Why Checklist Matters in Investment Decision Making

For long-term investors, creating a checklist can be a game-changer. A checklist acts as a guide to ensure that investors have considered all necessary factors before making an investment decision. It provides a systematic approach to decision making, reducing the risk of missed or overlooked opportunities.

Key Business or Financial Drivers

Understanding the key business or financial drivers is crucial before investing in a stock. These drivers can include financial health, company reputation, market trends, and industry competition. A checklist can ensure that all these factors are considered before making a decision.

Financial Health

Financial health is an important factor to consider when investing in a stock. It includes aspects like revenue growth, profit margins, and debt levels. A checklist can help ensure these are evaluated.

Company Reputation

A company’s reputation can significantly affect its stock price. A checklist can help investors systematically assess a company’s reputation, including its customer satisfaction, product quality, and corporate governance.

Expectations Vs. Reality

Investors often have expectations about a company’s performance based on its past performance or current market trends. However, reality can sometimes be different. A checklist can help investors compare their expectations with reality, ensuring that their investment decisions are based on accurate and updated information.

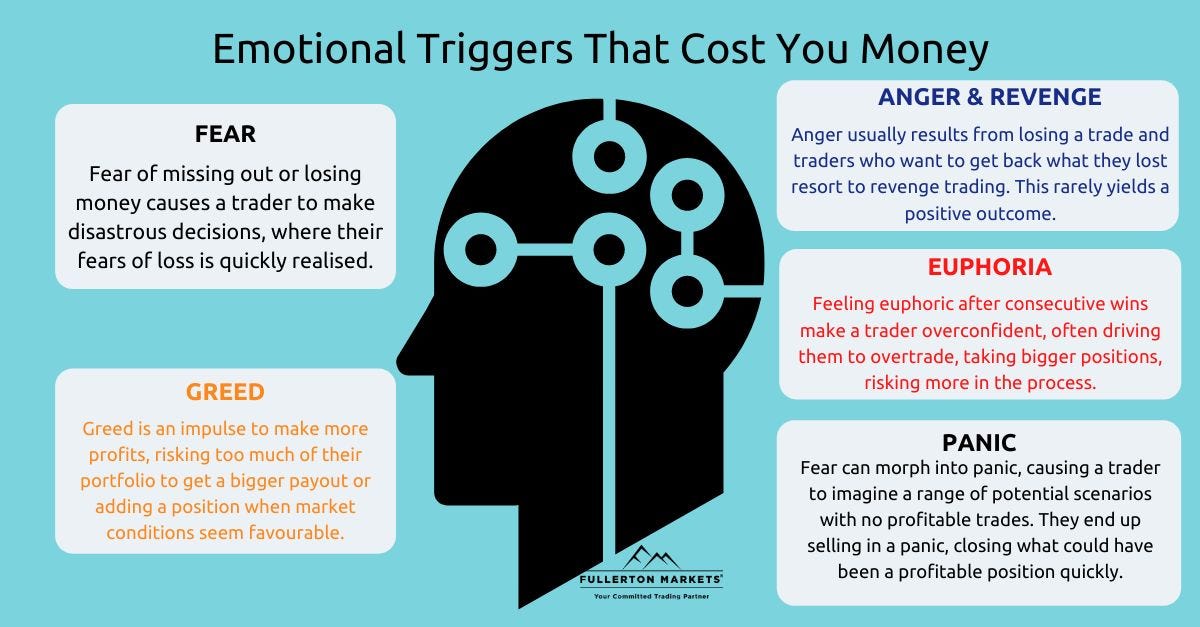

What Could Go Wrong

Even with a thorough checklist, things can still go wrong. Market volatility, unforeseen business risks, or sudden changes in a company’s leadership can affect a stock’s performance. A checklist can help investors prepare for these potential risks and ensure they have a plan in case things go wrong.

The Long-term Perspective

Investing is a long-term game. While short-term factors can affect a stock’s price, it’s the long-term factors that ultimately determine its value. A checklist can help investors focus on these long-term factors, ensuring that their investment decisions contribute to their long-term financial goals.

Investor Tips

- Create a checklist that includes both financial and non-financial factors.

- Regularly update your checklist to include new information or changes in the market.

- Always compare your expectations with reality before making a decision.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.

Leave a Reply