Why Should Investors Care About Compounding Strategies in US Equities?

Long-term investment in US equities is an effective strategy for wealth creation due to the power of compounding. Reinvesting dividends and capital gains can significantly enhance the growth of your investment over time. This article aims to dissect the core considerations of long-term compounding strategies in US equities and shed light on the potential risks and rewards.

Key Drivers of Compounding in US Equities

Two fundamental drivers of compounding in US equities are consistent reinvestment and time. Reinvesting dividends and capital gains allows your investment to grow exponentially over time. Additionally, the longer you stay invested, the more time your money has to compound and grow.

Reinvestment

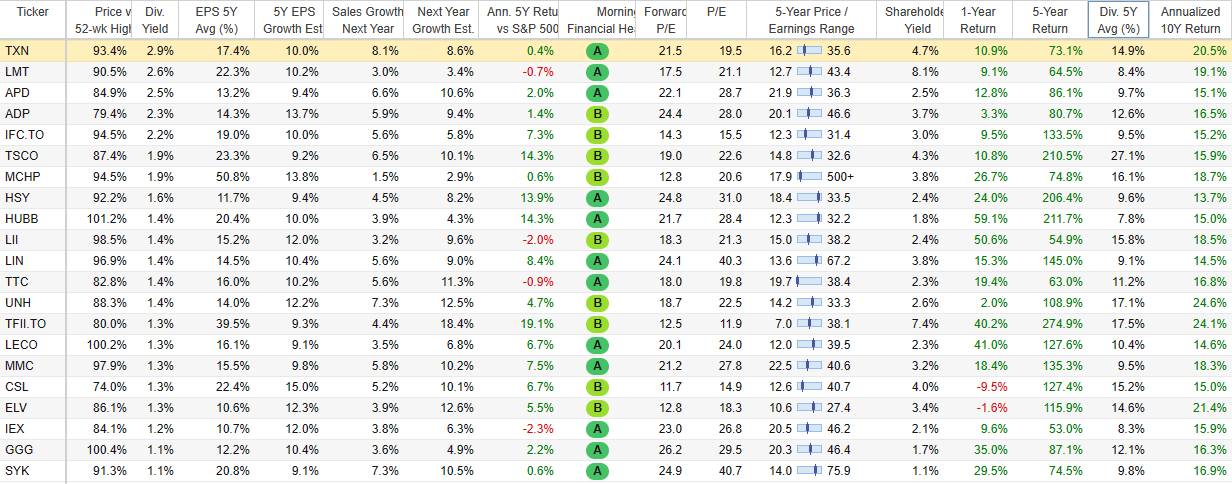

Consistent reinvestment is a critical driver of compounding. By reinvesting dividends and capital gains, you increase your shareholding, which boosts your total return over time. This is why dividend-paying stocks are often a core part of long-term compounding strategies.

Time

Time is the other crucial driver of compounding. The longer your money is invested, the more time it has to generate returns, and the greater the impact of compounding. Therefore, a long-term investment horizon is key to maximizing the benefits of compounding.

Expectations vs Reality

While the power of compounding is widely recognized, it’s important to maintain realistic expectations. Not all stocks will provide consistent returns, and there will be periods of market volatility. However, a diversified portfolio of high-quality, dividend-paying stocks can help mitigate these risks and enhance the compounding effect over the long term.

What Could Go Wrong?

There are several risks to be aware of when pursuing a long-term compounding strategy. Market cycles, economic downturns, and company-specific risks can all impact your returns. In addition, it’s essential to remember that past performance is not indicative of future results, and the compounding effect may not be as strong in the future as it has been in the past.

Long-Term Perspective

Despite short-term market volatility, a long-term perspective is key to maximizing the benefits of compounding. By staying invested through market cycles, you allow your investments to grow and compound over time, leading to significant wealth creation in the long term.

Investor Tips

- Focus on high-quality, dividend-paying stocks to maximize the compounding effect.

- Maintain a long-term investment horizon to allow your money to compound over time.

- Diversify your portfolio to mitigate risks and enhance long-term returns.

Please note that this article is for informational purposes only and does not constitute investment advice. Always do your own research or consult with a financial advisor before making investment decisions.

Leave a Reply