Why Earnings-Driven Investment Matters

Understanding earnings-driven investment signals is crucial for long-term US investors. These signals provide insights into a company’s financial health, profitability, and potential for growth, which are all key factors when making investment decisions. Being able to interpret these signals effectively can help you identify undervalued stocks, anticipate market trends, and make informed decisions about when to buy or sell.

Analysis of Key Financial Drivers

Earnings reports are one of the most important financial drivers for investment decisions. They reveal a company’s profitability, the success of its business strategies, and its prospects for future growth. Moreover, these reports can offer insights into economic trends and sector performance, which can help investors understand the broader market context in which a company operates.

Expectations vs. Reality

Stock prices often reflect market expectations about a company’s future earnings. If actual earnings exceed these expectations, the stock price typically rises. Conversely, if earnings fall short of expectations, the stock price may decline. Therefore, it’s essential for investors to monitor earnings reports closely and adjust their investment strategies accordingly.

What Could Go Wrong

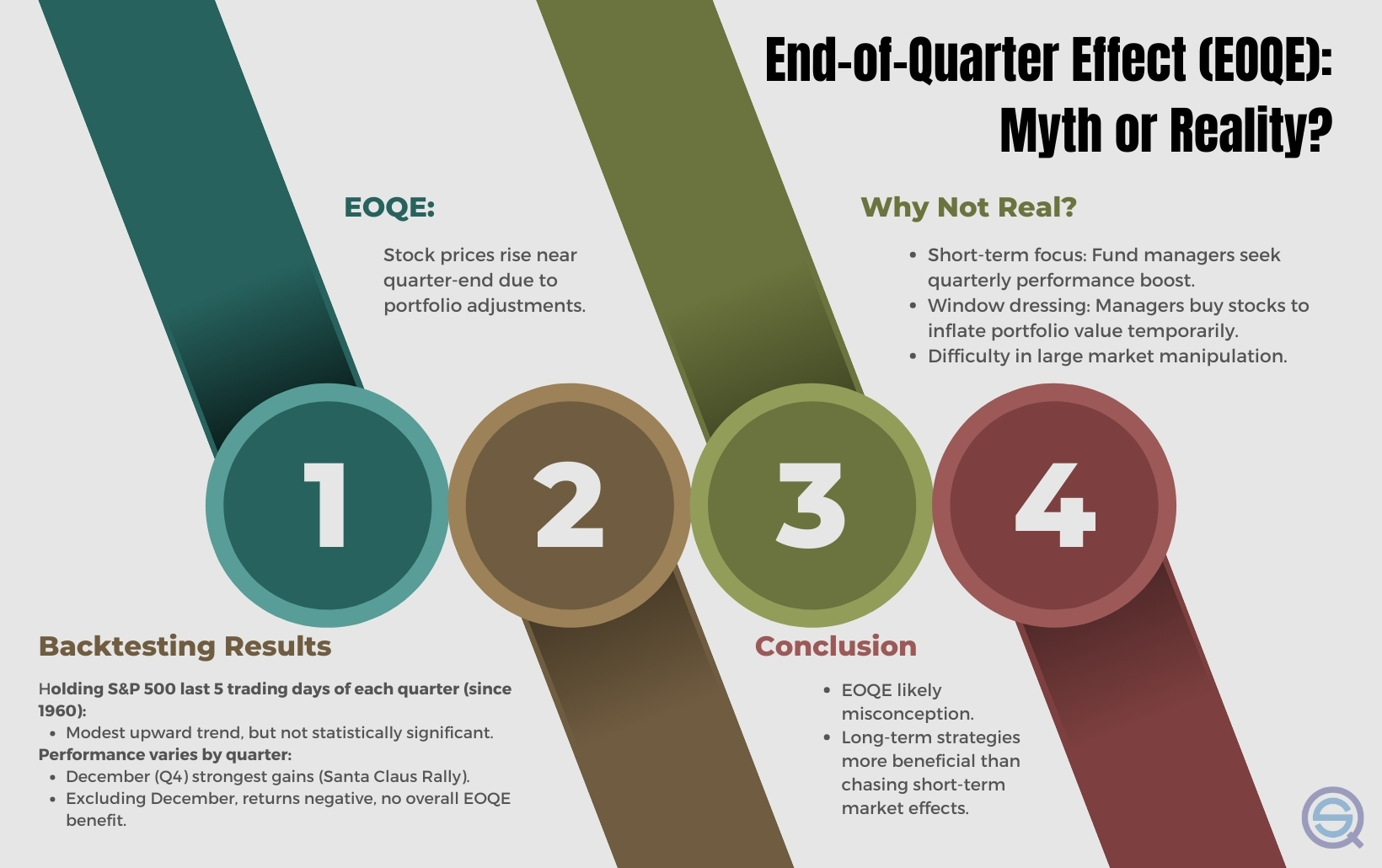

One potential risk of earnings-driven investment is that companies can manipulate their earnings reports to present a more positive picture of their financial health than is actually the case. This could lead investors to overvalue a stock and make poor investment decisions. To mitigate this risk, it’s important to look beyond the headline earnings figures and scrutinize the underlying financial data.

Long-Term Perspective

While earnings reports can influence stock prices in the short term, it’s important to remember that long-term investment success requires a broader perspective. Factors such as a company’s competitive position, management quality, and industry trends can all have a significant impact on its long-term earnings potential. Therefore, these factors should also be considered when making investment decisions.

Investor Tips

- Monitor earnings reports closely and adjust your investment strategies based on the insights they provide.

- Look beyond the headline earnings figures and scrutinize the underlying financial data.

- Consider other factors such as a company’s competitive position, management quality, and industry trends when making investment decisions.

This article is intended for informational purposes only and should not be construed as investment advice. Always conduct your own research or consult with a professional advisor before making investment decisions.

Leave a Reply