Why Past Market Cycles Matter

Understanding the lessons from past market cycles is crucial for long-term investors. These historical patterns serve as roadmaps, providing clues to potential market shifts, helping investors to anticipate movements and adjust their portfolios accordingly.

Key Business and Financial Drivers

Market cycles are influenced by various key financial drivers, including interest rates, inflation, and corporate earnings. Economic indicators like GDP growth and employment rates also play a critical role. Investors who understand these drivers can make more informed decisions about their investments.

Interest Rates and Inflation

Interest rates and inflation have a significant impact on market cycles. Lower interest rates generally stimulate economic growth, making borrowing cheaper and encouraging investment. Conversely, high inflation can erode purchasing power, leading to economic slowdown.

Corporate Earnings

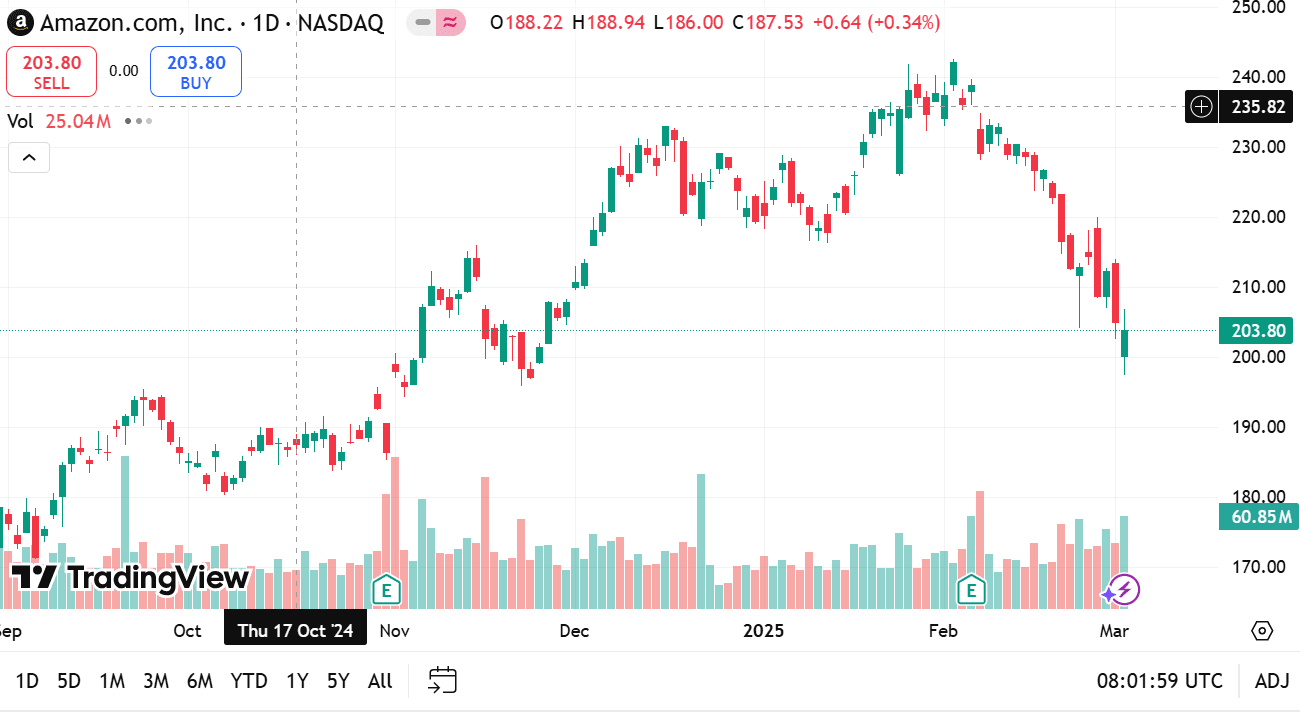

Corporate earnings are a reflection of a company’s profitability and a key driver of its stock price. During a bullish market cycle, strong corporate earnings can fuel investor optimism and drive stock prices higher. In a bearish cycle, weak earnings can trigger sell-offs.

Expectations vs. Reality

Stock prices are often influenced by investor expectations. When these expectations are not met, it can lead to significant price adjustments. For example, if a company’s earnings fall short of expectations, its stock price may drop. On the other hand, if earnings exceed expectations, the stock price may rise.

What Could Go Wrong

Despite the lessons of past market cycles, unpredictability is an inherent part of investing. Economic shocks, geopolitical instability, or unforeseen industry changes can disrupt market cycles. Investors must be prepared for these uncertainties and have strategies in place to mitigate potential losses.

Long-Term Perspective

While short-term market fluctuations can be influenced by a myriad of factors, the long-term trajectory of the market is typically driven by fundamentals such as economic growth and corporate profitability. By maintaining a long-term perspective, investors can navigate short-term volatility and benefit from the long-term growth potential of their investments.

Investor Tips

- Stay informed about key economic indicators and corporate earnings reports.

- Maintain a diversified portfolio to mitigate risk.

- Keep a long-term perspective, focusing on fundamentals rather than short-term market fluctuations.

Disclaimer: This article is for informational purposes only and should not be taken as investment advice. Always conduct your own research and consult with a professional financial advisor before making investment decisions.

Leave a Reply