Introduction: Why Portfolio Flexibility Matters

Investing in US equities is not a one-size-fits-all approach. The complexities of the market, along with the ever-changing economic landscape, necessitate a flexible strategy for portfolio management. As a long-term investor, understanding portfolio flexibility strategies can be the key to mitigating risks and maximizing returns over time.

Key Business or Financial Drivers

Several key drivers influence the effectiveness of portfolio flexibility strategies in US equities. These include market volatility, economic indicators, and individual company performance. Understanding these drivers allows investors to make informed decisions on when to adjust their portfolio strategies.

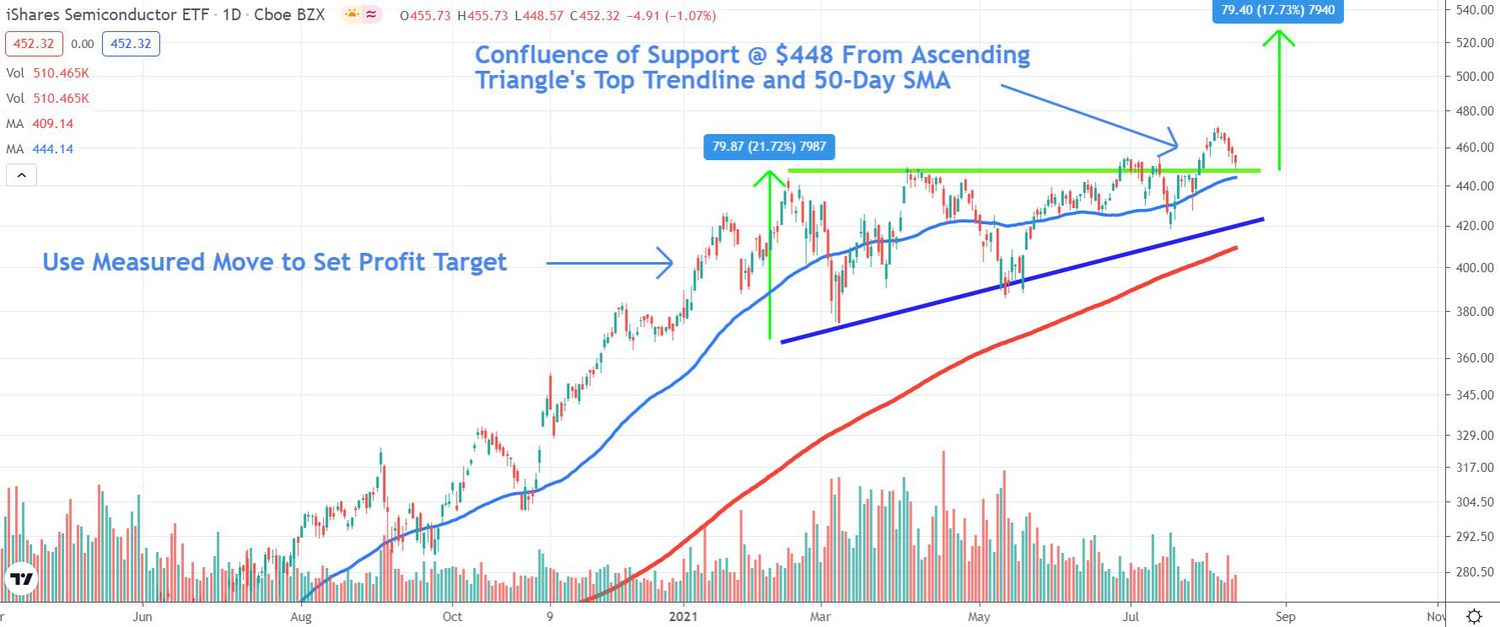

Market Volatility

The unpredictability of the stock market makes flexibility essential. Market volatility can be triggered by factors such as geopolitical events, economic policy changes, and industry trends. A flexible portfolio can adapt to these changes, seizing opportunities and mitigating risks.

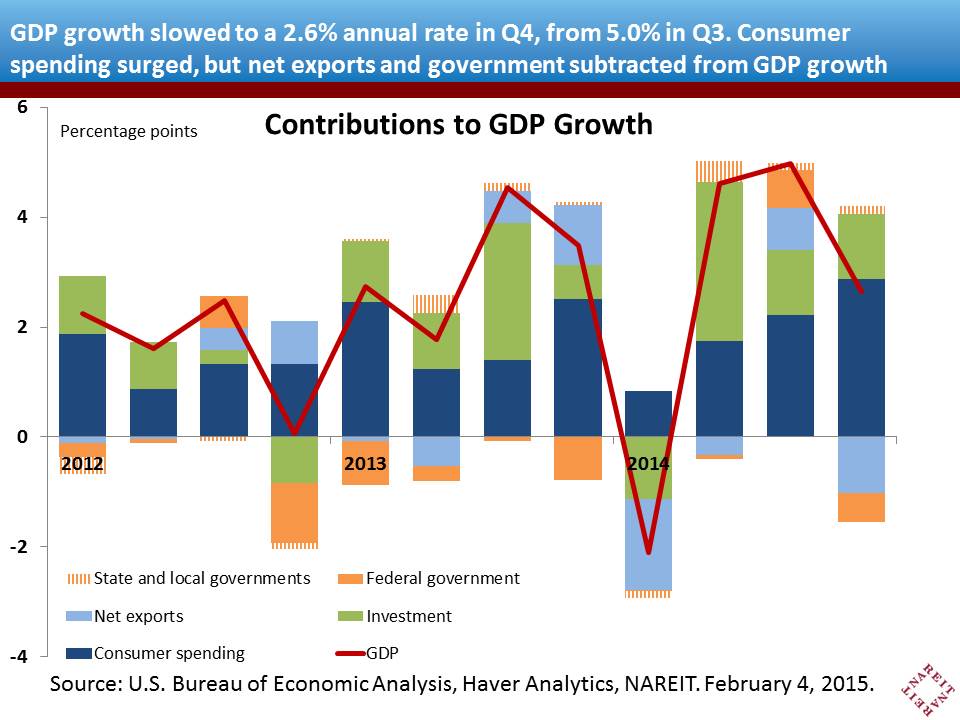

Economic Indicators

Economic indicators such as GDP growth, employment rates, and inflation can significantly impact the performance of US equities. By closely monitoring these indicators, investors can adjust their portfolios appropriately to capitalize on economic trends.

Company Performance

Company-specific factors such as earnings reports, leadership changes, and product launches can greatly influence stock prices. A flexible portfolio strategy allows investors to adjust their holdings based on these individual company events.

Expectations vs. Reality

When investing in US equities, expectations can often diverge from reality. Economic forecasts might not always come to fruition, and companies can underperform or exceed their projected earnings. Portfolio flexibility allows investors to adjust their strategies based on these realities, rather than being locked into decisions based on initial expectations.

What Could Go Wrong

Despite its advantages, portfolio flexibility is not without risks. Overreacting to short-term market fluctuations can lead to hasty decisions that undermine long-term investment goals. Furthermore, constant adjustments can increase transaction costs, impacting overall returns. Therefore, it’s crucial for investors to balance flexibility with a steadfast commitment to their long-term strategy.

Long-Term Perspective

While portfolio flexibility can help navigate short-term market volatility, its true value lies in its ability to foster long-term investment success. By allowing for strategic adjustments in response to market changes, it enables investors to seize emerging opportunities and mitigate potential risks, fostering sustainable growth over multiple years.

Investor Tips

- Stay informed: Regularly monitor market developments, economic indicators, and company news.

- React strategically: Adjust your portfolio in response to significant changes, but avoid overreacting to minor market fluctuations.

- Balance flexibility and stability: While flexibility is important, remember to stay committed to your long-term investment goals.

Disclaimer

This article is for informational purposes only and is not intended as investment advice. Always conduct your own research or consult with a professional before making investment decisions.

Leave a Reply