Why Portfolio Diversification Matters to Investors

Diversification is a key strategy in managing investment risks and optimizing returns. By investing in a broad range of US stocks, investors can spread their risks, ensuring that the poor performance of certain stocks is balanced out by the better performance of others. This strategy is particularly crucial for long-term investors aiming for steady growth over time.

Key Drivers of Diversification in US Stocks

Several factors drive the need for diversification in US stocks. Market volatility, sector-specific risks, and economic cycles can all impact the performance of individual stocks. By spreading investments across different sectors, industries, and even asset classes, investors can mitigate these risks and create a resilient portfolio.

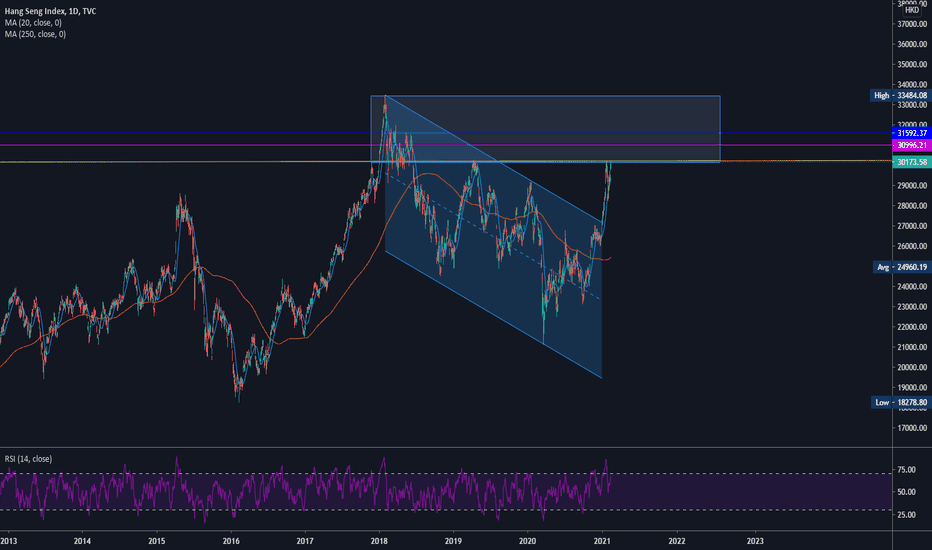

Economic Cycles and Market Volatility

Markets fluctuate in response to economic cycles and external events. During periods of high volatility, diversification can protect investors from significant losses by spreading risk across a variety of assets.

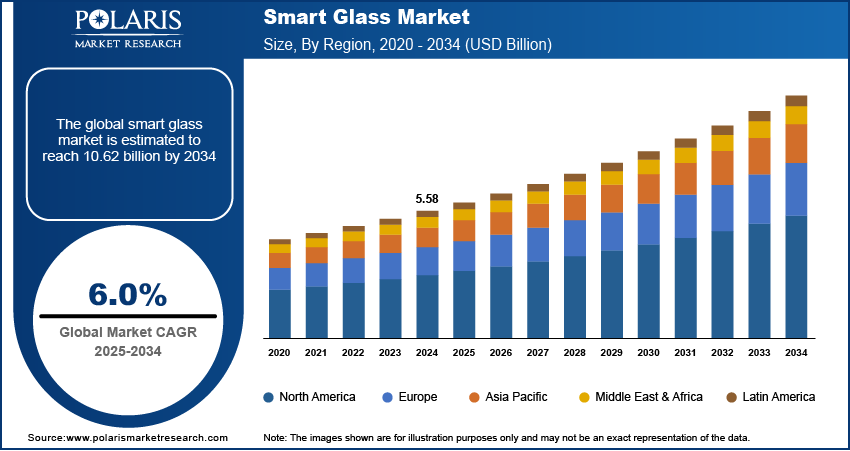

Sector-Specific Risks

Each sector has unique risks. For example, tech stocks may be affected by changes in technology trends, while healthcare stocks could be impacted by regulatory changes. Diversification allows investors to balance out these sector-specific risks.

Expectations vs Reality

Many investors expect that diversification will completely eliminate risks. However, while diversification can significantly reduce risk, it cannot eliminate it entirely. Therefore, it’s crucial for investors to maintain realistic expectations and continuously monitor and adjust their portfolio as necessary.

What Could Go Wrong

Over-diversification is a common pitfall. While diversifying your portfolio can help manage risk, too much diversification can dilute potential returns. This is because as you spread your investments thinner, the impact of high-performing assets is reduced. Therefore, it’s crucial to find a balance in your diversification strategy.

Long-term Perspective: From Short-term Factors to Multi-year Outcomes

While short-term market fluctuations can create uncertainty, a well-diversified portfolio is designed to weather these storms and produce steady growth over the long term. By focusing on a mix of assets that perform well in different market conditions, investors can build a portfolio that delivers consistent returns over multiple years.

Investor Tips

- Consider a mix of asset classes, including stocks, bonds, and alternative investments.

- Balance your portfolio across different sectors and industries.

- Regularly review your portfolio and adjust your diversification strategy as necessary.

This article is for informational purposes only and should not be considered investment advice. Always do your research and consult with a financial advisor before making investment decisions.

Leave a Reply