Introduction: Why This Topic Matters

Understanding the long-term perspective on valuation is essential for investors as it provides insights into a company’s future earning potential, its comparative standing in the market, and its resilience in dealing with market fluctuations. This can help investors make informed decisions and maximize returns over time.

Analysis of Key Business or Financial Drivers

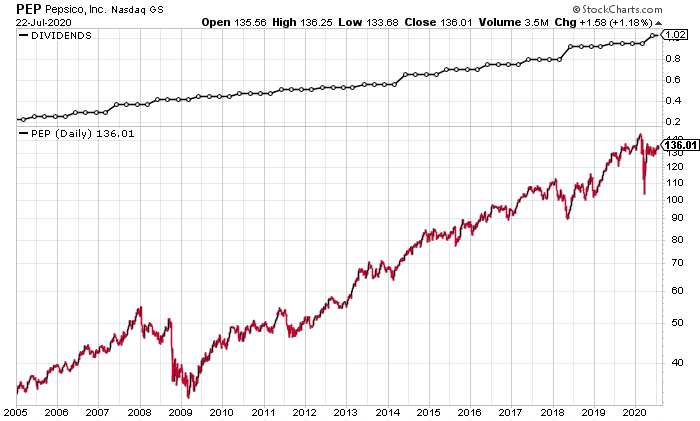

Three primary drivers impact a company’s long-term valuation: revenue growth, profitability, and risk. Revenue growth signifies the company’s ability to expand its business, profitability indicates its efficiency, and risk factors can influence its stability. Monitoring these metrics over a long period can reveal trends and patterns, helping investors predict future performance.

Expectations vs. Reality

Often, market expectations are based on short-term trends and may not fully reflect a company’s long-term potential. For instance, a company with a high current P/E ratio might seem overvalued, but if the company’s long-term growth prospects are strong, it may actually be undervalued. Therefore, investors should analyze both current market prices and long-term growth potential when making investment decisions.

What Could Go Wrong

While long-term valuation analysis can provide valuable insights, it also comes with its own set of risks. Predictions about future performance are based on assumptions that may not always hold true. Factors such as market volatility, regulatory changes, or unexpected business challenges can significantly impact a company’s long-term valuation.

Long-Term Perspective Connecting Short-Term Factors to Multi-Year Outcomes

Short-term market fluctuations can often create a misleading picture of a company’s worth. However, a long-term perspective can help investors see beyond these temporary variations and focus on the company’s fundamental value drivers. By connecting short-term factors to multi-year outcomes, investors can gain a more accurate understanding of a company’s true value.

Investor Tips

- Focus on companies with stable revenue growth, strong profitability, and manageable risks.

- Don’t let short-term market fluctuations cloud your judgement. Keep a long-term perspective.

- Always cross-verify market expectations with the company’s long-term growth potential.

This article is intended for informational purposes only and does not constitute investment advice. Always do your own research or consult with an investment professional before making investment decisions.

Leave a Reply