Why Rate Cycles Matter to Investors

As a long-term investor, understanding the influence of rate cycles on financial sector returns is crucial. Rate cycles, characterized by periods of rising and falling interest rates, directly impact the profitability of financial institutions, and in turn, the returns for investors. Being cognizant of these cycles can help investors make informed decisions about when to enter or exit investments in the financial sector.

Key Drivers: Rate Cycles and Financial Sector Returns

The core driver of financial sector returns during different rate cycles is the net interest margin (NIM) – the difference between the interest income generated by financial institutions and the amount of interest paid out to their lenders. When rates rise, NIMs typically expand, leading to higher profits and potentially higher returns for investors. Conversely, in a falling rate environment, NIMs tend to contract, pressuring profitability and investor returns.

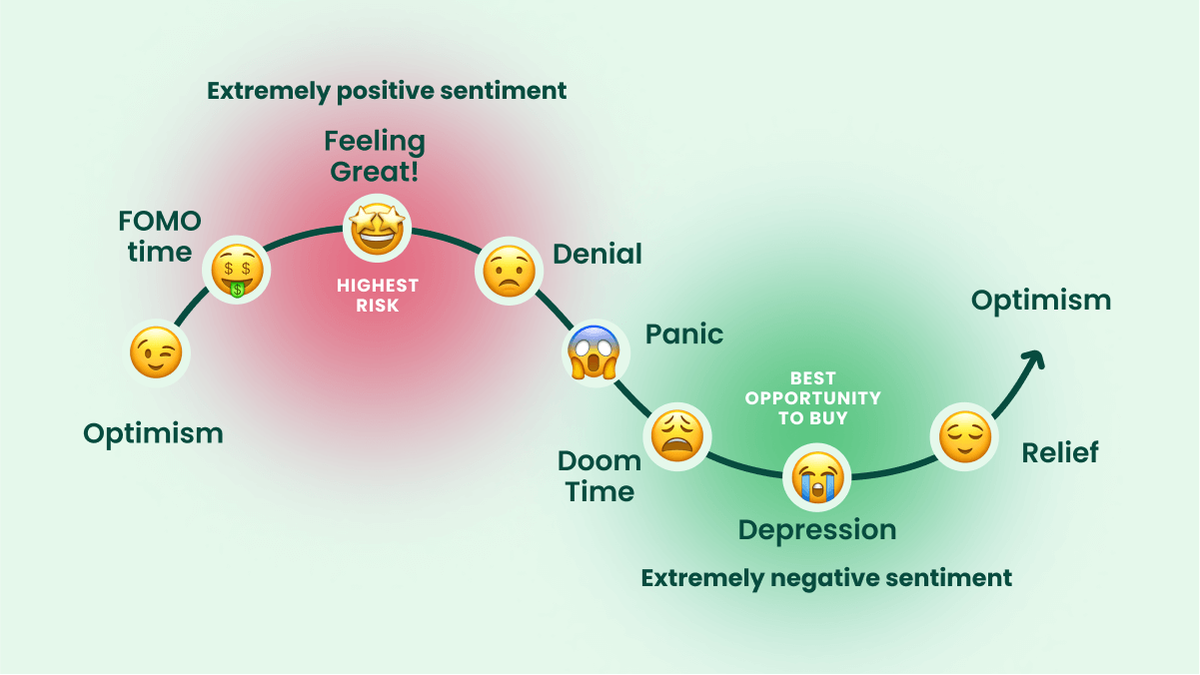

Expectations vs Reality

Market expectations often anticipate the impact of rate cycles on financial sector returns. For instance, financial stocks may rally in anticipation of rising rates, factoring in the expected boost to NIMs and profits. However, the reality could be different. The actual pace and magnitude of rate increases could be less than expected, or banks’ ability to pass on rate increases to borrowers may be limited, leading to a slower-than-expected expansion in NIMs and lower-than-anticipated returns for investors.

What Could Go Wrong

The primary risk is that the trajectory of rate cycles deviates significantly from expectations. Unanticipated sharp increases in rates could lead to credit defaults and loan losses for banks, hurting their profits and investor returns. On the flip side, a sudden drop in rates could squeeze NIMs faster and more severely than expected, impacting returns.

Long-Term Perspective

While rate cycles can impact financial sector returns in the short-term, it’s important to remember that over the long term, the fundamentals of individual financial institutions play a crucial role. Banks with strong balance sheets, prudent risk management, and diversified revenue streams can navigate rate cycle volatility and deliver sustainable returns over the long haul.

Investor Tips

- Stay informed about central bank policy decisions and economic indicators that influence interest rates.

- Monitor the financial health and risk management capabilities of financial sector companies.

- Consider diversification within the financial sector to mitigate rate cycle risk.

This article is for informational purposes only and should not be considered as investment advice. Always consult with a financial advisor before making investment decisions.

Leave a Reply