Introduction

For long-term stock investors, understanding how macro trends influence sector-level returns is imperative. These trends often dictate the performance of different sectors, shaping the profitability landscape for companies and ultimately influencing the returns of your investments. This article aims to provide an in-depth analysis of this crucial topic.

Key Business or Financial Drivers

Several macroeconomic factors significantly influence sector-level returns. These include interest rates, inflation, GDP growth, political stability, and global trade conditions. For instance, sectors like real estate and utilities are highly sensitive to interest rate changes, while consumer goods and technology sectors may be more susceptible to GDP growth and global trade conditions.

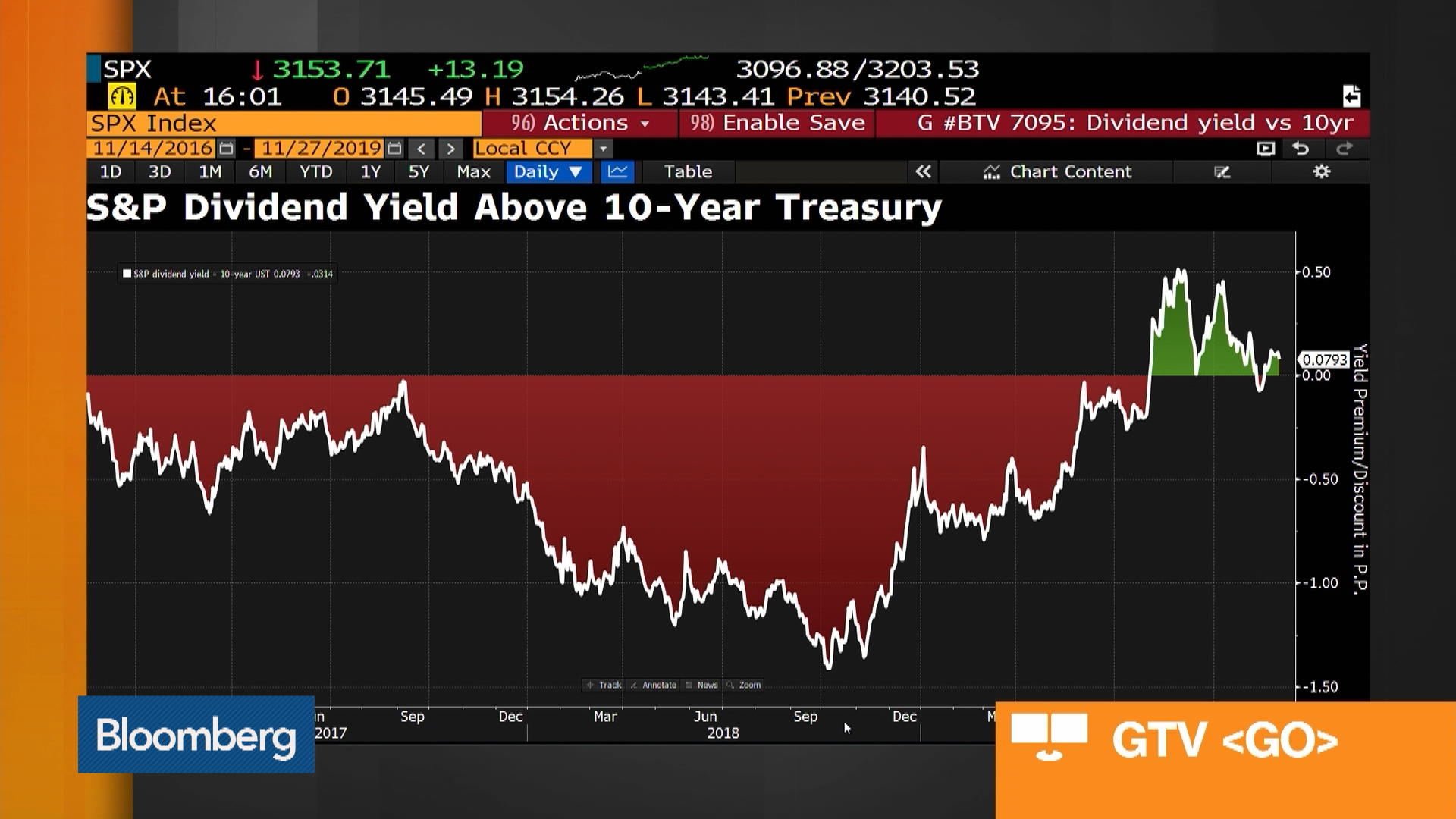

Interest Rates

A decrease in interest rates tends to stimulate economic activity, leading to increased borrowing and spending, which can boost the profitability of certain sectors. Conversely, rising interest rates can pressure companies with high levels of debt, potentially affecting their profitability and stock performance.

Global Trade Conditions

Global trade conditions can significantly impact sectors that heavily rely on import and export, such as manufacturing and technology. A favorable trade environment can lead to increased production and profitability, while trade disputes or tariffs can harm these sectors.

Expectations vs. Reality

While investors often form expectations based on macro trends, the reality may sometimes deviate. For instance, despite a rise in interest rates, a technology company might still perform well due to robust product demand, innovation, or effective cost management. Therefore, it’s essential to consider company-specific factors alongside macro trends when making investment decisions.

What Could Go Wrong

Investors must be aware of potential pitfalls when basing investment decisions on macro trends. For instance, macroeconomic indicators can sometimes be misleading, or economic policies might change abruptly, leading to unexpected market behavior. Additionally, unanticipated events, such as geopolitical tensions or health crises, can disrupt established trends and significantly impact sector-level returns.

Long-Term Perspective

Although macro trends can cause short-term fluctuations, their impact often becomes more apparent over the long run. For example, sustained low interest rates can lead to long-term growth in sectors like real estate and utilities, while prolonged unfavorable trade conditions can weigh on sectors reliant on global trade. Thus, understanding these trends is key to making informed long-term investment decisions.

Investor Tips

- Stay abreast of global macroeconomic conditions and understand how they might affect different sectors.

- Consider company-specific factors alongside macro trends when investing.

- Be prepared for the possibility that macro trends might not always play out as expected.

Disclaimer

This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research or consult with a professional advisor before making investment decisions.

Leave a Reply