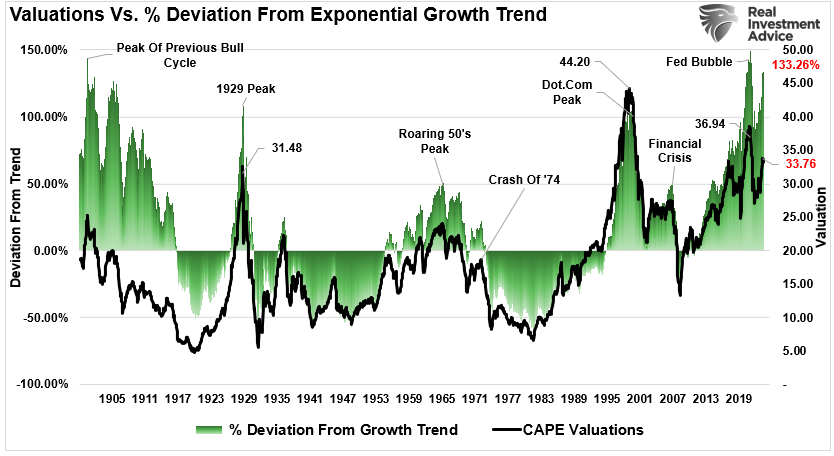

Why Earnings Based Risk Assessment Matters

Understanding the risk profile of investments is crucial for investors. A keen analysis of earnings-based risk provides an essential lens to assess the potential upsides and downsides of US stocks. This approach helps investors make informed decisions and align their investment strategies with their risk tolerance and long-term financial goals.

Key Business and Financial Drivers

The primary business and financial drivers that impact earnings-based risk assessment include revenue growth, operating margin, capital efficiency, and financial leverage. These factors significantly influence a company’s earnings, thus affecting the risk associated with its stock.

- Strong revenue growth can indicate a thriving business and lead to increased earnings.

- High operating margins signify efficiency and could result in higher earnings.

- Capital efficiency reflects how well a company uses its capital to generate earnings.

- High financial leverage can amplify earnings but also increases risk.

Expectations vs Reality

Investors often base their expectations on a company’s historical earnings performance. However, future earnings and stock performance may not always align with past trends. For example, a company with consistently increasing earnings may face unexpected challenges or market changes that impact its profitability. Therefore, it’s crucial for investors to regularly revisit and adjust their expectations based on current and forward-looking market conditions.

What Could Go Wrong

While earnings-based risk assessment can provide valuable insights, there are potential pitfalls. An overemphasis on earnings might overlook other critical aspects such as cash flow or balance sheet strength. Additionally, a company might boost short-term earnings through measures that could be detrimental in the long term, such as excessive cost-cutting or high leverage.

Long-term Perspective

Investors should consider short-term earnings trends in the context of long-term financial health and strategy. A company with fluctuating short-term earnings but a sound long-term strategy and robust market position may be a better investment than a company with steady short-term earnings but no clear path for future growth.

Investor Tips

While analyzing earnings-based risk, investors should:

- Consider a company’s earnings in the context of its sector and peers.

- Look beyond earnings to other financial indicators and the company’s overall strategy.

- Revisit their investment thesis regularly to align with changing market conditions.

Please note that this article is for informational purposes only. Always conduct your own research and consult with a professional advisor before making investment decisions.

Leave a Reply