Introduction

Understanding how to build an investment process that scales over time is critical for long-term investors. As the investment landscape evolves, so too should your approach. This article will explore the key components of a scalable investment process, the expectations priced into stocks, and potential risks and rewards.

Key Business or Financial Drivers

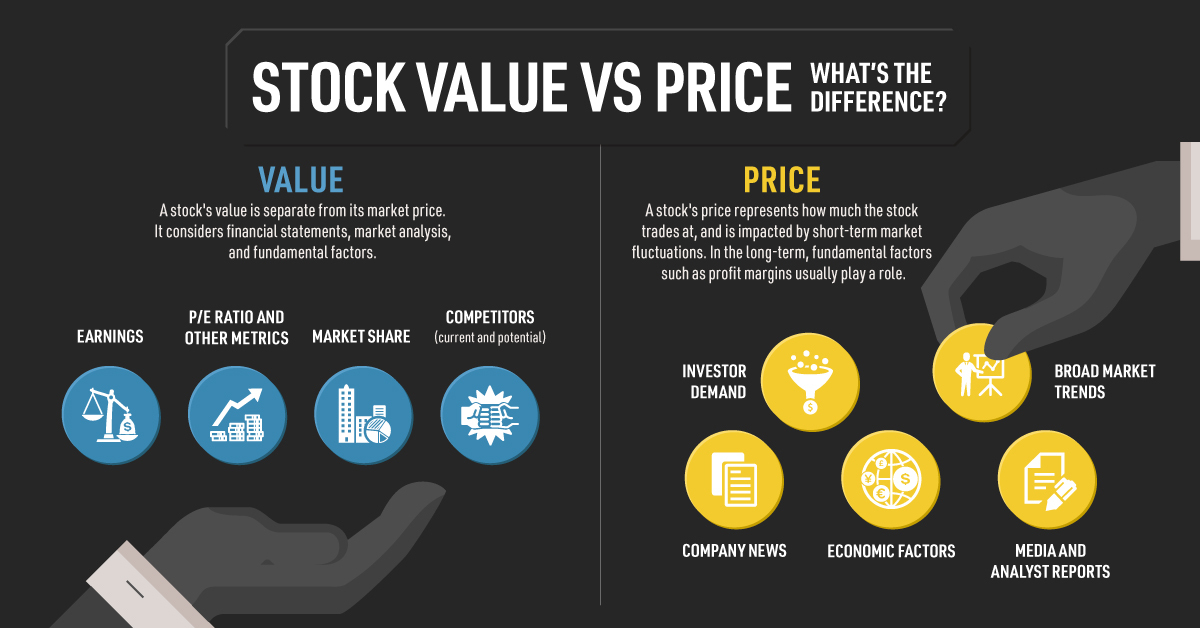

Several key business or financial drivers underpin a scalable investment process. These include the company’s financial health, its competitive position, and the broader market conditions. For instance, strong revenue growth, robust profit margins, and a sustainable competitive advantage could signal a promising long-term investment.

Expectations vs Reality

Investors often price expectations into a stock based on a company’s projected earnings and future growth prospects. However, these expectations may not always align with reality. For instance, a company might fail to meet its earnings projections due to unforeseen challenges, such as regulatory changes or market downturns. Therefore, it’s crucial for investors to regularly re-evaluate their investment thesis and adjust their expectations accordingly.

What Could Go Wrong

While a well-crafted investment process can mitigate risks, it’s impossible to eliminate them entirely. Market volatility, changes in regulatory environment, and company-specific risks such as leadership changes or product failures can adversely impact your investments. Therefore, it’s essential to incorporate risk management strategies into your investment process.

Long-Term Perspective

Although short-term market fluctuations can be disconcerting, it’s important to maintain a long-term perspective. Over time, well-managed companies with strong fundamentals tend to yield positive returns. Therefore, focus on your investment goals, stick to your investment process, and avoid knee-jerk reactions to short-term market movements.

Investor Tips

- Always conduct thorough due diligence before investing in a stock.

- Stay updated about the company’s financial performance and industry trends.

- Regularly review and adjust your investment process as needed.

- Don’t let short-term market fluctuations distract you from your long-term investment goals.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Always consult with a qualified financial professional before making any investment decisions.

Leave a Reply