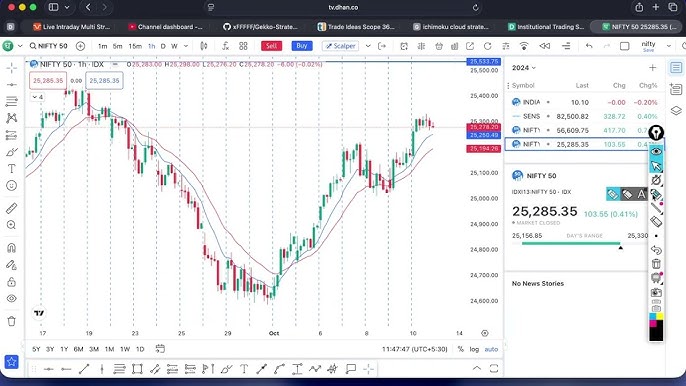

Introduction: Why Earnings Analysis Matters in Volatile Markets

Volatility in financial markets can significantly impact a company’s earnings, thereby altering its stock valuation. For long-term investors, understanding how this volatility affects earnings is crucial as it can provide insights into the company’s future financial health, helping them make informed investment decisions.

Key Business and Financial Drivers in Volatile Markets

Several factors drive a company’s earnings in volatile markets. These include operational efficiency, debt levels, market share, and the industry’s economic environment. Understanding these drivers helps investors gauge a company’s resilience in the face of market volatility.

Operational Efficiency

Companies with high operational efficiency are typically more resistant to volatility. They have streamlined processes and cost-effective strategies, which can mitigate the effects of market fluctuations on their earnings.

Debt Levels

High debt levels can expose a company to increased risk during market volatility. Companies with lower debt levels are often better positioned to withstand financial pressures, potentially leading to more stable earnings.

Market Share

Companies with a larger market share often have greater bargaining power, which can help them weather volatility better than their competitors. This could result in less fluctuation in their earnings.

Economic Environment

The overall economic environment, including inflation rates and monetary policies, can also affect a company’s earnings. Investors need to consider these macroeconomic factors when analyzing earnings in volatile markets.

Expectations vs. Reality

Investors often have expectations about a company’s earnings based on its historical performance, industry norms, and economic indicators. However, in volatile markets, these expectations may not align with reality. Companies that can adapt and maintain stable earnings despite market turbulence often exceed investor expectations, potentially leading to higher stock valuations.

What Could Go Wrong

In volatile markets, numerous factors could negatively affect a company’s earnings. These include sudden economic downturns, regulatory changes, increased competition, or major operational disruptions. Investors should be aware of these potential risks when analyzing earnings and making investment decisions.

Long-Term Perspective

While short-term market volatility can impact earnings, it’s important for long-term investors to maintain a broad perspective. Earnings stability over multiple years, despite short-term volatility, can indicate a company’s financial resilience and long-term growth potential.

Investor Tips

- Focus on companies with strong operational efficiency and low debt levels.

- Consider the company’s market share and the overall economic environment.

- Be aware of the potential risks and uncertainties that could negatively impact earnings.

- Keep a long-term perspective, focusing on earnings stability over multiple years.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with a financial advisor before making investment decisions.

Leave a Reply