Why Defensive Investment Strategies Matter

In times of economic downturns or market volatility, defensive investment strategies in US equities can play a crucial role in safeguarding investors’ portfolios. Understanding these strategies is essential as they help to mitigate risk and provide a steady stream of income, regardless of the overall market conditions.

Key Drivers of Defensive Investment Strategies

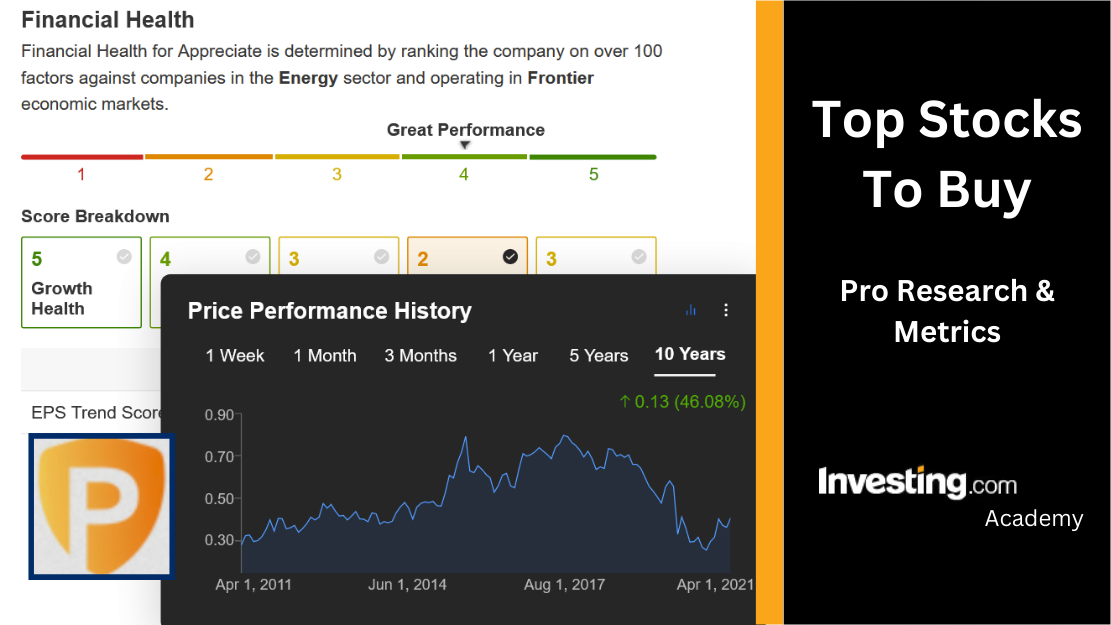

The effectiveness of defensive strategies largely depends on the selection of stocks that can withstand economic downturns. Typically, these are companies in sectors such as utilities, consumer staples, and healthcare, which tend to have stable demand, robust balance sheets, and consistent dividend payments.

Market Expectations vs Reality

Often, investors may expect defensive stocks to offer high returns similar to growth stocks during bullish markets. However, the reality is that these stocks are not designed for spectacular growth but for stability and resilience during unfavorable market conditions. Their primary role is to provide a cushion against losses, and any capital appreciation is considered a bonus.

What Could Go Wrong

While defensive investment strategies aim to reduce risk, they are not a foolproof shield against losses. In an extreme bear market, even defensive stocks can decline in value. Moreover, these stocks may underperform during a bull market, as investors chase after higher-risk, higher-return investments.

Long-term Perspective

From a long-term viewpoint, defensive strategies can contribute to portfolio stability and consistent returns. Although they may not always outperform in bull markets, their resilience in bear markets can help reduce overall portfolio volatility over a multi-year timeframe.

Investor Tips

- Review your risk tolerance and investment goals before adopting a defensive strategy.

- Consider diversification by investing in a variety of defensive sectors.

- Monitor market conditions and adjust your strategy as necessary.

Please note that this article is for informational purposes only, and should not be considered as financial advice. Always consult with a financial advisor before making investment decisions.

Leave a Reply