Introduction: Why Investment Objective Clarification Matters

Understanding your investment objective is crucial in the world of long-term stock investing. It provides a clear direction, helps in decision-making, and significantly impacts the allocation of your investment portfolio. This article delves into the importance of investment objective clarification and how it can influence the performance of your investments over time.

Key Business or Financial Drivers

Several key business or financial drivers play an essential role in shaping your investment objectives. These include risk tolerance, investment horizon, and financial goals. Understanding these drivers can guide you in making informed decisions that align with your investment strategy.

Risk Tolerance

As an investor, you must assess your comfort level with potential losses. This understanding will impact your selection of stocks and the degree of volatility you are willing to tolerate in your portfolio.

Investment Horizon

Your investment horizon—how long you plan to invest—can also influence your investment objectives. A longer investment horizon often allows for greater risk tolerance, as the market has more time to recover from downturns.

Financial Goals

Lastly, your financial goals—whether they’re for retirement, purchasing a home, or funding education—affect your investment objectives and the types of stocks you choose to invest in.

Expectations vs Reality

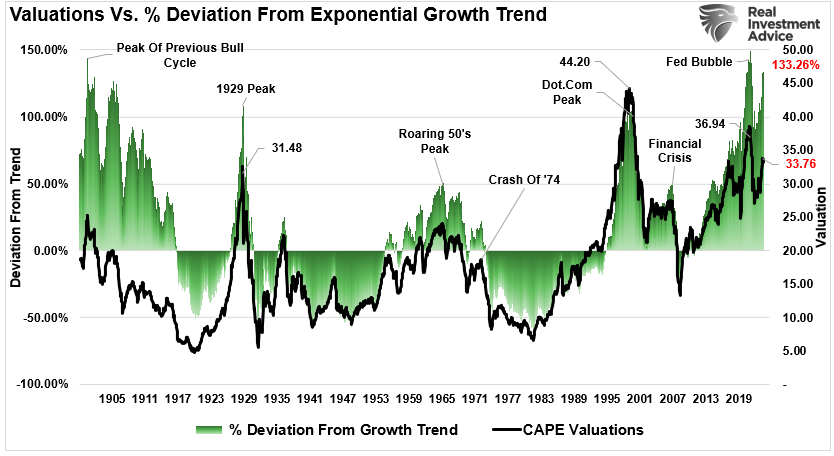

One of the most common pitfalls in stock investing is the gap between expectations and reality. Investors often have unrealistic expectations about their potential returns, disregarding market volatility and risks associated with their chosen stocks. It’s important to base your investment decisions on realistic expectations and solid research rather than on wishful thinking.

What Could Go Wrong

Long-term stock investing is not without its risks. Market volatility, economic downturns, and poor company performance can negatively impact your investments. Misjudging your risk tolerance or overestimating your potential returns can also lead to significant financial losses. Therefore, it’s crucial to carefully consider these risks and potential pitfalls when planning your investment strategy.

Long-Term Perspective

A long-term perspective in stock investing involves looking beyond short-term market fluctuations and focusing on the potential for future growth. This approach requires patience, discipline, and a thorough understanding of your investment objectives and financial drivers. By maintaining a long-term perspective, you can make better investment decisions that align with your financial goals and risk tolerance.

Investor Tips

- Clarify your investment objectives: Understand what you want to achieve with your investments and how much risk you’re willing to take.

- Be realistic: Base your investment decisions on solid research and realistic expectations, not on wishful thinking.

- Maintain a long-term perspective: Look beyond short-term market fluctuations and focus on your long-term financial goals.

This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Leave a Reply