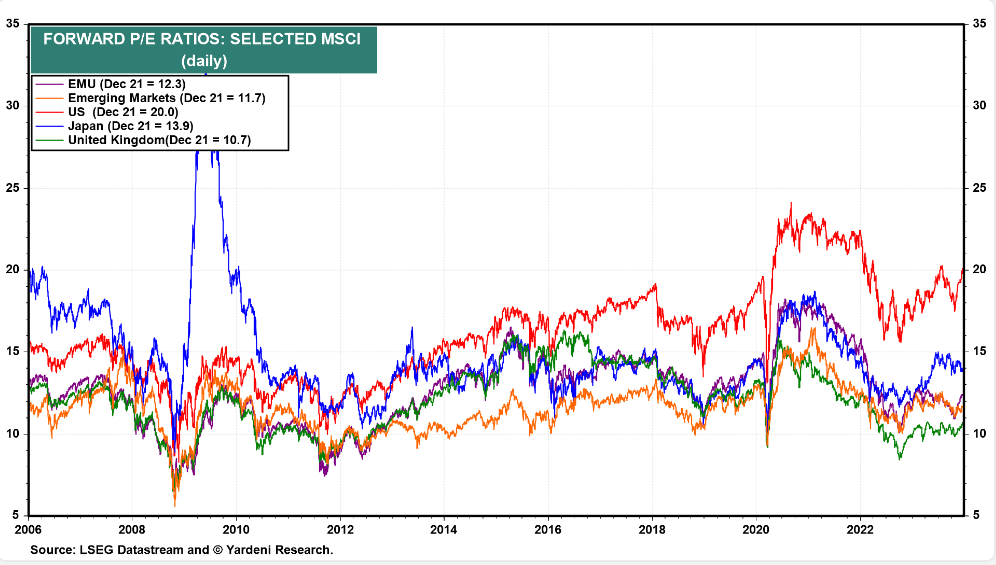

Market volatility is influenced by a myriad of factors, including economic indicators, geopolitical events, corporate earnings reports, and changes in fiscal and monetary policies. The interplay of these factors can cause dramatic price swings in US stocks.

Economic Indicators

Indicators such as employment rates, inflation, and GDP growth can cause shifts in market volatility. For instance, strong employment data can lead to positive market reactions, reducing volatility, while high inflation can induce market uncertainty, increasing volatility.

Geopolitical Events

Events such as elections, trade wars, or geopolitical conflicts can create uncertainties in the market, leading to increased volatility.

Expectations vs Reality

Investors often anticipate market volatility based on historical patterns, economic forecasts, and current events. However, the reality can often diverge from these expectations. Unexpected events or sudden changes in economic conditions can trigger market volatility. For instance, the COVID-19 pandemic caused unprecedented market volatility, defying most forecasts.

What Could Go Wrong

Investors might underestimate the potential for volatility, leading to overexposure in risky assets. A sudden spike in volatility could cause significant losses. Additionally, over-reliance on historical volatility patterns might cause investors to miss new trends or overlook emerging risks.

Long-term Perspective

Despite the short-term challenges posed by market volatility, it can create long-term opportunities. Volatile markets might present attractive entry points for investors with a long-term perspective. By carefully analyzing market trends and maintaining a diversified portfolio, investors can navigate market volatility and achieve sustainable returns over multiple years.

Investor Tips

- Stay informed about global economic indicators and geopolitical events.

- Consider diversifying your portfolio to manage risk.

- Adopt a long-term investment perspective.

Please note, this article is for informational purposes only and does not constitute investment advice.

Leave a Reply