Introduction: Why Capital Preservation Matters

For long-term investors, capital preservation is a crucial aspect of a well-rounded investment strategy. The U.S stock market, with its rich history of resilience and growth, offers numerous opportunities to maintain and grow capital over time. However, navigating this vast and complex market requires careful strategy and informed decision-making.

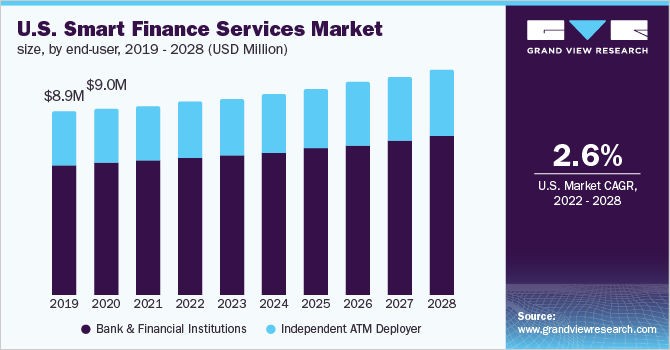

Key Business and Financial Drivers

Several key drivers impact capital preservation in the U.S stock market, including market volatility, interest rates, inflation, corporate earnings, and geopolitical factors. Understanding these drivers can help investors make strategic decisions about where to invest, when to buy or sell, and how to manage risk.

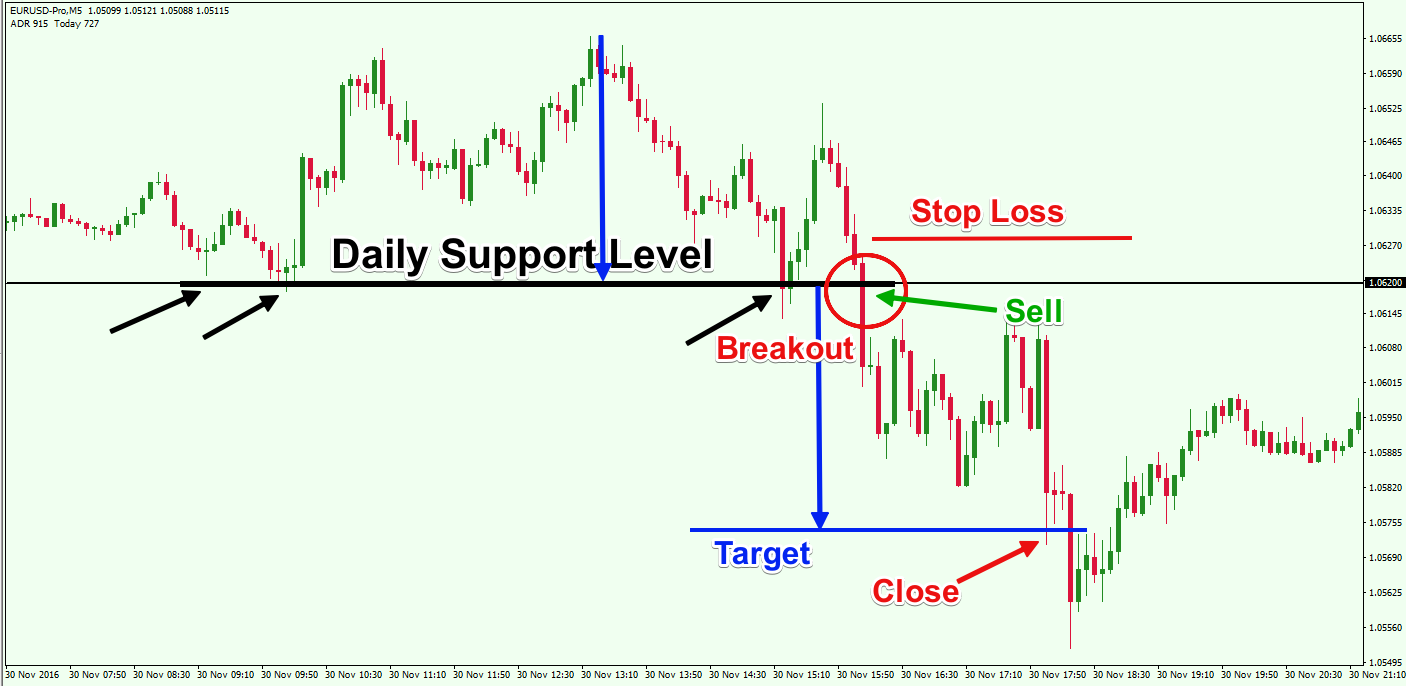

Market Volatility

Market volatility can significantly impact an investor’s ability to preserve capital. In volatile markets, stock prices can fluctuate widely in short periods, creating potential for both high returns and significant losses. Therefore, understanding and managing volatility is key to capital preservation.

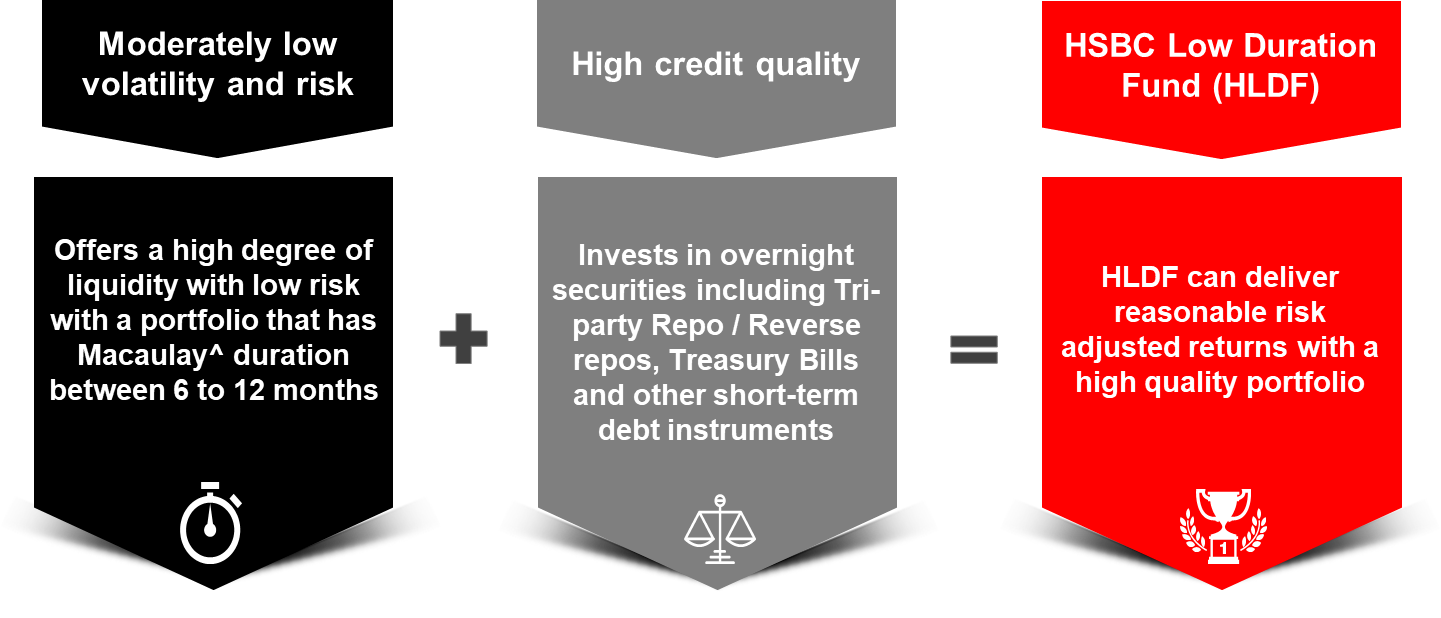

Interest Rates and Inflation

Interest rates and inflation can also have a significant impact on capital preservation. For instance, when interest rates are low, borrowing costs are reduced, potentially increasing corporate profits and stock prices. However, low interest rates can also lead to inflation, which can erode the value of capital over time.

Expectations vs Reality

Investors often have certain expectations about the performance of the U.S stock market. However, the reality can sometimes diverge from these expectations due to unforeseen events or changes in the economic landscape. For instance, the impact of the COVID-19 pandemic on the stock market was largely unexpected, causing significant volatility and uncertainty.

What Could Go Wrong

While the U.S stock market offers many opportunities for capital preservation, there are also risks involved. These include market crashes, economic recessions, changes in government policy, and other unforeseen events. Therefore, it’s essential for investors to have a contingency plan and regularly review their investment strategy.

Long-Term Perspective

Despite short-term fluctuations and potential risks, the U.S stock market has shown a consistent upward trend over the long term. Therefore, a long-term investment strategy that focuses on capital preservation can yield significant returns over time. This involves diversifying investments, regularly reviewing and adjusting the investment strategy, and staying informed about market trends and economic indicators.

Investor Tips

- Stay informed about market trends and economic indicators

- Diversify your investments to spread risk

- Regularly review and adjust your investment strategy

- Consider seeking advice from a financial advisor or investment professional

All investments involve risks, including the possible loss of capital. This article is for informational purposes only and should not be considered as investment advice.

Leave a Reply