Introduction: The Value of Scenario Thinking for Investors

Understanding the implications of scenario thinking is paramount for long-term investors. This strategic planning method allows investors to visualize possible futures and make educated decisions based on probable market fluctuations. The ability to anticipate potential outcomes and their impact on investment performance can significantly influence long-term portfolio growth.

Key Business and Financial Drivers

Scenario thinking is driven by several key factors, including market trends, economic indicators, geopolitical events, and company-specific factors. Investors who effectively use scenario thinking can anticipate how these drivers might impact stock prices, allowing them to make informed investment decisions.

Market Trends

Market trends significantly influence stock prices. By using scenario thinking, investors can anticipate changes in market trends and adjust their investment strategies accordingly. This foresight can help investors capitalize on opportunities and mitigate risks.

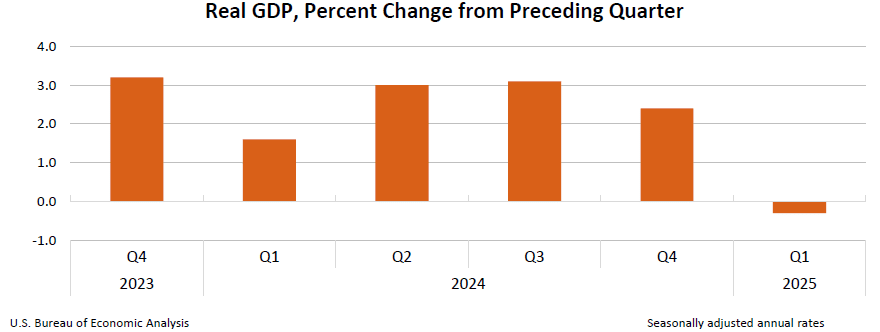

Economic Indicators

Economic indicators provide insight into the overall health of an economy. By analyzing these indicators, investors can create scenarios to predict how changes in the economy could affect stock prices.

Geopolitical Events

Geopolitical events can have far-reaching impacts on stock prices. Effective scenario thinking involves considering potential geopolitical shifts and their possible effects on investments.

Expectations vs Reality

One of the primary challenges in investing is distinguishing between market expectations and reality. Scenario thinking helps investors navigate this challenge by enabling them to envision different potential outcomes based on current market data and trends. This can help investors align their expectations with reality and make more informed investment decisions.

What Could Go Wrong

While scenario thinking is a powerful tool, it’s not foolproof. Errors in data analysis, unpredictable market events, or overly optimistic or pessimistic scenarios can lead to inaccurate predictions and potential investment losses. It’s crucial for investors to continually reassess their scenarios and adjust them as necessary.

Long-Term Perspective

Scenario thinking is particularly beneficial for long-term investors. By considering potential future scenarios, investors can make decisions that align with their long-term investment goals, rather than reacting impulsively to short-term market fluctuations. This strategic approach can enhance portfolio resilience and potential for growth over time.

Investor Tips

- Stay informed about market trends and economic indicators.

- Use scenario thinking to anticipate potential market changes.

- Regularly reassess your scenarios and adjust your investment strategy as necessary.

Disclaimer

This article is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.

Leave a Reply