Why Reading Beyond Headlines Matters

For long-term investors, understanding financial statements is more than just a cursory glance at profitability headlines. It’s about comprehensively analyzing a company’s fiscal health, potential risks, and future growth prospects. This deeper understanding provides a solid foundation for investment decisions, enabling investors to identify undervalued stocks and avoid potential pitfalls.

Key Business and Financial Drivers

Revenue, net income, and cash flow are undeniably important. Yet, other less obvious factors can be equally, if not more, insightful. Financial ratios, for instance, help assess a company’s efficiency, profitability, and debt management. Similarly, understanding a company’s operating cycle can give insights into how effectively it’s using its resources.

Operating Cycle

The operating cycle measures the time between acquiring inventory and receiving cash from sales. A shorter cycle often indicates better management and cash flow, which could translate into higher long-term returns for investors.

Financial Ratios

Profitability ratios, such as return on assets, reveal how efficiently a company is using its assets to generate profits. Meanwhile, liquidity ratios, like the current ratio, indicate a company’s ability to meet short-term obligations, a vital aspect for long-term solvency.

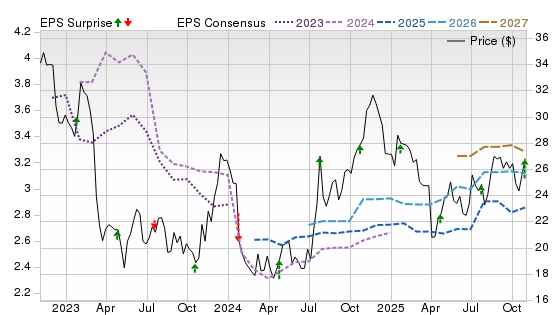

Expectations vs Reality

Investors often rely on analysts’ forecasts when assessing a company’s future performance. However, these forecasts are based on assumptions that may not always hold true. A close look at the company’s historical performance, industry trends, and macroeconomic factors can provide a more realistic picture of its future prospects. This divergence between expectations and reality can present investment opportunities.

What Could Go Wrong

Financial statements, while informative, have their limitations. They are based on historical data and may not accurately reflect future performance. Plus, they are subject to accounting practices that can sometimes mask a company’s true financial health. For instance, revenue recognition policies can inflate revenues, while EBITDA can hide a company’s debt burden.

Long-term Perspective

Short-term fluctuations can often distract investors from a company’s long-term prospects. However, a careful analysis of financial statements can help investors stay grounded, focusing on a company’s intrinsic value and long-term growth potential. This approach can help mitigate the effects of market volatility and lead to more sustainable returns.

Investor Tips

- Go beyond the headlines: Examine financial statements in detail to understand a company’s fiscal health and future prospects.

- Look at the bigger picture: Consider industry trends, macroeconomic factors, and company-specific factors when assessing future performance.

- Stay grounded: Don’t let short-term fluctuations sway your investment decisions. Focus on long-term growth potentials.

This article is for informational purposes only and should not be considered as investment advice or a recommendation to buy any particular security. Always do your due diligence or consult with an investment professional before making any investment decisions.

Leave a Reply