Why Thematic Investing Matters

Thematic investing is a forward-looking strategy that identifies powerful macro-level trends and the potential investment opportunities they create. It is increasingly becoming a vital tool for investors in the US equities market, helping them to identify long-term growth prospects and manage risks more effectively.

Key Drivers of Thematic Investing

Thematic investing is driven by the emergence of long-term trends. These trends could be social, technological, economic, environmental, or political. They affect multiple industries and are transformative in nature, leading to a reshaping of the business landscape.

Technological Innovations

Technology continues to be a significant driver for thematic investing. Innovations such as artificial intelligence, machine learning, and robotics are reshaping industries and creating new investment opportunities.

Demographic Shifts

Changes in population dynamics, such as aging populations or the rise of the millennial consumer, also drive thematic investing as these shifts create new market demands and investment prospects.

Expectations vs Reality

Investors often have high expectations of thematic investing, hoping for significant long-term returns. However, the reality may differ. The success of thematic investing depends on the ability to accurately identify and understand the long-term implications of a trend. Misjudging a trend could lead to missed opportunities or investment in sectors that do not yield the expected returns.

What Could Go Wrong

Thematic investing is not without risks. Trends could evolve differently than expected, or technological advancements could disrupt industries in unforeseen ways. Additionally, regulatory changes could impact the potential of a theme, or global events such as pandemics could alter the trajectory of a trend.

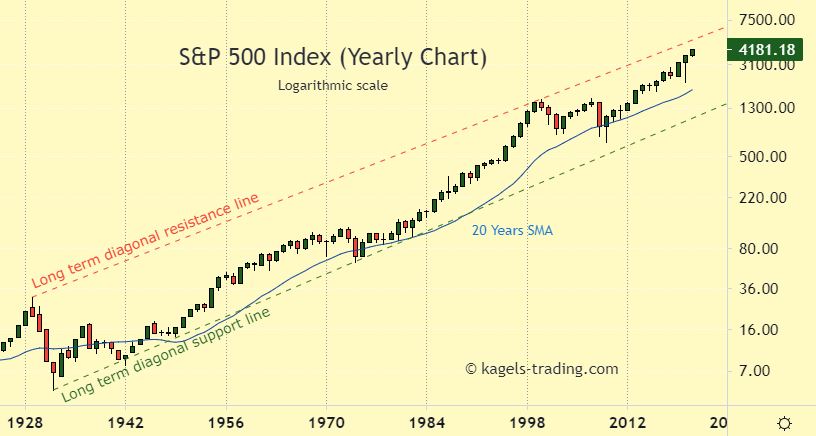

Long-Term Perspective

Despite the potential short-term volatility, thematic investing is a long-term strategy. It takes time for trends to materialize and for companies to adapt and capitalize on these changes. Therefore, investors should be patient and maintain a long-term perspective when engaging in thematic investing.

Investor Tips

- Stay informed about global trends and their potential impact on various sectors.

- Invest in themes that align with your investment goals and risk tolerance.

- Maintain a diversified portfolio to mitigate risks.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as investment advice. Always consult with a financial advisor before making any investment decisions.

Leave a Reply