Why Capital Efficiency Matters to Investors

For long-term investors, capital efficiency represents the ability of a company to generate robust returns from the capital it deploys. A business with a high capital efficiency ratio can continually grow its revenue without needing significant additional funds. This is a critical factor in driving sustainable growth and enhancing shareholder value.

Analysis of Key Business and Financial Drivers

Capital efficient businesses are typically characterized by low capital expenditure, high free cash flow, and strong return on invested capital. These businesses can reinvest their earnings into profitable growth opportunities, or return excess capital to shareholders through dividends or share buybacks, thereby creating a compounding effect on returns over the long term.

Expectations vs Reality

Many investors expect capital efficient businesses to consistently deliver high returns. However, it’s important to consider the quality of earnings, the sustainability of the business model and the company’s competitive advantages. A company may appear capital efficient on paper, but if its earnings are driven by short-term factors or unsustainable practices, its long-term returns could be at risk.

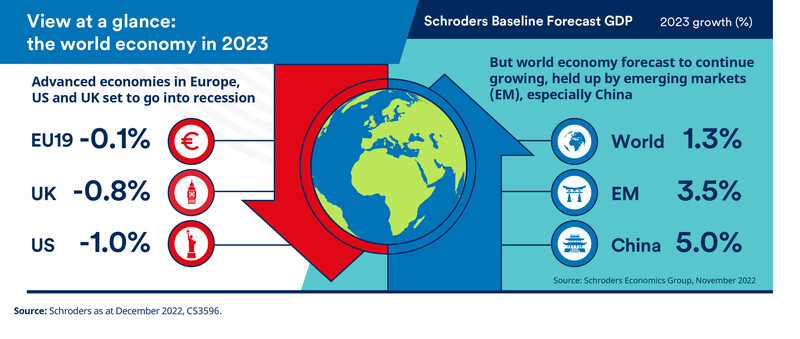

What Could Go Wrong

Capital efficiency can be influenced by several factors beyond a company’s control, such as changes in market conditions, regulatory changes, or macroeconomic shifts. Additionally, businesses overly reliant on external funding may face challenges in times of economic downturns or rising interest rates. It’s also worth noting that not all capital efficient businesses are good investment prospects. Some may have limited growth prospects or operate in declining industries.

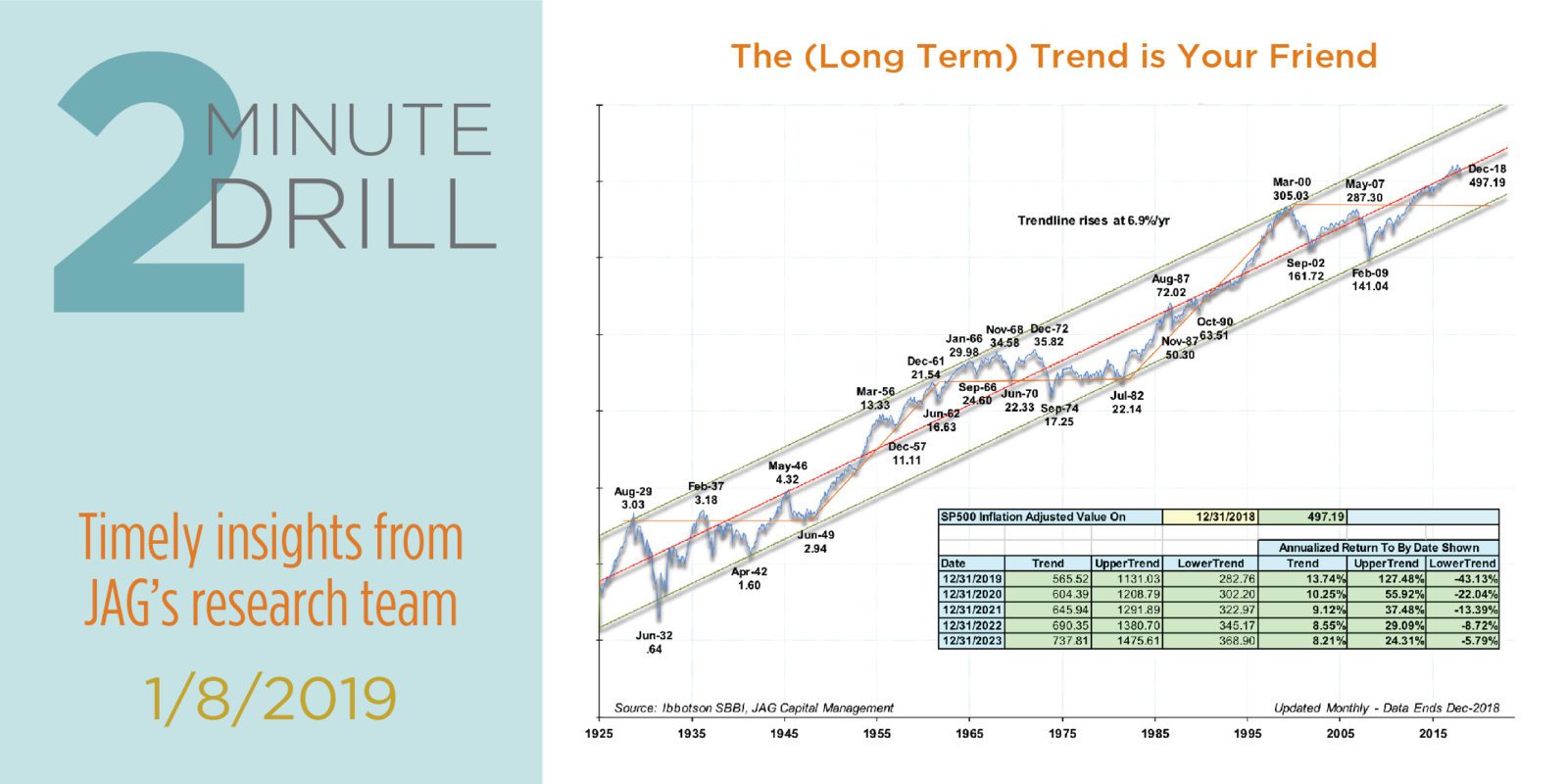

Long-term Perspective

While short-term factors can influence capital efficiency, it’s the long-term trends that matter most to investors. A business that can maintain or enhance its capital efficiency over multiple years demonstrates its ability to adapt to changing market conditions and continue creating value for shareholders. Therefore, it’s important to evaluate the company’s long-term strategic plans, competitive position, and management’s track record of capital allocation.

Investor Tips

- Look for companies with a track record of capital efficiency and sustainable growth.

- Consider the quality of earnings, not just the quantity.

- Don’t overlook the importance of a sustainable business model and competitive advantages.

- Maintain a long-term perspective and avoid being swayed by short-term fluctuations.

This article is intended for informational purposes only. It is not a recommendation to buy or sell any security and is strictly the opinion of the writer.

Leave a Reply